Your cart is currently empty.

In case you fell off the earth yesterday afternoon, Virgin Australia has gone into voluntary administration. The collapse leaves, beyond big questions around potential Qantas price hikes (or overseas competitors swooping in), 10 million Velocity points holders wondering if they should cash in their hard-earned points for a toaster.

Or is it just better to wait and see?

While savvy Velocity members transferred their balance over to Singapore Airlines back in March (before Virgin Australia pre-empted an exodus and removed one’s ability to do that), current Velocity points holders are now stuck between a crate of wine (if you can log into the system, which keeps crashing with demand) and an uncertain place (remember Ansett).

To gain a crampon of truth as the rumour mill whirrs, DMARGE spoke to Perth-based points hacking expert and owner of Flight Hacks, Immanuel Debeer.

Though, like the rest of us, Immanuel has no crystal ball on whether Virgin Australia will sell off assets (like the Velocity program) to individual buyers (it has even been suggested that a company like Coles could buy Velocity) or make itself open to a full-service airline takeover (which could mean the current structure of Virgin Australia and its points program is retained), he is one of the world’s leading points hackers, having spent years teaching his audience how to juice their Velocity points (as well as every other frequent flyer program) for all they’re worth.

View this post on Instagram

The situation may become clearer tonight after Virgin Australia’s board meets again. However, in the meantime, here is what Immanuel thinks will happen to your Velocity points now that Virgin Australia has gone into administration. Plus: what the hell you can do with them before they disappear forever (or become devalued after a new company takes over).

“Although Virgin Australia and Velocity Frequent Flyer are two separate companies, they are very much tied together,” Immanuel told DMARGE early this morning. “Virgin Australia owns Velocity and even stumped up a whole lot of change last year buying back the remainder of the program from an investment firm (those guys will be laughing all the way to the bank!).”

“Once the creditors swoop in it’s very likely that they will try to sell Virgin Australia and Velocity (if they can touch Velocity),” Immanuel added. “Frequent Flyer points won’t just disappear but when all this is over, their value will most likely slump depending on how things play out.”

“Velocity has shut down all options of redeeming points so those who didn’t act (I wrote about why people might want to transfer out points back in March) will need to hope that whoever buys out the assets knows how to run a frequent flyer program.”

View this post on Instagram

All that in mind, what are frequent flyers actually going to do? Especially in a context where on-ground redemptions typically provide less value (according to a News.com.au report, “you can score anywhere between $20 and $80 in value for every 1,000 Velocity Points when redeeming for flights, while using your points in the Velocity eStore typically offers a value of $5 per 1,000 points at best”), it’s a hard one to call.

The same report by News.com.au suggests some Velocity members now rushing out to redeem points in-store (despite the definite drop in value) and others waiting to see what happens (resigning themselves to a likely future drop in value, but one that will hopefully be more useful to them than wine and household appliances).

“There has also been a rush on redemptions for store gift cards using Velocity Points. These provide a comparatively low value, with gift card deals offering at best around $5.50 in value for every 1,000 Velocity Points spent,” News.com.au wrote last night.

“But enough customers appear to have decided ‘better some value than nothing’ that Velocity limited those redemptions to 1 per customer per day in early April.”

To end on a positive note, News.com.au also pointed out that the situation is not as dire as similar ones in the past. For instance, when Ansett Australia went into administration back in 2001, “points balances just vanished overnight.”

“Ansett’s corporate structure was different and its buyout options were more limited, so we won’t necessarily see a repeat of that scenario [with Virgin Australia].”

Here’s hoping.

Read Next

- Should Australians Feel Sorry For Qantas & Virgin Austalia?

- Private Jet Party Learns Hard Way What Counts As ‘Essential’ Travel

The post Points Hacking Expert Reveals WTF Is Going To Happen To Your Velocity Account Now appeared first on DMARGE Australia.

To say 2020 has been financially devastating would be to state the bloody obvious. But once business as usual returns, as it always does (remember 2008?), there’s a silver lining Australians will be able to take from all this.

Whether that’s in three months or three years, accountant Fernando Prieto, CA at Solid Partners Accountants & Advisors, has told DMARGE Australians – particularly those in their 20s, 30s and even 40s – now have the opportunity to learn, grow, and come out of this crisis richer, smarter and better financially protected.

In other words: that Whitsundays trip still awaits; you just have to play your cards right.

To get that expansive property portfolio and booming stock-pile though (you know: the one funding yearly getaways to locations which don’t require a sweater), we’re going to have to swallow some icky pills.

Namely: fiscal conservatism (though without going too far off the deep end and losing our entrepreneurial spirit). Confused? Good: we’ll allow Fernando to take it from here.

Before we can set a new course though, we have to understand how we got here (beyond, you know, some dude *allegedly* eating a bat) in order to motivate us to actually change. As Fernando puts it: “a lot of it comes down to culturally how… we’ve had this crazy unbroken record until now of letting the good times roll.”

View this post on Instagram

So far so good, right? Wrong: “people forget about savings, just thinking ‘there’ll be even more money next year’ and it’s like musical chairs. Then, all of a sudden, the music stops and someone’s left without a chair.”

That’s not to say you should hoard all your money: one of the smartest ways to make money is by spending it. But that doesn’t change the fact you’ll never get rich buying disposal goods: “If you’re still getting a credit card, loans living above your means you’re never going to be [the next Warren Buffet].”

“Spending money can be a good thing and a bad thing. It’s bad if it’s disposable (for instance, a handbag, a pair of sneakers, etc). But if you’re doing it as an investment to make money that’s a different story.”

“My motto was always: ‘have a savings plan in place,’ and just be conservative with what you spend,” Fernando tells us. “Create a budget for yourself personally.”

On top of that, treat yourself like a business, “every year you should go through your expenses and see if you can get better deals (e.g. new insurance companies, new internet providers).”

Do you really need Netflix, Stan, Amazon Prime and Google Play? How about Apple Music and Spotify? Refine, refine and refine again.

Getting to that silver lining: Fernando says: “after this, there’s going to be a re-awakening. Culturally in China – from the bottom to the top they save 50 per cent of their salary, whereas in Australia it’s more like zero to eight per cent of their salary for the month saved [and this will likely change].”

“I think it’s going to be a big shock, I think people are going to be really conservative,” Fernando said, suggesting we might regain some of the habits that characterised former Australian generations.

“It’s a big difference culturally… when times are good no-one puts any money aside for a rainy day, but if you grew up in a middle-income type household you would see how your parents had a different attitude to money.”

“You would have gone out somewhere for the day and you would have asked for a drink at the petrol station and your parents would have said no. Whereas now, if you’re my age and you have kids and they ask you for something like that, you just get your wallet out and buy it.”

“The whole Australian mentality back then was just to pay off debt quickly and save money. You probably wouldn’t become rich doing that but you were secure.”

Now though, even though Fernando advises we embrace that mindset to a degree, he says we need to find a balance because – especially coming out of the financial crisis we are about to find ourselves in – there are opportunities to be had.

“Say you had half a million stored away today, now the shares have imploded, and can afford to, if you’re pretty savvy you could take a pretty good punt and invest 2-3 hundred thousand of that and when all’s said and done in a couple of years time and the market bounces back you might make a million to two million dollars out of it.”

“That’s exactly what Warren Buffet does: he just has billions and billions stored away… and now everything’s on sale and he’s just snapping up all these companies at a discounted bargain price.”

As for us more humble citizens, Fernando predicts a decline in the popularity of credit cards, and an increase in the popularity of interest-free repayment schemes like Afterpay. He also believes, after the crisis, we’ll see Australians “saving bigger deposits and saving more money, and demanding the same of their employers.”

“I think new businesses… will place a bigger effort on saving. And employees are going to say, ‘do you have a year’s salary set aside for us employees? Do you have us covered?’ It’ll be a two-way street.”

Disclaimer: The information provided below is general in nature and should not be relied upon by individuals as it does not take into consideration your circumstances. We are not responsible for any damages or penalties that may arise from the information we have provided.

Read Next

- Property Expert Reveals ‘Lowball’ Mistake Australians Make In A Falling Market

- Think Twice Before Accessing Superanannuation Early, According To Money Expert

The post Money-Saving Tips Australia: Lifestyle Changes To Save Money appeared first on DMARGE Australia.

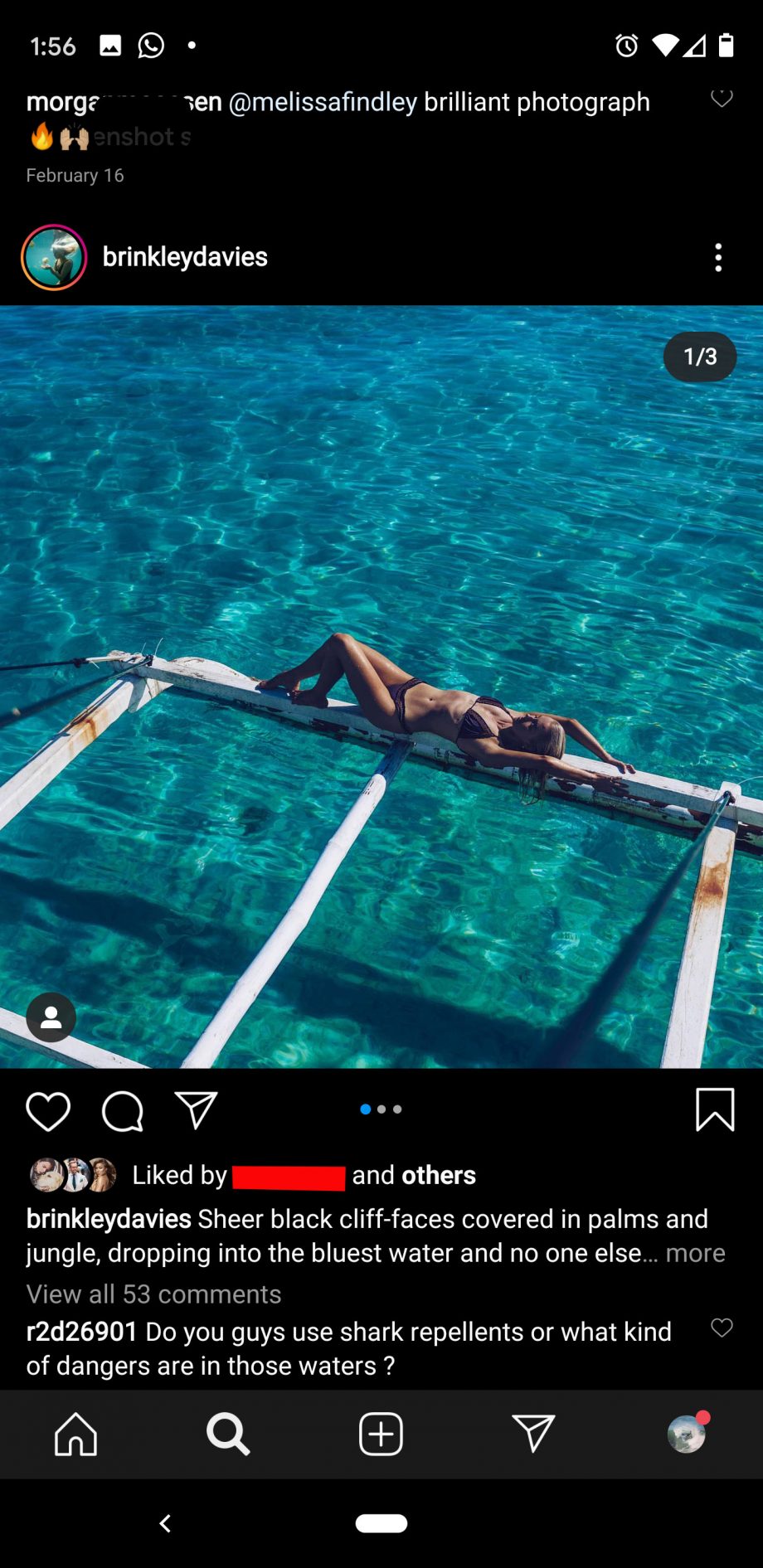

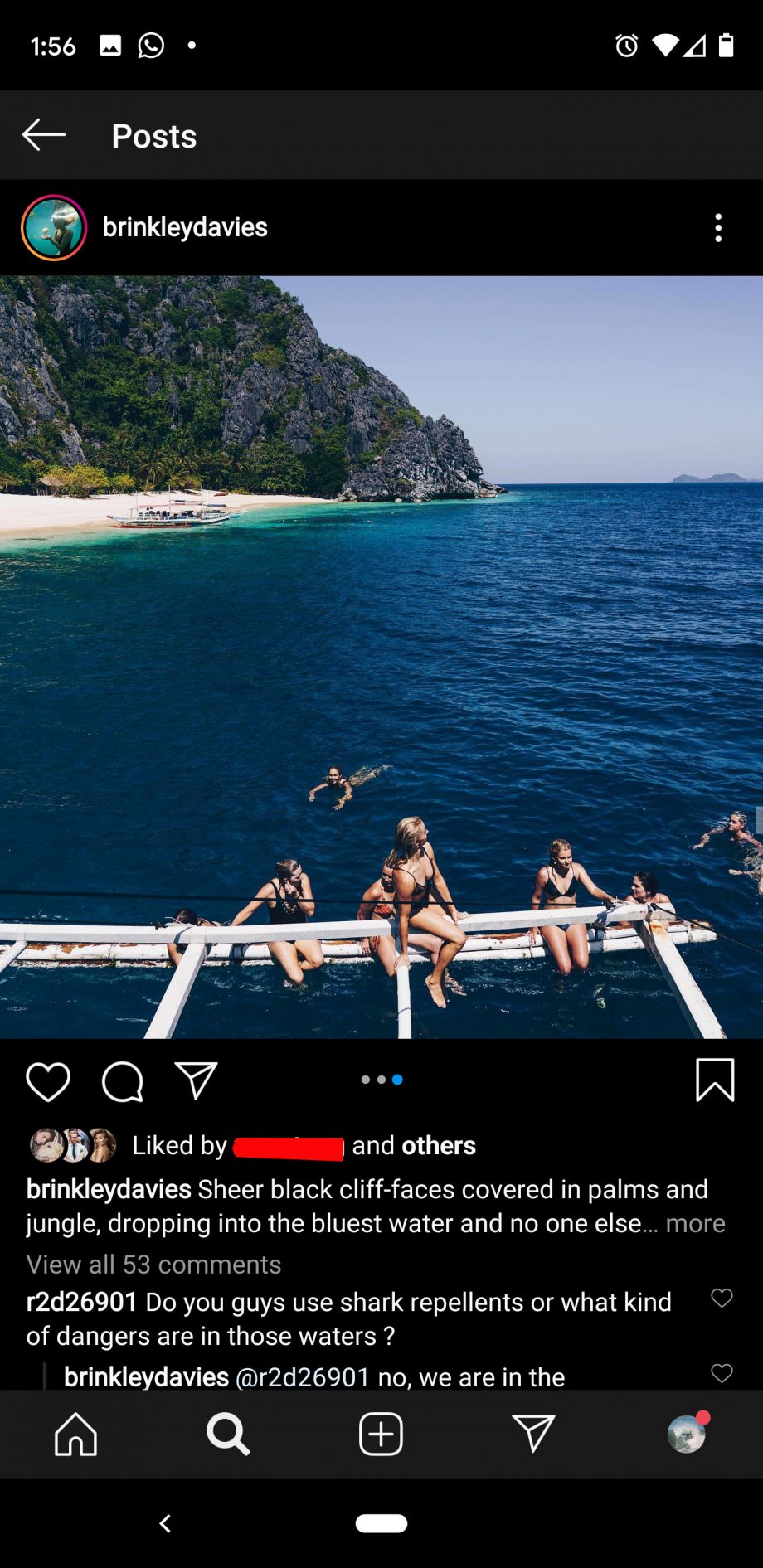

Some relationship mistakes transcend generations. Others are sparked by accidentally liking the wrong picture on Instagram. I’m in the latter camp. Scrolling last week through my feed, giving my thumb some isolation-exercise, I felt a sense of fear and loathing not felt since Hunter S. Thompson caught his accountant cavorting in a Vegas hotel room.

Underneath an image of an Instagram personality I follow, posing in an exotic locale in a black bikini, was a cattle prod to the heart.

My girlfriend had liked it before me – presumably because, the week before, I had accidentally liked a similar image.

I kept scrolling.

Turns out it has happened more than once. It also turns out I have more than one friend who (confidentially) admit they have had the same happen to them.

But back to me: not sure what my next move should be in this Instagram Cold War, I hit up Sydney-based couple’s counsellor Heidi Gee to ask: ‘what the hell do I do?’

According to Heidi, before examining your partner’s movements, you should look inwards: “Perhaps she noticed you were following these accounts and wanted to see why you were following the accounts and interested in what you’re looking at, especially since these are accounts of females.”

“Do you need to do anything about it? Ask yourself Why is it bothering you so much? You could say, oh I noticed you’re following x too, isn’t it great that x is an advocate for animal rights.”

All up though, rather than donning your Henry Kissinger hat and ruining your relationship, “it’s best to be honest and communicate.”

That’s not to say you can’t be smart: “Being passive aggressive could potentially lead to an argument [however] I think if you said what I mentioned in the above answer you might get more of an idea about how she feels but what her response is.”

To bring the saga to an end, we asked Heidi if she thinks Instagram Cold Wars are a new phenomenon, or just an ancient standoff being held in a new way. This is what Heidi told us: “I think ‘stand off’ passive aggressive arguments can come in many forms [but] today we have social media and… access to what our partners like, follow and comment on.”

“Some people might feel insecure about seeing their partner follow a model’s page or male stripper or male actor and most of the time it’s because the focus is on something that is different to what we have. For example, ‘she’s got blonde hair and is a surfer and I am brunette and hate sports,’ – some people might get self conscious about this or feel insecure.”

“The thing is we all like a variety of things/tastes so it doesn’t mean we prefer to have what we are looking at and admiring if you’re simply admiring,” Heidi added.

“If it’s bothering you it’s important to talk to your partner about it so you’re both on the same page instead of getting worked up and second-guessing why your partner is doing what they’re doing.”

Read Next

- New Social Media Standard Women Are Judging You By

- Relationship Experts Say It’s Healthy To Follow Models On Instagram

The post Australian Couples Resort To 'Instagram Wars' To Pass Time In Isolation appeared first on DMARGE Australia.

[vc_row][vc_column][vc_single_image image="252604" img_size="medium" onclick="custom_link" img_link_target="_blank" link="https://www.matchesfashion.com/au/mens/lists/mid-season-sale"][vc_column_text]Sales are one thing, getting something you actually want on sale is another. All too often we find o...

↬ Click here to view the full article/gallery on D'Marge

The post Score 30% Off Designer Brands At The Matches Fashion Mid-Season Sale appeared first on DMARGE.

We’d all like to come out of lockdown ‘prison fit.’ But if you’ve recently dedicated yourself to a home fitness program and are not seeing the consistent results the trim-tummied instructor claimed you would, you might find yourself wondering: why the hell is my weight loss journey less consistent than a bi-polar yoyo?

Or is that just us?

In any case, if you can relate, online body transformation coach and founder of The Transformation Academy James Kew is here to set the record straight: weight loss isn’t meant to be linear, even if you’re doing everything right.

Why? James recently took to Instagram to explain: “Bodyweight can fluctuate a LOT from one day to the next,” James wrote on Saturday, which “often leads people to advise you to ‘ditch the scales.'”

View this post on Instagram

“Whilst I agree that focussing too much on the scales is a mistake, they CAN be a helpful tool for tracking your progress if you understand their limitations, and how to interpret the numbers,” James added.

James then wrote: “To lose one pound of fat requires you to create a calorie deficit of roughly 3500 calories. In the vast majority of cases, you are not going to even come close to creating a deficit that big in a single day. This means that if you drop a pound from one day to the next, most of it is probably not fat. And equally if you gain a pound it’s not fat either.”

Then: “Most of our body is made of water, which is why our weight can change so rapidly from one day to the next. Factors such as fluid intake, salt intake, the last time you went for a pee and much more can influence your water weight.”

“Once you understand that it’s perfectly normal for weight to fluctuate a lot, you can begin to understand why weighing yourself only once a week is often not very useful.”

This is because you could easily catch yourself on a ‘high’ or a ‘low’ day which might have a big influence on your mood (and perception of your progress).

View this post on Instagram

Instead, James advises “you take more regular measurements, and calculate your AVERAGE weight for a week. You can then compare that to the previous weeks average, and this will give you a much clearer idea of how your weight is actually changing over time!”

Summed up, this means, rather than fixating on every minor fluctuation you see on the scales, you want to look at the bigger picture and concentrate on getting the fundamentals right (as well as weighing yourself more regularly and taking averages).

Read Next

- The $90 Bunnings Squat Rack Australian Gym Junkies Will Froth Over

- Learn To Jump Rope Like An Expert From The Man Who Trains The US Olympic Team

The post Weight Fluctuation: Fitness Coach Reveals Why It Happens appeared first on DMARGE Australia.

Does driving a 265K supercar count as a form of exercise? That’s the question Sydney police had to answer just after midnight on Saturday night – and it didn’t take them long to answer. “No it f*cking doesn’t,” was their, loosely paraphrased response.

The driver was given a $1,000 fine. But the saga didn’t end there; the driver then lived up to every rich dickhead stereotype under the sun, responding: “won’t hurt with my $15 million.”

Leaving aside the lack of human solidarity shown in a crisis, this is a pop psychologist’s (read: our) wet dream: how insecure do you have to be to feel the need to impress police with your wealth whilst already driving a McLaren 650S?

We digress.

The story gets even more bizarre as we learn the driver, a 43-year-old man, argued driving was a ‘form of exercise’ before being fined for breaking stay-at-home orders during the coronavirus lockdown.

This came after, having been pulled over in Kings Cross in Sydney’s CBD, the driver told officers he was on his way to Wolloomooloo to get petrol with a friend – despite living over 30 kicks away in Fairfield in the city’s south.

When police told him he was breaking the law, he lashed out: “Do what you want mate, I don’t care.”

“This $1,000 fine won’t hurt with my $15 million.”

According to Daily Mail Australia, police have issued at least 45 lockdown infringement notices in the last 24 hours in New South Wales alone.

“Australians have been urged to stay home unless absolutely necessary, and cannot travel in groups of more than two people,” reported Daily Mail Australia yesterday.

“The only acceptable reasons for leaving the house include daily exercise, collecting essential supplies like food or medicine or to go to work.”

“Other infringement notices that were handed out on Saturday included a group of four men – aged between 18 and 23 – who were travelling in a car together on the mid north coast and a Mount Druitt man who told officers he was on his way to a friend’s house to ‘smoke weed,'” Daily Mail Australia added.

“Two men, aged 71 and 77, were also fined after they were moved along with warnings twice on the same day before being caught breaking the rules again.”

RELATED: Private Jet Party Learns Hard Way What Counts As ‘Essential’ Travel

Although Australia’s number of known cases of the virus are – relative to much of the rest of the world – quite low (there are currently 6,598 known cases in Australia, including 70 deaths), and the curve is flattening, individuals can still be fined $1,000 for breaking social distancing rules and businesses up to $5,000.

So even though Prime Minister Scott Morrison has indicated the government will begin looking at loosening restrictions (if case numbers continue to plummet), for now you best stick to burpees in the park rather than laps in your supercar.

Capische?

Read Next

- The BMW 2002 Everyone Secretly Wants Is Now Selling In Sydney’s South

- LaFerrari Owner Hits 372 Km/h On European Road…Whilst Filming Everything On His Phone

The post McLaren Owner Delivers Ultimate Douchebag Response To $1,000 Lockdown Fine appeared first on DMARGE Australia.

[vc_row][vc_column][vc_single_image image="252570" img_size="medium" onclick="custom_link" img_link_target="_blank" link="https://www.dmarge.com/2020/04/relwen-blazer-deal.html"][vc_column_text]If there is one style that seems to be thriving more than ever in 2020, it's Cowboy style. For some strang...

↬ Click here to view the full article/gallery on D'Marge

The post This $128 Denim Shirt Will Make You Look Like A Texan King appeared first on DMARGE.

As the stock-market cattle-prods investors’ hearts, hospitals worldwide nudge capacity and Sydney surfers concede maybe they shouldn’t congregate in such tight-knit packs, Australia’s housing market is set to undergo a metamorphosis of its own.

Mainly: no one is buying or selling right now unless it’s the opportunity of a lifetime, or they have no other choice but to move.

But what happens on the other side? Whether it’s two months or two years, what’s the situation going to be like for Australian property buyers coming out of this? And, assuming we’re going to come out of this crisis in a falling property market, which is almost certainly going to be the case, how does one make savvy purchasing moves?

These are the questions we took to Edward Brown, director at Australia’s leading real estate provider Belle Property. While Edward doesn’t have a crystal ball at his disposal, he’s probably one of the most informed individuals out there on the Australian property market.

Last week we spoke about how savvy buyers can take advantage of the market right now, and the week before that about Australian housing market trends and how the Australian real estate market is responding to the current pandemic.

View this post on Instagram

This week we are here to look to the future, giving you Edward’s thoughts on the common mistakes Australian buyers make in a falling market (and the biggest regrets almost-owners have), and how to avoid them. In other words: if you plan on getting yourself a piece of land in the next few years, this is for you.

First up, Edward told DMARGE that smart buyers, irrespective of what the market is doing, will have their – to put it technically – shit together.

This means a budget you have discussed with your bank (and partner), and a list of priorities you have clear, including your tolerance of a commute and lifestyle expectations.

Then, when it comes time to buy, you’d do well to avoid the following mistake: going around lowballing everything, wasting endless weekends (yours and other people’s) in the hope that one day your persistence will randomly be rewarded.

“Biggest falling market mistake? Lowballing on the assumption people have to sell. Of course, no one wants to pay too much money – they [the lowballers] have just taken a realistic and pragmatic approach – but [the truth is] you’ve got to have a bit of emotion and running around.”

And when “a lower amount than you hope is going to be accepted doesn’t work,” you may find yourself backed into a corner, or having pissed off the vendor who knows that, if they are in an area with more demand than supply, they can get more money by waiting.

View this post on Instagram

“A house is worth what someone is willing to pay,” Edward told us. “But if you’re trying to run around putting lowball offers on everything, there’s a reason why your offer will be accepted on something – no-one else wants it.”

“Good quality homes will sell for a fair and reasonable price – maybe not the same price they could have once achieved in a booming market, but good homes will always have demand in any marketplace.”

Case in point? Even though the CBA is now predicting a 10% drop in housing prices over the next six months, units in desirable areas are still going for upwards of $21 million (the latest record, set by Rugby Australia’s Peter Wiggs, the news of which came through last week).

This in mind, another related – and common – mistake Australians tend to make, which can be exacerbated by hearing news of a ‘falling market’, is allowing themselves to be overly influenced by non-expert (and even, in some cases, expert) opinions.

“Everyone’s going to share their view. But, in reality, if it’s a couple buying (or if it’s a bachelor or bachelorette buying), they should think about what it’s worth to them.“

“Do your research, look at realestate.com.au, look at Domain, see what’s been selling that’s similar, get a bit of a feel for what things are worth and take that into your value – every real estate agent, buyer, broker, all have an opinion – it’s whether or not it has any relevance.”

“Family members are always going to say – don’t pay more than such an such – but what we always see is people having regrets that they should or would have paid more for a property, had they had their time around again.”

“The opinion was said to them that they shouldn’t pay any more, that they should walk away – but one of the biggest mistakes people tend to make is they ask too many opinions of everyone and then pass up good opportunities.”

So, all up, if you lowball, with no wiggle room for negotiation, you are both putting yourself in a weak position to own the property, and also risking offending the vendor (it’s also a sign you’re just not looking at the right properties for your budget).

“People make offers and if they make an offer well below, sometimes the vendor just doesn’t want to deal with them,” Edward says.

“Not saying you need to go crazy – it’s worth what your willing to pay – but add to the consideration; it’s someone else’s property.”

Consider yourself warned…

Read Next

- Think Twice Before Accessing Your Superannuation Early, Says Australian Money Expert

- How Savvy Buyers Can Soon Take Advantage Of The Australian Property Market

The post Property Expert Reveals ‘Lowball' Mistake Australian Buyers Often Make In A Falling Market appeared first on DMARGE Australia.

If you’re able to drag yourself away from checking out the epic Porsche 911 ‘Malibu’ by Singer we recently featured on DMARGE, then we’d like to point your attention to another equally drool-worthy car, this 1971 BMW 2002 Automatic, which is available on Carsales right now.

With what is undoubtedly one of the best body shapes BMW has in its long-list of historic vehicles, the 2002 is as iconic as it is insanely cool. The 2002 was born in 1968 as an evolution of the 1600-2 (for 2-door), which itself was the first car in the “02” series and designed as an entry-level vehicle.

The 2002 came to be after BMW’s director of product planning Helmut Werner Bönsch and designer of the M10 engine Alex von Falkenhausen, both had a two-litre engine installed in their 1600-2 cars. Upon realising that the extra power afforded by the new engine, the two men asked BMW to put a two-litre version of the 1600-2 into production.

BMW accepted and launched the 2002 in 1968 with the same 2.0L engine, but with two different states of tune: a single-carburettor producing 101hp and a dual-carburettor ‘ti’ model delivering 119hp. The 2002 Automatic, like the one on sale here, arrived in 1969.

The owner of this vehicle says it’s Australian-delivered, with its life down under beginning in Melbourne. Since then it’s travelled just under 64,000 miles and has undergone a few cosmetic changes, including a BMW E30 M3 Alpine White paint job and having chrome bumper accents blacked out. Mechanically it’s had new brake lines fitted along with a new rubber seal kit, and the exhaust has been relocated to the centre.

As with any historic car, you should look for signs of rust and not be too put off by mileage. These were cars to be driven, after all. Other issues can arise with the air conditioning system, but it’s a common problem among 2002s and can be upgraded pretty easily.

But you’ll be pleased to know that if you do need to make any upgrades to this particular BMW, you’ll have plenty of spare cash, and its asking price is a rather modest $24,500. A steal if you ask us.

Read Next

- Very Rare & Awesome BMW Z3 M Coupe Is Up For Sale In Western Australia

- Rare As ‘Rocking Horse Sh*t’ BMW Alpina C1 On Sale In Australia

The post The BMW 2002 Everyone Secretly Wants Is Now Selling In Sydney’s South appeared first on DMARGE Australia.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »