Your cart is currently empty.

Russia’s economy is on a substantial decline. The ruble has collapsed, inflation is surging toward rates of nearly 20% and now a potential default that could ruin the entire economy is just around the corner.

Because the Ruble has shed so much value, international lenders aren’t taking payments in Russia’s currency, meaning that the government will have to find a new way to pay its US$117 million interest bill on bonds this Wednesday.

What would a Russian default look like?

If Russia fails to pay its foreign-debt bills, it could lead to an eventual default of approximately US$150 billion in foreign-denominated debt, which is owed by major corporations and the government itself.

While the outcome of such a default wouldn’t be as severe as the 1998 Russian collapse, as the markets are already well aware of Russia’s economic woes, it could still create unexpected waves throughout the global economy.

Once a country defaults, especially one as large as Russia, it can be cut off from bond-market borrowing until the default is figured out and investors regain confidence in the government’s ability to secure assets. This means that markets may become further disinterested in Russian financial assets.

Flow on effects

Russia is a major exporter of both crude petroleum and wheat, meaning that prices for both of these assets could see substantial increases following continued Russian economic turmoil. The west is already experiencing a huge series of flow-on effects from sanctions that the US and the EU have placed on Russia. As allied nations refuse to purchase Russian oil, petrol prices have risen dramatically across Europe, the US and Australia.

Speaking to New York Magazine, Nigel Gould-Davies, senior fellow for Russia and Eurasia at the International Institute of Strategic Studies, said that while the US and other western nations are currently experiencing some market distress, there’s nothing major to fear from a Russian default.

“The United States, as issuer of the major global reserve currency, has a power that no other country has currently.”

Speaking on the potential for Russian backlash in the current “economic war”, Gould-Davies said that apart from withholding production of goods, Russia really can’t inflict any substantial damage to western powers.

“There’s nothing proportionate, nothing conceivably approaching that, that Russia can inflict in response. Russia’s only effective response is to stop the outflow of things that other countries buy and value, and that’s essentially stuff you get out of the ground — oil, gas, metals, and minerals and so on.”

What does this mean for stocks?

In regards to the stock market, investors can expect to see negative price action continue while global conflict drags on. Because the US Federal Reserve has hiked interest rates, and with general inflation continuing to grow in both the US and Australia, investors should probably get used to seeing red in the portfolio. Global market conditions are simply too uncertain for institutions and large investors to keep piling huge sums of money into markets.

The S&P 500 is already down 11.1% year-to-date and the ASX has mirrored this action, also down 11.4% from Jan. 1 this year.

What does this mean for crypto?

Unfortunately, investors probably shouldn’t get too excited about digital assets either. Despite the general increase in positive sentiment towards crypto adoption globally, markets haven’t exactly been taking the developments to heart. The total crypto market is still down 24% year-to-date, and rumours of Bitcoin and other cryptocurrencies becoming an economic safe haven for Russian citizens were quickly dashed as ruble-denominated Bitcoin purchases plummeted despite Russian inflation surging.

Until major market conditions begin to change, such as Russia and Ukraine coming to some form of positive peace agreement, experts are hinting that crypto investors could be wise to break out the umbrellas, as it looks like the financial drizzle may be here to stay.

Short-term outlook

Painting a somewhat dire picture for the short-term, World Bank President, David Malpass warned people against hoarding bread and gasoline on Monday, March 15, at a virtual event hosted by the Washington Post.

“The right thing to do in these current circumstances is not to go out and buy extra flour or extra gasoline, it’s to recognize that the world is a dynamic global economy and will respond. There’ll be enough to go around.”

While Russia continues to create major potholes for investors in the global market, there is ultimately nothing the country can do to majorly upset the status quo in the long-term, shy of it further escalating its military action against Ukraine and neighbouring countries.

Read Next

- Russian Superyachts Fleeing To Grim New ‘Riviera’

- ‘Russia Internet Shutdown 2022’: Everything We Know So Far

The post Russia’s $150 Billion Default: What It Means For Your Share Portfolio appeared first on DMARGE Australia.

Without getting too deep into the politics of the situation, the fact is, the current invasion of Ukraine by Russia has sent shockwaves around the world and is starting to disrupt the global economy. The biggest consequence? Countries aren’t buying Russian oil.

This has caused oil prices to skyrocket since the supply from other countries is now facing increased demand. We’re already feeling the effects here in Australia, with the price of a litre of unleaded petrol and diesel rising to well over $2. With no potential end to the invasion insight, it could mean high fuel prices for the foreseeable.

So, what’s the best way to navigate the problem? Well, other than trading in your current vehicle for one of the best electric cars in Australia, you could look into trading it in for one of the most fuel-efficient cars. But, looking into all the specifications and figures can be daunting, so we’ve taken away the hard work and put together this guide to the 7 most fuel-efficient cars currently available in Australia, that just so happen to rank for cool points too.

So, without further ado, these are the coolest, most fuel-efficient cars in Australia right now.

In this fuel-efficient cars story…

Fiat 500

Fuel Economy: from 4.8L/100km (combined)

Price: From $23,179 Driveaway

Not just a car for young girls who just passed their driving test, the Fiat 500 is a cool, small car that offers a great city driving experience. We completely agree it’s not the quickest or most performance-orientated car ever, but when you’re talking about fuel efficiency, those sort of words won’t be thrown around too much.

With a fuel consumption rated at a low 4.8L/100km combined on the automatic model, it’s one of the most fuel-efficient cars available right now. And, with prices starting at just over $23,000 for the base Lounge model with standard paint, it’s also one of the most affordable. The figures don’t lie, and they’re hard to argue with. Its small size and fuel efficiency make it perfect for city driving.

Toyota RAV4 Hybrid

Fuel Economy: from 4.7L/100km (combined)

Price: from $41,000 Driveaway

If you really want to bring down your fuel consumption, you need to go hybrid. A combination of electric and internal combustion engine (ICE) power makes for an incredibly smooth and economical driving experience, and the Toyota RAV4 does it oh so well.

It’s the best-selling SUV in Australia and for very good reason. Smooth, quiet, good-looking and boasting plenty of room for the whole family, it’s a killer package.

The 2.5L hybrid engine keeps fuel economy incredibly low, matching the figures of the much smaller Fiat 500 mentioned previously. Even if we weren’t in the current economical and political climate we find ourselves, the Toyota RAV4 hybrid would be a no-brainer.

Škoda Fabia

Fuel Economy: from 4.5L/100km (combined)

Price: from $23,990 Driveaway

A great option as a first car or second, fuel-efficient family car is the Škoda Fabia. The Czech carmaker is part of the Volkswagen Group, and their cars are effectively just more affordable versions of VW vehicles, making them an absolute steal. That’s especially true when you consider the company has made a real improvement to the overall finish of their cars, putting them on par with more expensive rivals.

Like the Fiat 500 above, the Škoda Fabia isn’t a hybrid vehicle, but its small size and fuel-efficient engine means it really sips fuel. With just a single 1.0L engine to choose from, with either an automatic or manual gearbox, it makes picking your own Fabia a simple process.

Kia Picanto

Fuel Economy: from 5.0L/100km (combined)

Price: from $18,490 Driveaway

Continuing the small, fuel-efficient car trend is the Kia Picanto. Available in three trim levels, S, GT-Line and GT, all of which we’d class as fuel-efficient, with the most potent 1.25L MPI petrol engine coming in at 5.8L/100km combined, it means securing yourself a good-looking and fun little car to drive a breeze. It’s also cheap as chips while boasting exceptional build quality. Plus we reckon it looks good too.

The top-spec Kia Picanto GT has previously made our list of the best hatchbacks in Australia, and it guarantees itself a place on this list too. Again, it’s not the quickest thing on four wheels, even in GT spec, but for a fun scoot around town, and with enough power to get you going on the motorway, it’s a fuel-efficient car that ticks off all the major boxes.

MG HS Plus EV

Fuel Economy: 1.7L/100km (combined)

Price: From $46,990 Driveaway

MG has been on a roll since re-entering the Australian car market in 2016 and while its small MG3 hatchback continues to sell like hotcakes, it’s the larger MG HS Plus EV that makes this list of fuel-efficient cars. A plug-in hybrid, the HS Plus EV pairs a 16.6kW battery with a 1.5-litre petrol engine, giving you up to 63km of driving on electric power alone.

If you’ve never driven a Chinese car before, expect to be pleasantly surprised with the MG HS Plus EV. Fit and finish is impeccable, and rather sporty, too. It’s spacious, cleverly designed and best of all, priced very competitively.

It’s no slouch either, and will reach 100km/h in a smidge under 7 seconds. Not bad for a low-powered SUV. There’s much to love about the HS Plus EV and we implore you to consider it when looking to go down the fuel-efficient route.

Mitsubishi Triton GLX Turbo Diesel

Fuel Economy: 8.4L/100km

Price: from $38,940 Driveaway

Ok, so the Mitusbishi Triton GLX TD isn’t the most fuel-efficient car ever, or on this list, but as far as utes go, it’s up there with the most economial. And, after all, many Australians want or need a ute for work and family life, so arming yourself with the most fuel-efficient of the lot makes a lot of sense.

One of the best-selling utes in Australia, the Triton offers a great deal of equipment as standard and does a great job of getting over tricky terrain and driving out in the Australian bush. We think it’s a bit of a looker (by ute standards at least) and when you consider it’s a good $10,000 cheaper than its main rivals, the Toyota HiLux and Ford Ranger, it makes the Triton all the more appealing.

For a greater selection of the best utes to buy in Australia, check out our full round-up.

Tesla Model 3

Fuel Economy: N/A

Price: from $60,900 Driveaway

You quite literally can’t get more fuel-efficient than a fully-electric vehicle, and for our money, the Tesla Model 3 is still the cream of the crop. While it now faces increasingly stiff competition as more and more carmakers switch to pure electric power, the Tesla Model 3 offers an experience unlike many others.

It offers up to 602km of range when specced in Long Range trim, far exceeding other electric vehicles in the same price bracket. The amount of tech you get as standard is truly mind-blowing, too. It isn’t the most affordable electric car compared to other battery-powered sedans and hatchbacks, but they don’t offer the same experience or range that you get from Tesla.

We might be talking about fuel-efficient cars to navigate the current climate, but if you really want to futureproof yourself, then you’ll want to go pure electric, and the Tesla Model 3 is the car to have.

The post Most Fuel-Efficient Cars In Australia 2022 appeared first on DMARGE Australia.

More and more men are finding themselves struggling with day to day life and feelings of anxiety but it’s important to know, that not only is it quite common – one in five men will experience anxiety at one stage in their life – there are also ways to manage those feelings.

If you consider yourself ‘high functioning’ – meaning you can get up, go to work, be productive, get chores and errands done, exercise etc. – but have moments of stress or anxiousness; you may suffer from anxiety and not even realise it. It’s actually called ‘high functioning anxiety’.

It’s important to look out for any and all signs of anxiety, as without a diagnosis or treatment, high functioning anxiety can get worse and worse; and can eventually manifest itself with panic attacks. As Tom Cronin, renowned speaker and corporate meditation and mindfulness trainer can attest, this can be hard as the signs can be very small at first.

For example, as Tom outlines, men who have high functioning anxiety regularly suffer from the following minor symptoms.

- “They find it hard to go to sleep or they wake up at two or three in the morning.”

- “They have a tapping leg when they’re sitting in a chair [and] don’t realise that it’s constantly moving.”

- “They get restless legs when trying to sleep at night.”

- “They feel like they need to drink alcohol to relax at the end of the day.”

- “They get sweaty palms throughout the day.”

- “They get snappy and agitated when things aren’t working out for them.”

- “They feel constantly drawn to their phone [and] can’t seem to pull himself away from it.”

Another hard thing when it comes to diagnosing high functioning anxiety, is that it can present itself differently in different people. Justin Noble, Resilience Coach and founder of the Noblemen Collective – a community for men who want to heal, grow and connect – says it’s important for men to learn how to recognise the physical feelings in their own bodies and assess what’s prompted those feelings of stress, anxiousness and/or irritation.

“Just notice the way you are feeling things in your body. Anxiety can be a feeling in the pit of [the] stomach; a churn or a pain. Becoming aware of what’s going on in your body is so important…

For me, I’ll notice an electricity in my hands or in my fingers… or a tingling. That’s a prompt for me to go ‘hang on, what’s triggering me?’ And then if you can, take yourself out of the situation or take some time to yourself… close your eyes; do some breathing exercises.”

If you suffer from any of the above symptoms or you feel moments of extreme stress regularly – but can still go about your daily life – chances are you have high functioning anxiety, so it’s probably a good idea to take action before things get worse. Admittedly, this can be daunting as, unfortunately, there is still stigma surrounding mental health issues.

If you think you may suffer from high functioning anxiety but feel apprehensive about reaching out to your friends and family, or even a trained psychologist, for help, there are other things you can do. Justin advises that men should:

“Write everything down that’s on your mind, get it down on paper… Often getting it all down on paper can really relieve those anxious feelings. It’s a bit of a cliché but journaling really can be a therapeutic and helpful way to deal with [anxiety].”

He also strongly encourages men to still seek help from a professional even if they’re nervous about it.

“It’s important for men to know that trained professionals [are] trained to be unbiased. They’re not your mates, they’re not going to spread gossip… They’re just there for you to talk about and help you with what you’re going through.”

If you’re struggling with anxiety, please contact Beyond Blue or see your GP for help.

Read Next

- Risk Of Depression Drops Dramatically With One Simple Change, Study Finds

- Australian Weatherman’s On-Air Panic Attack Shows Men Suffering From Anxiety Are Not Alone

The post Signs You Have High Functioning Anxiety – & How To Cope With It appeared first on DMARGE Australia.

Richard Branson’s latest high seas venture – Virgin Voyages – recently launched a new ‘adults only’ cruise ship. The ship, which is called Valiant Lady, houses 2,770 passengers.

It’s a luxurious concept, with the idea behind it being “less about retirees drinking their inheritance, and more about young people ruining their chances of ever owning a home” (as we put it last year).

Branson has hyped the ‘rock star’ vibes of the venture. Speaking about the original ‘adults only’ vessel (Scarlet Lady), which launched in 2021, he told media: “She is very ‘Virgin.’ She’s going to be a fun cruise for people to go on. If they want to dance, there’s plenty of dancing. If they want to chill, there’s plenty of chilling.”

“I think there are some people who would never dream of going on cruises and all our research suggests people are willing to give Virgin a try when we launch a new business and generally they’re happy with the results,” Branson told news.com.au.

Virgin Voyages’ latest vessel – the Valiant Lady – held launch celebrations on Friday at the London International Cruise Terminal, in anticipation of its “limited bookable MerMaiden voyage.”

The launch event featured a line up full of big names like Tom Grennan and Diplo. Virgin Voyages also got UK radio station Capital on board to help promote a launch competition to give away an all-inclusive one-night luxury stay on The Valiant Lady.

Virgin Voyages shared footage of the new ‘adults only’ ship as it left for Liverpool, showing off features like the spacious decks, the Sun Club, the VIP sundeck and the private cabanas.

So far so good.

There has been a fly in the ointment, however, with various customers taking to Twitter to complain about cancelled bookings.

One Twitter user even claimed it was “for some rich guy.”

Too bad you canceled our 20th anniversary cruise last minute for some rich guy. #Virginvoyages

— stblood (@SenseiBane) March 9, 2022

Another said: “We’re in the same boat, or rather not, very short notice and not for a good reason.”

Money talks

— James Roberts (@JamesHabit) March 9, 2022. At least you know what their values are and what they think of their customers. (not a lot)

Another even suggested it could have something to do with the filming of The Bachelorette.

Well looks like @ABCNetwork made them a better offer for the Filming of the Bachelorette

— James Stewart (@jamesastewart80) March 9, 2022

This rumour was also raging on Reddit. One thread claimed “passengers are rightfully outraged” and said “twelve days notice for one of the cancelled cruises (late March and most of April, this is on the Valiant Lady).”

“Thousands of people with booked flights, hotels, having already taken the time off work, limited availability with school holidays, booked non-Virgin excursions, pet boarding, etc. Honeymoons, Easter family vacations, etc all canceled.”

u/Never-On-Reddit

Another Reddit user commented: “If that happened to me, I’d be in a rage just so they can accommodate a garbage reality show.”

Virgin Voyages said the following of the cancellations: “We understand planning a holiday isn’t easy. We missed the mark when it came to providing initial options for our April cancellations, and that’s on us. We’ll be offering every affected itinerary a complimentary sailing on board Valiant Lady + original offers.”

Ahoy Sailors,

— Virgin Voyages

We understand planning a holiday isn’t easy. We missed the mark when it came to providing initial options for our April cancellations, and that’s on us.

We’ll be offering every affected itinerary a complimentary sailing on board Valiant Lady + original offers(@VirginVoyages) March 15, 2022

Virgin Voyages offered affected customers two options. The first option was: “150% Future Voyage Credit (FVC)” where “Sailors will automatically receive a Future Voyage Credit for 150% of the voyage fare amount paid to date.”

Option 2:

— Virgin Voyages

Refund + 25% Future Voyage Credit (FVC)

Sailors who prefer a refund may call or email to receive a full refund for the amount paid to date + FVC for 25% of the voyage fare amount paid(@VirginVoyages) March 15, 2022

The second option? A “refund + 25% Future Voyage Credit (FVC).” Virgin Voyages also said that “Sailors who prefer a refund may call or email to receive a full refund for the amount paid to date + FVC for 25% of the voyage fare amount paid.”

Complimentary Sailing:

— Virgin Voyages

In addition to Option 1 or 2, all affected Sailors will receive a complimentary sailing aboard our Valiant Lady. This includes all Valiant Lady sailings available from March 18, 2022, through October 16, 2022(@VirginVoyages) March 15, 2022

“In addition to Option 1 or 2,” Virgin Voyages have said, “all affected Sailors will receive a complimentary sailing aboard our Valiant Lady. This includes all Valiant Lady sailings available from March 18, 2022, through October 16, 2022.”

This comes after Virgin Voyages cancelled three sailings on Valiant Lady after agreeing a deal to charter the ship in April, Travel Weekly reports.

“The line confirmed departures on April 4, April 15 and April 18 have been cancelled, but would not say how many passengers had been affected by the decision,” (Travel Weekly).

The cancelled trips are an 11-day Coast The Canary Islands, Spain, Portugal sailing; a three-day Long Weekender In Zeebrugge cruise; and another 11-day Coast The Canary Islands, Spain, Portugal voyage, according to Travel Weekly.

A Virgin Voyages spokesperson said of the cancellations: “Virgin Voyages understands that impacted Sailors [passengers] were caught off guard and apologise for any inconvenience that this has caused.”

“To make up for this, they have offered several options to Sailors to make sure that they are able to enjoy a sailing at a later date.”

Virgin Voyages

In more positive news, talking about Valiant Lady’s launch, Virgin Voyages CEO Tom McAlpin said the company is seeing an increase in bookings.

“The lifting of UK travel restrictions has already shown promising signs with 70 per cent uplift in bookings since December – and we can’t wait to welcome sailors (passengers) on-board,” he said.

Hello to @VirginVoyages #ValiantLady currently docked in #Liverpool this morning!

— ScouseScene (@scousescene) March 14, 2022pic.twitter.com/oOJEKLkXb2

“We’ll be showcasing our newest lady in Tilbury and Liverpool, where fans are invited to wave her in before we kick off our bookable European sailings from Portsmouth in March and our new homeport in Barcelona in May.”

According to Traveller, “The 100,000-gross-tonne ship is set to take in such destinations as Palma de Mallorca, the Canary Islands, Lisbon, Belgium and Ibiza.”

Traveller also reports that the vessel is eying off “sailings” to Australia later this year, assuming our cruise ship ban is lifted next month.

I loved the scarlet lady, I got engaged on it on the dock on Jan 5th 2022 pic.twitter.com/qHXFRXasGU

— Supermangt94 (@Supermangt941) March 4, 2022

Further posts on Twitter suggest that when the trips actually go ahead, many passengers have loved the Virgin Voyages experience.

Read Next

- The Ugly Truth About Virgin Voyages’ Adults-Only Cruise

- Cruise Ship Industry Finds Bizarre New Way To Make Your ‘Holiday Fling’ Unforgettable

The post Virgin Voyages’ New ‘Adults Only’ Cruise Is Already Facing Its First Scandal appeared first on DMARGE Australia.

Here’s everything Australian men are talking about on Wednesday, March the 16th.

Australia’s cruise ship ban slated to lift

Australia’s cruise ban is slated to lift on April 17th, just over a month away. With this, cruising will be back to every single major market in the world. The first cruise lines to sail from the country will include Princess Cruises & P&O Australia. pic.twitter.com/Ppi49NPJCZ

— UltimateCruiseNews (@UCruiseNews) March 15, 2022

Australia’s cruise ban is set to lift in mid-April. According to Ultimate Cruise News, this means that cruising will soon (as of the 17th of April) be back to “every single major market in the world.” Ultimate Cruise News also reports that “the first cruise lines to sail from the country will include Princess Cruises & P&O Australia.”

Yet another superyacht has been seized

Spain has seized (or, technically speaking, “immobilised”) a Russian oligarch’s $140 million ($195 million AUD) superyacht in Barcelona, the Spanish Prime Minister has said. The Guardian reports that “two sources said the vessel belonged to the head of Russian state conglomerate Rostec, an ally of Russian president Vladimir Putin.”

A man has died in flood waters at Broken Hill

Man dies in flood waters at Broken Hillhttps://t.co/rjH3DflZDU

— Mirage News (@MirageNewsCom) March 15, 2022

According to Mirage News, a man has died after his vehicle entered flood waters in Broken Hill overnight.

A house fire in Sydney is being treated as suspicious

A deadly house fire in Sydney’s inner-west is being treated as mass murder, with police hunting for a suspected arsonist. #9Today pic.twitter.com/Pebk1k2qpu

— The Today Show (@TheTodayShow) March 15, 2022

Two Victorian surfers allegedly just took down a plane hijacker

Two Victorian surfers, on their way to Indonesia to chase a big swell, reportedly took down a man threatening to blow up a plane as it flew over Melbourne.

Men are thinking about their heart health

There is a total lack of maturity in Morrison comments. As much as I loathe Howard and Abbott neither would take a cheap shot at their opponents appearance. An adult would say “Whilst I don’t agree with Mr Albanese’s politics I might ask him for a few tips on losing some kilos.”

— Don O’Brien (@bigdon61) March 15, 2022

Scott Morrison is under fire for having an “apparent crack” at opposition leader Anthony Albanese’s weight loss, just weeks after a national sporting hero (Shane Warne) and a Senator (Kimberley Kitching) have died of suspected heart attacks in their fifties.

RELATED: Shane Warne’s Sudden Death Made Robbie Williams Re-Evaluate His Life Priorities

Bali is back

Bro flying from Sydney to Bali costs the same as filling up your car

— shelton (@SHELTONZOR) March 15, 2022

Australians are finally able to fly to Bali again, without having to quarantine. And (compared to petrol for your car) flights aren’t even that expensive, some reckon.

Is Byron Baes good or garbage?

Well, Byron Baes is even worse than I could possibly have imagined.

— Joel Creasey (@joelcreasey) March 9, 2022

Some reckon Byron Baes is binge watching gold, others think it represents “the last days of Rome.”

Some Russians are protesting against Russia’s invasion of Ukraine

— The Kyiv Independent (@KyivIndependent) March 14, 2022

Russian state TV interrupted by “No War” protest.

During the “Vremya” news program on Russia’s main TV channel, Maria Ovsyannikova, a Channel One employee, rushed in front of the camera with a poster saying “stop the war, don’t believe the propaganda.” pic.twitter.com/BsyqPYenJg

Sydney public transport needs to sort out its issues

A Reddit thread that began with the above photo of North Sydney’s overly-crowded train station is filled with Reddit users discussing how poor Sydney trains have been ever since the industrial dispute and floods that took place over the last few weeks. Many trains are still being severely delayed or cancelled entirely, putting pressure on commuters trying to get to work on time.

Read Next

- Pirates, Plagues & Putin: Russian Superyachts Taking Huge Risks To Reach Safe Ports

- Elon Musk Explains Why He’s Not Selling His Bitcoin Right Now

The post What Men Are Talking About Today, Wednesday March 16 appeared first on DMARGE.

The following article was produced in partnership with IWC Schaffhausen.

Guy Sebastian needs no introduction.

The Malaysia-born singer-songwriter has won seven ARIA awards including Best Pop Release and Best Live Act, released ten top ten albums, is the only male artist in Australian chart history to achieve six number-one singles, and has appeared on a number of television shows, most recently in his role as coach on The Voice Australia.

After nearly 20 years in the public’s eye, Sebastian’s music and work can be recognised across the generations from Baby Boomers all the way to Gen Z. “I always knew I wanted to sing, I just never in a thousand years thought it would be to the capacity of what I do now,” he tells DMARGE.

“I don’t know whether it was because I didn’t dream big or whatever, I just grew up in a fairly small city in the suburbs and I just thought it would be a hobby and I would always have this burning desire to make it a job.”

When he was 19 years old, he took a gamble. After doing some minor touring with a local band in Adelaide, he took a chance to make music his full-time job. “I sort of had a little bit of a taste of what it would actually be like to make it my day job and one day I decided to jump in with both feet and I quit university to the dismay of my parents,” he says. The rest, as they say, is history.

“I remember really trying hard for a while without that much success and then suddenly this tv show came along and some friends of mine said there’s this new show, it’s called Idol and you should try out for it.”

At first, he was sceptical. “I don’t know, I was immediately a little bit pessimistic,” he says. “I thought it’s probably not for me and there’s no way I would win.”

Thankfully, curiosity got the better of him and before long, he would go on to be the first-ever winner of music talent show Australian Idol in 2003. “All of a sudden I found myself in this position where I had this amazing springboard that I could capitalise on and make it my day job,” he says.

That was 18 years ago now. But it still taught him some of his best lessons. Sebastian now knows an artist can never please everybody, but it was a lesson he admits he may have had to learn a little faster than most.

“In the creative industry, sometimes that quick success can be a curse,” he says. “On one hand you’re so grateful for the opportunity and the ability to get your music to the masses … but then there’s this strange hill you’ve got to climb to prove yourself.”

“I used to be a little bit limited by a time frame,” he admits. He also learned that it’s important for a creative to know when to put their foot down. “Respect was a very big thing that my parents had passed on so I had to find the fine line of being nice and being a good steward of my gift,” he says. As he’s gotten older, he’s become more at peace with the process of writing music.

“I think the creative process has evolved for me probably as I’ve grown up and matured and got a bit more confidence to speak up for things that I think are important.”

Now, he has a strictly non-limiting approach. “I don’t really go into any project with a vision I want it to sound like because I’ve done it for long enough now to know that by the time the projects are released it would have changed maybe four times,” he says with a laugh. “Nowadays I just literally say to myself, ‘just write what comes out during inspired moments.’”

Today, the father of two, who’s had just shy of two decades in the limelight, is patient with his music. “Every time I’m driving, I’m constantly hearing melodies and I’m constantly hearing ideas and yes, most of them are rubbish but you’ll think they’re a great idea at the time,” he says.

“Recently I had this realisation that this isn’t something that I really think about but just happens. If you think you can just turn on inspiration, it just doesn’t happen.” Writing music, he says, is really just a numbers game.

“When you finally get to that period when you’re ready to write, you’ll have a thousand ideas that you’ve narrowed down to 40,” he concedes. “It’s just the lifestyle of a creative person.”

Although no longer pressed for time, Sebastian relies on only the best to tell it every day. He wears the IWC Schaffhausen Big Pilot’s Watch 43, a watch he says falls very much in line with his values.

His introduction to the Swiss luxury watchmaker came via a generous gesture from a friend. “I always loved the brand and my first ever IWC was a gift from a friend, a very generous gift, and it was a Portofino. I just fell in love with the elegance of it”.

No wonder, then, that such an iconic artist wears such an iconic watch like the Big Pilot.

Discover the IWC Schaffhausen Big Pilot’s Watch 43 collection here.

The post Guy Sebastian Has IWC Schaffhausen To Thank For His Love Affair With Watches appeared first on DMARGE Australia.

If you’re interested in cryptocurrency then you’re practically guaranteed to have heard of Crypto.com. But just how good of an exchange is it? We’ve put together this comprehensive review of Crypto.com to help you decide.

Figuring out where to get started in crypto investing can be pretty overwhelming. It’s so easy for new investors to get lost in the sea of hype, marketing and all of the blockchain-related jargon.

That’s why we’re going to start at the very beginning: choosing a trustworthy exchange to buy, sell and hold your crypto assets. Today, we’re going to take an objective look at everything that you need to know about the crypto exchange: Crypto.com.

Check out our full round-up of the best crypto wallets here.

In This Crypto.com Review

What is Crypto.com?

Crypto.com is a cryptocurrency platform that you can technically access from a desktop device, however, in order to access all of the features that crypto.com offers, you really need to download the mobile app, which is available on both iPhone and Android. The app is extremely user friendly, meaning that beginners can navigate the platform with ease.

Crypto.com was originally founded in 2016 in Hong Kong and today it offers more than 250+ cryptocurrencies to over 10 million users around the world — now serving users in over 90 countries. Since 2016, Crypto.com has emerged as a market leader in the cryptocurrency industry, launching the first broad-scale crypto-ready debit card for its users, as well being one of the fastest growing crypto trading apps on the planet.

Crypto.com allows for investors from around the world to purchase everything from Bitcoin (BTC) and Ethereum (ETH) all the way down to a comprehensive assortment of random altcoins all while transacting in almost any major currency — making Crypto.com one of the most functional exchanges for a crypto newbie.

To get a better understanding of Crypto.com, let’s use a classic pros & cons list to weigh up the verdict.

Pros & Cons of Crypto.com

Pros

-

Beginner Friendly: If you’re new to cryptocurrency, then Crypto.com is definitely an exchange that you will find intuitive. If you just want to buy and hold crypto assets, Crypto.com takes out all the complicated and unnecessary “trading” jargon, charts and info so that users can focus on the simple stuff.

-

Crypto-Ready Debit Card: Other being one of the most beginner-friendly major exchange apps, crypto.com also offers its investors access to a range of crypto-ready debit cards, where users can easily transfer their crypto assets into spendable money. Once users “stake” a certain amount of CRO, the native token of crypto.com, they will gain access to different crypto cards (depending on how much is staked). Each card offers unique incentives including free Netflix and Spotify as well Airport lounge access for higher-tier cards.

-

Staking Available: Crypto.com makes it easy for investors to access staking products via the Crypto.com Earn service. Staking lets investors earn interest on their crypto interest while they hold them.

-

Massive Selection of Major Tokens & AltCoins: One of the most frustrating experiences is getting completely set up on a new app or platform and then realizing that the random, niche altcoin your mate mentioned to you isn’t actually available on the app you’ve just signed up for. You most likely won’t have that problem with Crypto.com, as it offers over 250+ digital assets, covering all of the weird and wonderful tokens you could think of. Crypto.com has also recently created its own on-chain NFT marketplace.

-

Desktop Version is Packed With Features: Crypto.com offers more advanced investors a massive selection of unique trading features such as margin trading and leveraged futures on its desktop application.

- Extremely Low Fees: Crypto.com offers some of the lowest fees in the business charging a reducible 0.4% per trade, offering a further discount for users who choose to stake the Crypto.com Coin (CRO).

Cons

-

Clunky Deposit Process: The one major downside to Crypto.com is that its deposit process is extremely slow. If Australian users want to purchase crypto from scratch instantly, they will have to cop the 3.5 to 4% credit card fee. Alternatively investors can transfer via BPAY or NPP, both of which take anywhere from a few hours to a few days to go through.

- Poor Customer Service: While Crypto.com is loaded with features, customer service is lacking when compared to other exchanges like CoinSpot, Swyftx or Digital Surge. While these large Australian-owned exchanges all offer some form of LiveChat customer support Crypto.com does not, meaning that technical or administrative issues can often be frustrating to resolve.

Crypto.com Fees Explained

Fees are ultimately how crypto exchanges and platforms make their money, so it’s really important for investors to understand how much they’re paying every time they make a trade. Fee structuring can be pretty tricky, as platforms often like to disguise hidden costs in the form of strange fees.

Here are the main types of fees that users of Crypto.com will come across.

Crypto.com Deposit Fees

The first fee that crypto investors will encounter is the deposit fee. This is because investors need to deposit funds before they can start trading. For Australians, Crypto.com only offers two primary methods through which to deposit AUD funds: card purchase or BPAY / NPP.

- When using a debit or credit card to make a purchase, there is a fee of up to between 3.5% and 4% for Australian users. However, Crypto.com waives this fee for the first 30 days.

- Deposits made through BPAY or NPP are free, however they may take some time to go through.

- Withdrawing funds is also free, however the process tends to be just as clunky as the deposit.

Crypto.com Transaction Fees

Crypto.com has a slightly confusing fee structure, however the fees are extremely low. Investors are also incentivized to “stake” CRO to receive a discount of trading fees. This discount is increased as investors stake more CRO, however it only really makes a substantial difference to those trading large sums of crypto.

Crypto.com offers 0.04% to 0.4% maker fees and 0.1% to 0.4% taker fees based on a somewhat complex Maker-Taker model, which changes based on your monthly trading volume. Essentially, most beginner investors will be charged a 0.4% fee on all trades, unless they move more than $25,000 worth of crypto around each month.

Is Crypto.com Safe to Use?

No matter your experience level, the security and safety of the platform used to buy and sell digital assets is usually a top concern for crypto investors. Crypto.com is officially one of the world’s highest security crypto exchanges, being the first major international exchange to secure an ISO 27001 certification, meaning that it has the highest information security clearance possible.

All Crypto.com activity is further protected by 2FA (two-factor authentication) that requires investors to enter a code generated on their registered mobile device to sign in to the Crypto.com platform.

Crypto.com also insures all investor accounts up to $250,000 and stores most of its digital assets in an offline crypto wallet in cold storage, meaning that even if the exchange were to be hacked, the majority of its assets would be physically inaccessible to hackers.

Crypto.com Alternatives

If Crypto.com isn’t exactly what you’re looking for, there are plenty of alternatives. The alternatives listed here are ranked in order of similarity and preference for using Australian Dollars.

- Binance: The largest crypto exchange in the world based on daily trading volume. Binance is oriented more strongly towards non-Australian users and is more suitable for advanced traders looking for niche pairs.

- CoinSpot: Australia’s largest cryptocurrency platform with more than 350 digital assets available.

- Digital Surge: Another Australian exchange with more than 200 cryptocurrencies that operates natively in AUD. Has a quick verification process but higher fees than Crypto.com.

- Swyftx: Also an Australian platform with more than 260 digital assets available. Swyftx offers slightly lower trading fees and also allows users to ‘stake’ their crypto assets to generate passive income.

- Cointree: An Australian operated exchange and fully AUSTRAC-regulated. Offers similar features to Crypto.com but with a smaller selection of tokens and slightly higher fees.

- Coinbase: Possibly the most well-known exchange in the world. Investors can trade a variety of different cryptocurrencies but fees are high and all values are denominated in USD.

- eToro: Offers commission-free crypto trades with the added bonus of social and copy trading.

Overall Crypto.com Conclusion

Crypto.com is by far one of the best crypto exchange apps that any crypto investor can use. Crypto.com’s app is built with the functionality for both beginners and experts alike, and offers a trading-volume reducible fee of just 0.4% on all trades. Crypto.com is also one of the most comprehensive platforms offering over 250+ different tokens as well as access to its incentive-packed, crypto-ready debit card.

Furthermore, Crypto.com is the one of the world’s largest crypto exchanges meaning that investors can always access a high liquidity marketplace. It was also the first exchange to receive ISO 27001 certification (extremely high information security). Crypto.com is also registered with AUSTRAC and Blockchain Australia, which actively prevent financial crimes, scamming and any other unsavory business from occurring on the platform.

Finally, Crypto.com’s selection of over 250+ different cryptocurrencies is one of the widest ranges in the world. Investors will be able to purchase all of the major crypto assets, such as BTC, ETH, BNB, XRP, ADA, as well as most of the altcoins that you’d want to invest in.

Read Next

- Swyftx Review 2022: Everything Australian Investors Need to Know

- Digital Surge Review 2022: Everything Australian Cryptocurrency Investors Need to Know

The post Crypto.com Exchange Review 2022 appeared first on DMARGE Australia.

We may be enduring an extended, sodden summer right now, but by the time we get to July, many Australians will be itching to clamber the coop and soak up some more hot weather.

Only problem is, logging onto Qantas, Qatar, Emirates or Singapore Airlines might leave you rubbing your eyes. Flights are expensive right now. Real expensive.

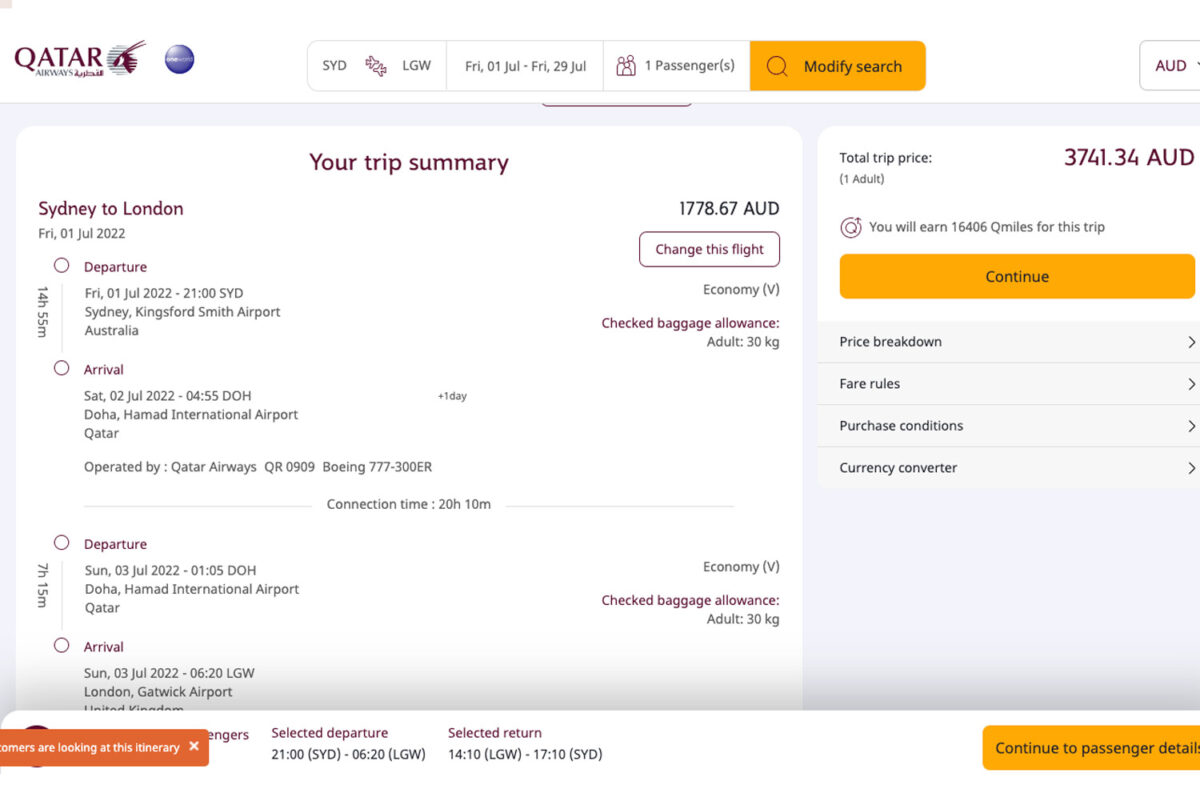

Take Qatar Airways for instance. A flight from Sydney to London in July flight currently costs between $1,700 and $1,951. A return trip is up around $3,000 to $4,000.

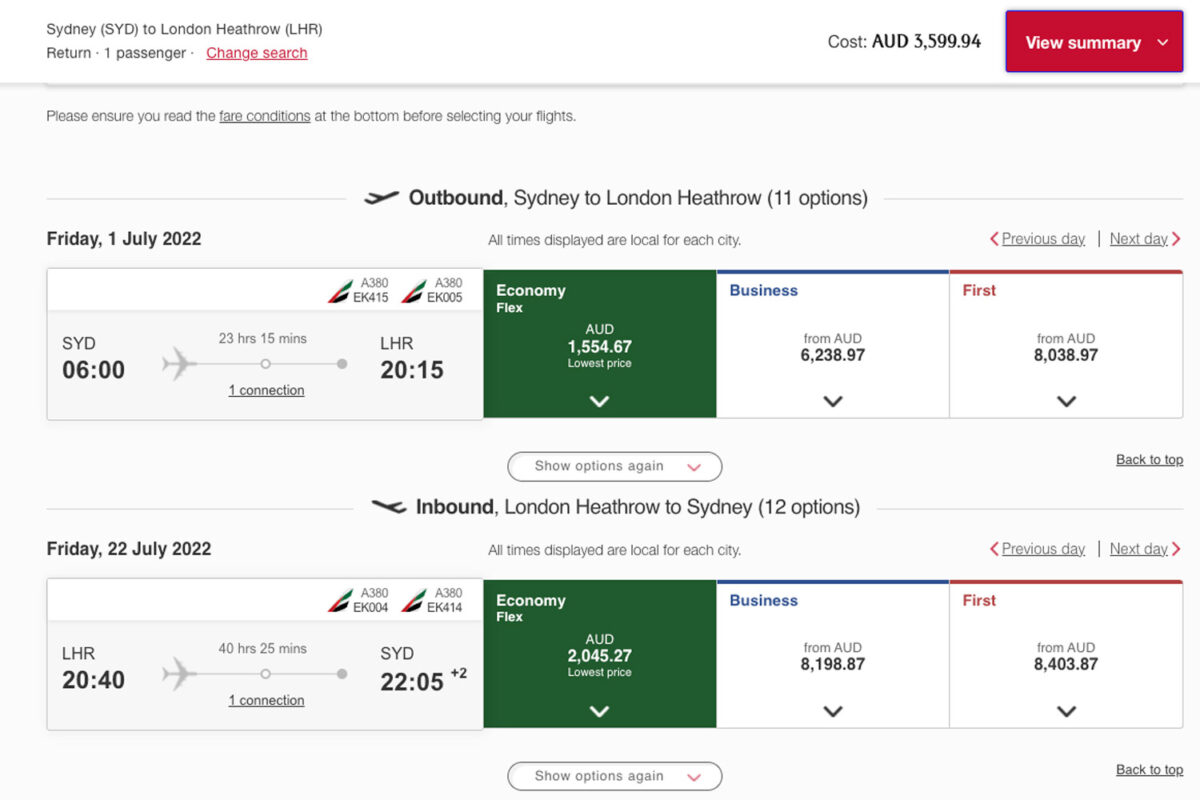

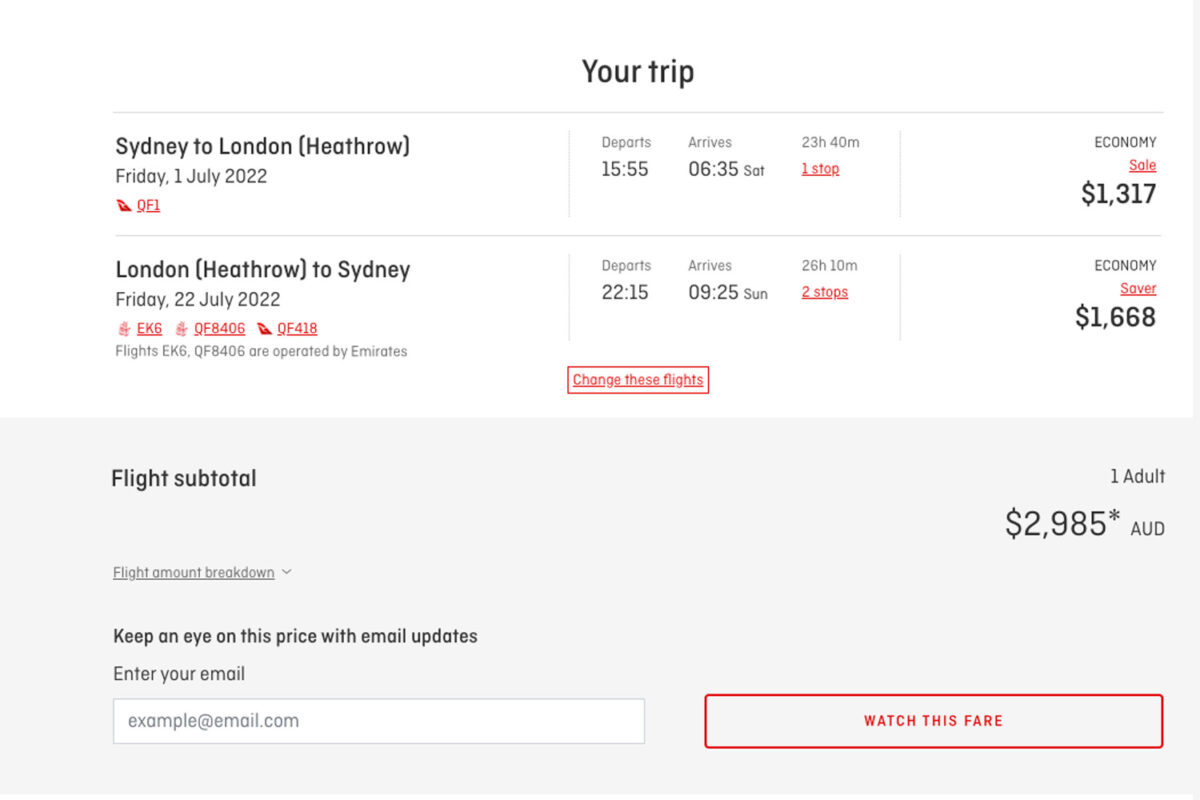

When it comes to Qantas, though it’s a tad cheaper, you’re still looking at dropping $3,000 to book a return trip to Europe in July. As for Emirates, we found a return flight to London for $3,599. On Singapore Airlines, we found a return trip in July for $3,893.

And are things going to go from bad to worse? Many think that’s unavoidable.

Comparing the standard routing for JL43 between Tokyo and London to today’s routing. pic.twitter.com/x28WGyOf3o

— Flightradar24 (@flightradar24) March 4, 2022

Why? Russia’s invasion of Ukraine is hurting airlines’ bottom lines for two reasons. One: some of them used to fly over Russian airspace (and now have to take a longer route around). Two: it’s making oil more expensive, as Russia, before the sanctions, was one of the biggest suppliers to Europe.

As news.com.au reports: “As the invasion approached its third week, Britain said it would phase out Russian oil by year’s end while oil giants BP and Shell announced an immediate halt to Russian oil and gas purchases and the European Union planned to slash gas imports by two-thirds.”

RELATED: Pirates, Plagues & Putin: Russian Superyachts Taking Huge Risks To Reach Safe Ports

Russia has warned the sanctions will have catastrophic consequences. But the US has led the push anyway, with Russia accounting for less than 10% of US oil and petroleum imports.

In terms of airfare prices, Forbes reported on March 12th that ticket prices are determined by consumer demand, “so even when fuel prices are low but demand is high, ticket prices will rise.”

“Airlines also hedge their fuel purchases, meaning they buy their fuel in advance to protect against sudden price spikes. And, as you can see, jet fuel still hasn’t reached the record highs set in 2008.”

Forbes also reported: “Airfares will probably rise for your next vacation,” explaining “Prices were already trending higher, with airfares expected to rise 7% this month.”

While experts predict ticket prices will climb even higher, there’s some uncertainty about whether it will happen sooner or later,” Forbes added. “Energy prices are putting pressure on airlines to raise fares, but demand is also weakening in some markets. (Even when energy prices fall, airlines don’t necessarily lower their fares.).”

As for Australia, USYD Professor of Transport and Supply Chain Management Rico Merkert has told DMARGE the sanctions may not have as huge an impact on flight prices as you might think.

“The sanctions on Russian airlines will not be too big of a deal for Aussie flyers, unless, they want to travel to Russia,” Merkert told DMARGE.

“For Russian airlines, those sanctions are problematic, as they affect not just the leasing of their aircraft but also maintenance, repair and overhaul. Spare parts will be hard to come by and so it is not just about cost but about remaining operational overall.”

“The flight prices for Aussies are unlikely to be impacted by this though,” he added. “Freight rates for air cargo are more likely to increase (due to less capacity in the market) and of course, any detours around Russian/Ukrainian airspace will be impacting operating cost and schedules.”

“That is particularly relevant for airlines operating Europe to Northeast Asia routes, such as Finnair.”

Merkert finished: “What will have a bigger impact on airfares on flights of unhedged airlines are the elevated oil/jet fuel prices. The longer they remain above $100/bbn, the higher the chance of paying more for your flights to Europe or anywhere else (or to refuel your car).”

Qantas CEO Alan Joyce has said Qantas fares will increase by 7% for now to account for increasing oil costs. He also indicated there could be more price hikes coming.

At the Australian Financial Review Business Summit last Tuesday, Joyce said Qantas has hedged around 90 per cent of the fuel it needs through to the end of June, and 50% of its requirements for the September quarter.

“(Hedging) gives us time to react to that higher fuel price,” he said. “Unfortunately, if we stay at these levels, airfares are going to have to go up, we’re going to have to pass them on.”

Flight Centre managing director Graham Turner has warned that passengers could soon face a 10-15% increase in airfare prices, if oil prices hit US$200 a barrel.

Turner told The Australian: “My guess is with airline capacity increasing, we should get back to pre-COVID international airfares over the next six months, but the cost of fuel could put 10-15 per cent on an airfare.”

Maybe Byron Bay doesn’t look so bad after all…

Read Next

- How Russia’s Ukraine Invasion Will Impact Australians’ European Holidays In 2022

- This Documentary Explains Why Putin Is Invading Ukraine

The post Rising Oil Prices Could Make Your July Holiday Wildly More Expensive appeared first on DMARGE Australia.

As inflation rates continue to rise at a rate not seen since the early 1980s, Elon Musk has said that he isn’t going to sell his Bitcoin any time soon.

Replying to the CEO of MicroStrategy & notorious Bitcoin investor Michael Saylor on Twitter, Elon Musk told his 78 million followers that owning stocks in companies that produce high quality goods was superior to stockpiling cash.

He also added that he won’t be selling any Bitcoin, Ethereum or Doge (fwiw: for what it’s worth).

On the back of these tweets, Dogecoin rose 3.9% to $0.11, according to TradingView before falling 1% in the following hours. Bitcoin rose approximately 3.4% before shedding its gains and Ethereum was up a measly 0.3%.

Saylor initially stated that increasing inflation would cause people to run away from cash, debt and value stocks to buy more “scarce” items such as Bitcoin.

Musk has also said in the past that Bitcoin is less likely to become a currency as it is more suited to being a “store of value”, a status usually assigned to low-risk assets such as gold and treasury bonds.

“The transaction value of Bitcoin is low and the cost per transaction is high. At least at its base level, it’s suitable for a store of value. But fundamentally, Bitcoin is not a good substitute for transactional currency.”

Elon Musk – Time Magazine

Unfortunately for both Musk and Saylor, the market hasn’t given much in the way of legitimacy to the thesis that Bitcoin as a stable store of value during times of economic uncertainty.

According to the US Bureau of Labor Statistics, inflation in the United States has already surged from less than 1% to a rate of 7.9% in the past 18 months alone. Despite the rate of inflation skyrocketing further in recent months, the price of Bitcoin has continued to plummet from its all-time-high on November 10 last year.

For the most part, Bitcoin seems to behave in a similar way to high-growth stocks like Tesla and Shopify, where investors place a high value on the future benefits of the asset or company. Most institutions tend to approach Bitcoin with an “opportunity cost” mentality rather than with a long-term investment strategy.

Matt Comyn, the CEO of Commonwealth Bank Australia summed up the institutional investment thesis perfectly when he told Bloomberg,

“We see risks in participating, but we see even bigger risks in not participating.”

Read Next

- Pirates, Plagues & Putin: Russian Superyachts Taking Huge Risks To Reach Safe Ports

- 5 Biggest Traps & Pitfalls Cryptocurrency Investors Fall For

The post Elon Musk Explains Why He’s Not Selling His Bitcoin Right Now appeared first on DMARGE.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »