Your cart is currently empty.

The following article was produced in partnership with Myer.

Men. Have you ever felt you want to up your grooming game but don’t want to invest in the cheap products you find in your local supermarket? Where else can you find products without having to go into high-end boutique stores? The answer? Myer.

Myer fully understands the world of male grooming can be overwhelming. Product ranges continue to expand and ingredient lists can become increasingly confusing. It’s not surprising that some men find it hard to tap into quality grooming products.

Fortunately, Myer has now done the hard work for you and introduced The Grooming Zone, bringing together a comprehensive selection of some of the best male grooming products on the planet, into one easy-to-navigate destination. The result? A complete solution to the grooming needs of Australian men.

What is The Grooming Zone?

The Grooming Zone is Myer’s inventive destination for all things male grooming, catering to skincare, haircare, makeup, personal hygiene and other grooming essentials. You can find The Grooming Zone both in store at Myer locations around Australia, as well as online.

Searching for and finding the best grooming products for you has never been easier.

What brands are stocked in The Grooming Zone?

The Grooming Zone unites a wide range of products from various male grooming brands, both local and international. One of the standout performers, however, is undoubtedly Charles + Lee.

Charles + Lee is an Australian male grooming brand that hails from Melbourne. Having only been founded in 2015, it’s fair to say they’re still a youngster relative to some others, but their no-nonsense approach to male grooming has quickly catapulted them into the spotlight.

Believing that male grooming products need not be overcomplicated, Charles + Lee do away with creative jargon and instead focuses on what really matters. All products are made in Australia from natural ingredients, for example, and better still, all are cruelty-free and vegan friendly.

You won’t find ingredients that are sourced from atop the most remote mountains or the deepest oceans, but when the natural ingredients they do use perform to the highest standards, then who cares?

While all grooming products in the Charles + Lee collection are worthy of your attention, some of the star performers include:

Face Wash: A simple daily cleanser that leaves your skin feeling energised and refreshed, thanks to a combination of grape seed oil, chamomile extract and AHA to lightly exfoliate the skin and draw away impurities.

Charcoal Face Scrub: This occasional-use face scrub draws on the benefits of charcoal powder, which works as a natural detoxifying agent to draw out dirt and oil from the skin, leaving it feeling super fresh. Perfect for use before shaving, the charcoal face scrub is a bathroom cabinet essential.

Oil-Free Moisturiser: It’s a fact of life that we all have different skin tyes, whether it be normal, dry, oily or combination. You need to make sure you buy the right products for your particular skin to see the best results. Charles + Lee has done the hard work for those with oily skin by developing this oil-free moisturiser.

It works in the exact way you’d want a moisturiser to work, i.e. leaving the skin feeling hydrated, but does away with excess shine, while the inclusion of vitamin E helps to prevent signs of ageing.

Hair & Body Wash: It’s not just your facial skin you need to pay close attention to, but your hair and the rest of your body also deserve the same high performance treatment. The ultimate 2-in-1 bottle of goodness, Charles + Lee have called upon native Australian Kakadu Plum, which is abundant with vitamins C & E to fight signs of aging, whilst eucalyptus oil removes impurities from both the hair and skin, making both look their damn best.

Moisturiser SPF 15: Australian men know well that the harsh sunlight and UV rays beaming down on this country can have a negative effect on your skin if you don’t protect it effectively. To that end: this Moisturiser with SPF 15 gives you a daily dose of protection against harmful UVA/UVB, while also hydrating the skin and improving its overall health in the process.

See, skincare and self-care don’t have to be hard. It just takes a quick visit to Myer’s The Grooming Zone to stock up on some essential products to have you looking and feeling your best. Perhaps the best thing about the Charles + Lee collection is that it’s incredibly affordable.

While you’ll find some skincare brands charge crazy money, justifying it with the use of rare and exotic ingredients, Charles + Lee offers an incredible selection of quality products that won’t break the bank.

The entire Charles + Lee grooming collection is available now at Myer’s The Grooming Zone. We implore you to check it out.

The post ‘The Grooming Zone’ Is Australian Men’s Go-To For Quality Self-Care appeared first on DMARGE Australia.

- ADA is the native token of the Cardano blockchain platform, which has positioned itself to be a competitor to Ethereum (ETH)

- ADA is currently down 70% from its all-time-high in early-September last year, trading for $0.91 ($1.24 AUD) at the time of writing

- ADA’s downturn has been accelerated by the current crypto market decline, as well as concerns that the Cardano platform may not be able to deliver on its promises

- Experts remain completely divided about the future of Cardano, with some claiming that ADA will be worth $58 by 2030 and others predicting that the platform will fail in the long-term

This year has been a challenging one for crypto investors. The overall crypto market remains down 18% year-to-date and holders of ADA will be disappointed to know that the token has further underperformed the general market, currently down 33% from January 1 of this year. As of today, ADA is ranked as the 8th largest cryptocurrency by market cap.

Table of contents

What is Cardano (ADA)?

Launched in 2017 by Ethereum co-founder Charles Hoskinson, Cardano (ADA) was initially marketed as a “third generation” cryptocurrency that would solve the problems faced by both Bitcoin and Ethereum. It was designed to offer users fast, secure transactions as well as being a platform for running decentralized applications and smart contracts.

What Caused Cardano’s Price to Drop?

In September of last year Cardano released an upgrade called the “Alonzo” hard fork, which would allow for users to run smart contracts and mint NFTs on the blockchain. Since the day of the upgrade, however, the price of ADA has been on a gradual decline, now down 65% from the day of the announcement on September 13.

According to Finder, expert analysis from a panel of crypto industry leaders attributed the price decline to a whole host of reasons, including the lack of something called “Total Value Locked” (TVL) on the Cardano platform as well as a failure to deliver on promised utility.

ADA Short-Term Price Prediction (1 month)

For the most part, expert technical analysis seems to conclude that buying ADA now might be a good move, with FXStreet analyst Ekta Mourya, predicting some short-term disruption for ADA however, expecting that it will continue to display strong upward price momentum in the long-term following recent updates and network developmont.

Despite the downward price action — if ADA can break the $1 ($1.35 AUD) mark in the coming weeks, then it is reasonable to expect that the token will continue to grow to $1.20 (USD), which would be a 33% increase from its current price. The positive price action comes as the Cardano platform continues to grow its DeFi capabilities and investors slowly regain confidence in the project.

Expert ADA 1-Year Price Prediction (2022)

In a report from Finder, the Chief product officer at Permission, Vanessa Harris, outlined that she was incredibly bullish on the future of Cardano and expects ADA to end this year with a valuation of approximately $3 ($4.06 AUD) mark.

Adding to the bullish thesis is Bilal Hammoud, CEO at NDAX, also believes strongly in the future of Cardano, adding:

“ADA is one of the most underrated assets – as the smart contract and DeFi stabilize, we should see many projects migrate to it.”

However, expert opinion on Cardano remains strongly divided, with Joseph Raczynski, a technologist and futurist at Thomson Reuters saying that he expects Cardano to fail in the final analysis, claiming that its slow growth and failed utility will render the project worthless:

“I believe Cardano will fade away in the coming years. They have failed on their promise of delivery for the last several years.”

ADA 3-year Price Prediction (2024)

On a more bearish note, according to automated technical analysis from DigitalCoinPrice the price of ADA is set to reach $1.65 ($2.23 AUD) by the end of 2024.

This is contrasted by more bullish automated analysis from WalletInvestor that expects the price of ADA to reach $3.89 ($5.27 AUD) in roughly 3 years time.

Expert ADA 9-year Price Prediction (2030)

Investor, Veronica Mihai offers a bearish view on the long-term price of Cardano, stating that in the next 9 to 10 years the token will fail to grow, saying that:

“Unless they achieve great tech advances and a significant user base, it may suffer the same fate as most PoS coins.”

However, according to a panel of experts interviewed by Finder, if Cardano can continually grow adoption it could be set to reach a price of $58 by 2030.

According to automated analysis from DigitalCoinPrice, ADA is on track to reach a price of $4.31 ($5.84 AUD) by the end of 2030.

ADA Price Prediction Conclusion

- Cardano is one of the largest projects in the crypto space and i’s long-term success depends on whether or not the project can deliver on its promise to become a legitimate competitor to the Ethereum network, by offering developers a cheap and cost-effective platform to build smart contracts and other decentralized applications.

- Investors should expect to see volatility in the price of ADA when Ethereum launches its ETH 2.0 upgrade later this year, as Ethereum’s transition to Proof of Stake (PoS) will challenge the benefits provided by Cardano.

- Ultimately, if you think that the Cardano platform has the ability to provide a competitive edge against Ethereum and other platforms such as Solana, then buying ADA may be a good long-term decision.

Read Next

- Ripple Price Prediction AUD: What Price Can XRP Reach In 2022?

- Binance Coin Price Prediction AUD: What Price Can BNB Reach In 2022?

The post Cardano Price Prediction AUD: What ADA Could Reach In 2022 appeared first on DMARGE Australia.

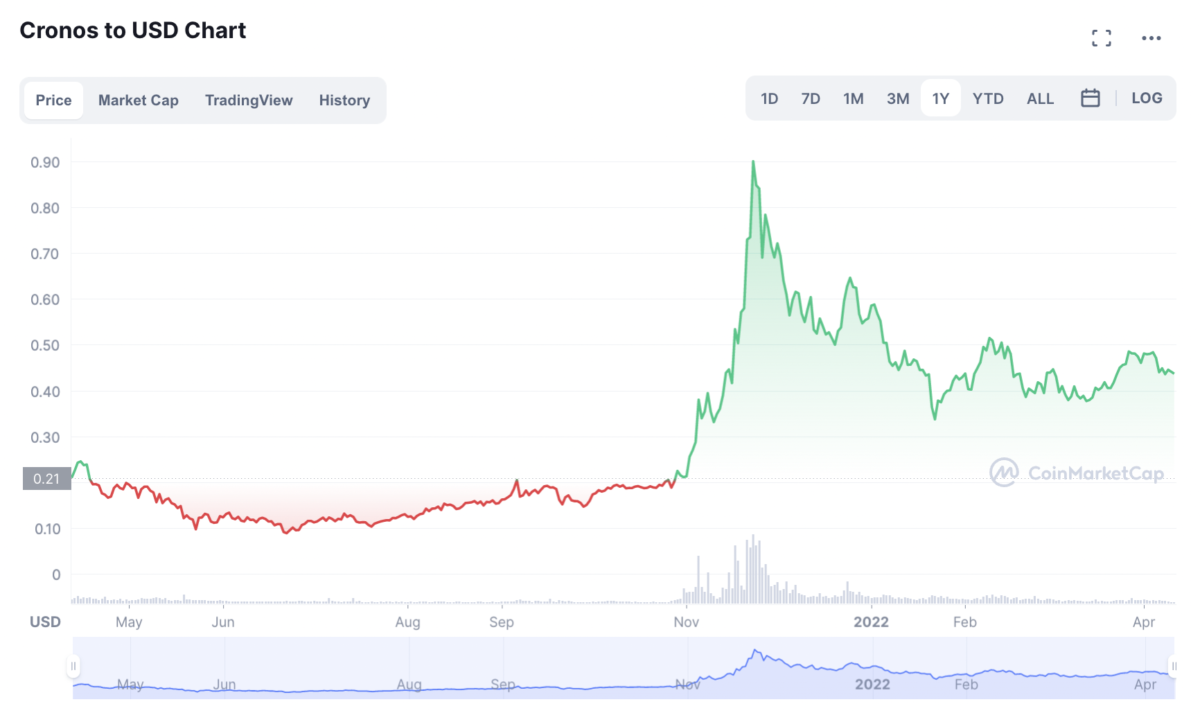

- CRO is the native token of Crypto.com — a market-leading cryptocurrency exchange app and payment platform and is the 17th largest cryptocurrency by market cap.

- CRO began to attract the attention of crypto investors in November last year, after rallying over 400% in under a month on the back of an NBA naming rights deal that saw the Staples Centre renamed as the ‘Crypto.com Arena.’

- The ‘Crypto.com’ token (CRO) was recently renamed ‘Cronos’, reflecting Crypto.com’s move towards a larger decentralized ecosystem — focusing on DeFi, NFTs and the metaverse .

- Most experts are quite bullish on CRO, as the token’s value is supported by a growing underlying business that is leading the charge of mainstreaming cryptocurrency adoption.

The price of CRO has consistently tracked movements of the broader crypto market during the recent market slide and is down 31% year-to-date. CRO currently trades for US$0.43 ($0.58 AUD) per token and is ranked as the 17th largest cryptocurrency by market cap — valued at a respectable US$11 billion ($14.8 billion AUD).

Table of contents

What is CRO?

To clear up any confusion moving forward, what was once called the ‘Crypto.com token’ (CRO) has been recently renamed to ‘Cronos’. On February 18, Crypto.com went ahead with the name change, not just as a branding move, but to demonstrate that the Crypto.com organization is making serious progress in creating a larger decentralized network that may eventually compete with the Binance Smart Chain and potentially even the Ethereum network.

Cronos belongs to a class of digital assets known as “utility tokens” — which means that it is used to pay and validate transactions on the Crypto.com Network. Users of the Crypto.com app are incentivised to buy, hold and stake their CRO to receive rewards, and even gain access to the crypto.com debit card.

CRO Tokenomics

Cronos is a non-mineable, limited supply token with 30 billion tokens in circulation. CRO is also a deflationary token, meaning that the total number of Cronos tokens decreases over time. This generally tends to have a positive impact on price long-term, as the total number of tokens become more scarce.

It is important to note that 40% of the total supply has been locked until the 7th of November 2022, meaning that investors can expect the price of CRO to be diluted in the mid-term when these tokens once again become available on the market.

Crypto.com Overview & News 2022

Founded in 2016 by now-CEO Kris Marszalek, Crypto.com is one of the world’s largest exchange apps, boasting over 10 million users. The Singapore-based exchange is responsible for the world’s largest cryptocurrency card program, after announcing a global partnership with card-payment provider VISA in March last year.

In addition, Crypto.com have recently launched its own premier NFT platform, alongside its new smart chain called ‘Cronos Chain’ which aims to make the entire organization more decentralized and allows for DeFi projects and DApps to be built on a CRO-native network for the first time.

CRO Short-Term Price Prediction (1 month)

Despite the recent rebrand to Cronos and with Crypto.com arguing that the Cronos chain is faster than the Ethereum network, CRO has remains down 25% YTD.

Analysts at FXStreet are relatively bullish on CRO in the short term, expecting the price to rise from its current price of US$0.43 ($0.58 AUD) to US$0.46 ($0.62 AUD) over the next few days, a comfy 7% increase in the short term.

Contrastingly, analysts from Central Charts have a more bearish outlook for CRO in the short-term, predicting that if CRO continues its downtrend from here then CRO may be expected to reach a new yearly low of US$0.33 ($0.46 AUD) for the token.

CRO 1-Year Price Prediction (2022)

Like most other cryptocurrencies at present, mid-to-long-term technical analysis from both TradingView and CoinCodex remains bearish, with most indicators leaning towards a negative price sentiment for the coming months.

The overall analysis of CRO remains bullish for the long-term with automated analysis from WalletInvestor predicting that CRO could feasibly reach a price of US$0.95 ($1.31 AUD) by the end of 2022.

Analysis from DigitalCoinPrice is slightly less bullish and predicts that CRO will be worth US$0.57 ($0.80 AUD) by the end of this year. Additionally, CoinQuora suggests that an end of year price target of US$0.97 ($1.35 AUD) is still on the cards. Finally, analysis from Gov.Capital predicts that CRO will finish the year at a price of $0.87 ($1.21 AUD).

CRO 5-year Price Prediction (2026)

Automated analysis from Wallet Investor states CRO could be valued at US$2.92 ($4.08 AUD) in the next 5 years, provided that current long-term macro trends continue.

Gov.Capital’s algorithmic predictions are slightly less bullish than Wallet Investor but still put BNB at a value of US$2.77 ($3.88 AUD) come 2026.

How to Buy CRO

So, if you decide to go ahead and purchase CRO you can do so on most major crypto exchanges. Unless you are already extremely comfortable with a certain exchange or platform, the best place to purchase CRO is on the native Crypto.com app itself, as Crypto.com will charge users lower fees and offer incentives for everything involving CRO.

CRO Price Prediction Conclusion

- CRO token (Cronos) has an extremely solid & sustainable foundation for growth and strong performance in the wider crypto market. Because CRO is a high utility token with some of the most impressive real-world use cases, it is arguably one of the more high-growth crypto assets to invest in.

- Currently, Crypto.com is the only large company with products that solve the most irritating and counter-intuitive problem with the crypto market today — actually using crypto as a currency.

- What makes CRO attractive to investors is that despite being the 17th largest cryptocurrency, it still has a good deal of room to grow. If CRO were to reach the size of a similar utility token such as Binance Coin (BNB), which has a market cap of $62 billion ($87.6 billion AUD) — CRO would grow a further 590% from here.

- Even if CRO doesn’t ever “moon” from here, it has all the necessary fundamentals to grow sustainably into the future. Investors should keep a watchful eye on all updates regarding broader crypto regulation as the price of CRO is particularly vulnerable to events that disrupt the performance of Crypto.com and its financial activity.

RISK STATEMENT:

This article is of a general nature only, and is intended for solely informational purposes.Crypto markets are substantially more volatile than that of regular finance, unexpected and dramatic price movements are bound to occur. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next:

- Best Crypto: The Three Best Cryptocurrencies To Buy Right Now

- Polygon Price Prediction AUD: What Price Can MATIC Reach In 2022?

- I Bought $1,000 Worth Of Cryptocurrency. It Taught Me A Painful Lesson

The post Crypto.com (Cronos) Price Prediction AUD: What Price Can CRO Reach In 2022? appeared first on DMARGE Australia.

- Ripple (XRP) is the native token of a digital payment platform called RippleNet and is the 7th largest cryptocurrency by market cap.

- XRP has consistently been in the top 10 cryptocurrencies since 2018, yet it remains one of the most lacklustre altcoins when it comes to performance.

- XRP is currently down 78.1% from its all-time high of US$3.40 ($4.32 AUD) on Jan. 7 2018 and is currently down 12% year-to-date (YTD).

- Experts remain utterly divided on XRP, with some analysts suggesting that XRP could revolutionize global finance while other say it lacks the necessary fundamentals to grow substantially in price from here.

While 2022 continues to be a rough year for crypto investors, XRP has held more ground than most of its large-cap counterparts, only down 12% year-to-date (YTD) which is slightly better than the overall crypto market which is still down 16% YTD. As of today, XRP trades for US$0.73 ($0.98 AUD) per token and is ranked as the 6th largest cryptocurrency by market cap. XRP remains one of the most well-established & widely used digital assets in the cryptocurrency industry.

In this story…

What Is XRP?

Before we can properly dive into an in-depth analysis of XRP, we need to clear up any potential confusion concerning the difference between XRP, RippleNet and Ripple.

As mentioned earlier, XRP is the Ripple ecosystem’s native token. RippleNet is the digital payment network that runs on a public distributed ledger (slightly different from a blockchain), called XRP Ledger. Ripple itself is a for-profit company that controls the growth and development of RippleNet.

Most investors aren’t aware that the idea behind Ripple and XRP actually predates Bitcoin and cryptocurrency altogether. In 2004, John Fugger launched a peer-to-peer (P2P) financial network called RipplePay. Fugger’s goal was to eliminate the need for banks by creating a “trustless” exchange of money on the internet.

However, it wasn’t until August 2012, when Jed McCaleb, an early Bitcoin pioneer — realized that RipplePay could potentially solve many of the concerns he had with Bitcoin and approached Fugger to turn RipplePay into a crypto network. Since then, XRP has continued to specialize in facilitating, fast and efficient cross-border transfer of money with large financial institutions around the world.

XRP News & Information 2022

Unlike other cryptocurrencies, which are more decentralized in nature, XRP’s price action tends to be majorly correlated with news concerning it’s parent company Ripple. Therefore, the growth of XRP is largely dependent on the partnerships that Ripple can forge with traditional institutions.

Since December 2020, Ripple has been embroiled in a legal case with the SEC. The claim is that Ripple traded $1.3 billion in their cryptocurrency XRP without ever registering the digital asset as a security with the SEC. The case is still underway, and the outcome could have major consequences for the price of XRP.

Ripple’s CEO, Brad Garlinghouse remains incredibly optimistic about the future for XRP, stating that he plans to take the company public following the conclusion of the lawsuit. The numbers from Ripple’s fourth-quarter report are undeniably positive:

“2021 was RippleNet’s most successful and lucrative year to date as global momentum skyrocketed with customer demand despite the headwinds from the SEC,” states the report.

“The number of transactions on RippleNet more than doubled, with a payment volume run rate of over $10B… and with over 20 payout markets for On-Demand Liquidity (ODL) … RippleNet continues to see more global demand for the product, states the report,” it continues.

When looking at how XRP behaves in relation to the crypto market — Price analysis from Capital.com shows that XRP tends to follow the general direction of the broader market. The price of XRP spiked to US$1.96 ($2.71 AUD) in mid-April 2021 when the crypto market rallied — reaching its highest point since it’s original all-time-high of US$3.40 ($4.32 AUD) in the previous market rally in Jan. 2018. Unfortunately for XRP enthusiasts, the token has failed to perform as strongly as other altcoins in recent rallies.

XRP Short Term Price Prediction (1 Month)

The short-term outlook for XRP is mixed, with analysts from FX Street predicting that the price of XRP will tumble a little bit in the coming days before before potentially rebounding upwards to $1. Analyst Akash Girimath, says that If XRP fails cannot hold consistently above a support level of US$0.77 ($1.04 AUD) then investors can expect a further drop from here.

Seeing as XRP is currently trading for US$0.73 ($0.98 AUD) per token, it’s reasonable to expect that the price will continue to slide in the short-term. However, if XRP can close above US$0.77 ($1.04 AUD) consistently over the coming days, the possibility of an upswing to US$1 ($1.35 AUD) is possible.

XRP 1-Year Price Prediction (2022)

Any long-term price prediction for XRP is somewhat contentious, because a lot of XRP’s future price action will be dependent on the outcome of the SEC lawsuit. If the SEC finds no wrongdoing or XRP can reach some form of settlement, the price of XRP should remain relatively stable.

However, if the outcome of the trial finds Ripple guilty of a securities violation, then the impact may have a negative impact on the immediate price of XRP. Furthermore the flow-on effect from a guilty verdict would have broader repercussions for the entire crypto market, concerning the regulation of cryptocurrencies.

Mid-term technical analysis for XRP from both TradingView and CoinCodex remains bearish, with most indicators leaning towards a negative price sentiment for the coming months.

The overall analysis of XRP remains bullish for the long-term with automated analysis from WalletInvestor predicting that XRP could feasibly reach a price of US$1.28 ($1.77 AUD) by the end of 2022.

Technical analysis from DigitalCoin is slightly less bullish, predicting that XRP will reach a price of approximately US$1.14 ($1.58 AUD) by the end of this year. It further predicts that XRP could reach $1.34 by the end of 2023.

PricePrediction was also bullish in its expectations, predicting the XRP coin to average $1.22 in 2022

XRP 5-Year Price Prediction (2026)

For the long-term, DigitalCoin suggests that XRP should reach an average price of US$1.47 ($2.03 AUD) in 2026 and reach US$3.44 ($4.76 AUD by 2030.

The experts at PricePrediction are far more bullish, predicting that XRP will reach $4.78 in 2026, and continue to grow to a more substantial price of approximately $24 by 2030.

When looking at automated technical analysis, it’s important to remember that the high volatility of the crypto market makes it extremely difficult to accurately predict long-term prices.

How To Buy XRP

If you decide to go ahead and purchase XRP, you can do so on almost all major crypto exchanges. The one main exception here is Coinbase, which has delisted the token from its platform pending the outcome of the SEC trial.

The best crypto exchanges & platforms for beginners to purchase XRP on are:

See our FULL REVIEW of CoinSpot here.

If you’re already purchasing crypto like a pro and you feel comfortable with the more technical exchanges you can also find ONE on Binance & KuCoin. All legitimate crypto exchanges and platforms will require you to go through some form of verification process that will ask you to provide a phone number, email address or upload ID documentation. Always make sure that the platform you purchase crypto on is secure.

Once you’ve purchased it, you’ll also want to make sure you have a secure crypto wallet to keep it safe.

XRP Price Prediction Conclusion

- XRP has an extremely strong foundation, owing to its parent company Ripple, forging partnerships with large financial institutions and consistently pioneering new use-cases for cryptocurrency in international banking. XRP is also one of the few digital assets with an extremely clear use that crosses over into the world of traditional finance. This makes XRP an attractive prospect for investors who believe in Ripple’s ability to improve and grow its customer base over time.

- Owing to its current status as the 7th largest cryptocurrency, flexing a substantial market cap of US$35.8 billion ($48.3 billion AUD), it is unlikely that you’ll ever 100X your money with XRP.

- Furthermore, XRP’s continued tenuous situation with the SEC makes investing in the cryptocurrency slightly more risky for the everyday investor. If the outcome of the investigation is negative, it’s expected that XRP will suffer substantial losses.

- Even though XRP is more risk-oriented than other digital assets, it has all of the necessary underlying fundamentals to grow sustainably into the future, especially if CEO Brad Garlinghouse comes good on his promise to take the company public.

RISK STATEMENT

This article is of a general nature only, and is intended for solely informational purposes.Crypto markets are substantially more volatile than that of regular finance, unexpected and dramatic price movements are bound to occur. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next

- Best Crypto: The Three Best Cryptocurrencies To Buy Right Now

- Polygon Price Prediction AUD: What Price Can MATIC Reach In 2022?

- I Bought $1,000 Worth Of Cryptocurrency. It Taught Me A Painful Lesson

The post Ripple Price Prediction AUD: What Price Can XRP Reach In 2022? appeared first on DMARGE Australia.

- While the rest of the crypto market has recovered some of its gains over the past month, Polygon (MATIC) is still down over 50% from it’s all-time-high on December 21 of last year, and has struggled to keep pace with the rest of market.

- On December 5 2021, an unknown hacker breached the Polygon network and made off with $1.6 million ($2.3 million AUD) in MATIC tokens. This raised red flags around the security of the Polygon network.

- Polygon is a scaling solution network, also called a “Layer 2 solution” for the Ethereum (ETH) network, that allows users to access all the benefits of the Ethereum network at a fraction of the cost.

- Experts and analysts remain divided on how MATIC will perform over the coming year, with some predicting that the Polygon network will fail to adapt to new Ethereum developments and will continue to fall in price.

Even though the fears of ‘crypto winter’ are starting to calm down, crypto investors and blockchain enthusiasts still seem to be somewhat cautious about where they invest their money. The question on everyone’s mind is: which token will perform the best in this unpredictable market? Some experts point to Polygon (MATIC), while others are not so sure… Let’s find out if Polygon can actually go the distance in 2022.

Currently trading for $1.42 ($1.91 AUD) per token, Polygon (MATIC) is down 51% from its all time high of $2.92 ($4.03 AUD) on December 21 last year. With a market cap of $11.09 billion ($14.95 billion AUD) Polygon is ranked as the 20th largest cryptocurrency at the time of writing.

What is Polygon?

Polygon is one of the more ‘technical’ tokens that investors need to wrap their heads around. Launched in October 2017, Polygon (MATIC) was developed as a Layer 2 scaling solution for the Ethereum network.

Now, if that sentence has you scratching your head a little, don’t worry. Put simply, Polygon is a parallel blockchain that runs on top of the Ethereum blockchain (hence the name, Layer 2), allowing users of the Ethereum network to create new DApps, mint NFTs and transfer digital assets, without paying the absurd gas fees that Ethereum has become infamous for.

If anyone is familiar with minting NFTs on Opensea or any other platform you’ll know that the Polygon network is extremely easy to use, and slashes minting costs from approximately $50 if you were to use ETH compared to a crisp $0 if you opt for MATIC.

Did Polygon Get Hacked?

In short, yes. Polygon was the victim of an attack on December 5, 2021. The hacker, who remains unknown, managed to make off with approximately $1.6 million ($2.3 million AUD) in MATIC tokens. This event was not made public until 24 days later when Polygon shared the news in a blog post on their website.

Despite the team at Polygon claiming that all network security issues have been sufficiently addressed, these events do cast reasonable doubt on the overall security of the Polygon network and other “scaling-solution” blockchains, that tend to be far more centralised than other blockchain networks. The entire point of a blockchain is to be ultra-secure, so if a project cannot ensure this, investors should approach with caution.

In light of this, the developers at Polygon are widely recognised as some of the best in the blockchain / crypto industry and have made substantial improvements to the network. They have also personally taken on all costs associated with the recent hack.

Will Polygon Become Obsolete?

The next important thing investors need to consider is – just how long with Polygon remain useful?

As Polygon is a solution to the network congestion that has emerged from Ethereum’s slow, power-hungry Proof of Work (PoW) system, many investors and developers are worried that when Ethereum moves to a much faster Proof of Stake (PoS) system, Polygon may be rendered obsolete.

While this has proved to be a genuine concern for many investors across social media, almost all of the technical experts in the blockchain industry don’t seem to be that worried, arguing that the Polygon network and other Layer 2 solutions will always be needed for Ethereum as network adoption grows.

As reported by Cointelegraph, the co-founder of Polygon, Sandeep Nailwal stated the following:

“Even if 2.0 comes in here, that will not provide enough scalability. Next year, the proof-of-stake upgrade will keep everything the same; like Ethereum has 13 transactions per second [TPS] right now, maybe it will go to 20 TPS [after PoS], but not more than that.

So that does not add anything to scalability. And let’s say in three to five years, even if the sharding comes, we’ll have a projection of 64 shards. And with each acting at 20 transactions per second, but that’s still 1,280 transactions per second overall, right? That’s still not enough for the entire world.”

Providing some added legitimacy to this statement is Vitalik Buterin, the founder of Ethereum. When he was asked about Polygon and its role in the Ethereum project nearly 8 months ago, he responded:

“I think [Polygon] has a very reasonable strategy and I’m definitely happy that they’re part of the ecosystem.”

If we listen to the experts, we can see that the most worrying threats to Polygon don’t come from within the Ethereum network itself, rather, investors should keep a close eye on other platform-based networks such as Cardano (ADA) or Solana (SOL) that threaten to take over the role of the Ethereum. As Polygon is practically 100% ETH focused, it means that if a competitor can “flip” or overtake Ethereum sometime in the near-future, the Polygon network will be sure to suffer some heavy losses.

Polygon Short Term Price Prediction (1 Month):

Price action for Polygon, much like all digital assets year-to-date (YTD) has been undeniably bearish.

Analysts from FXStreet expect this downward trend to continue, as a variety of technical indicators are beginning to point towards a major decline in price in the near future. FXStreet’s analysts expect that Polygon may “self destruct” over the coming days as the continued downward price actions plagues the token’s trading activity. They say that investors should expect to see Polygon reach a price of $1.32 ($1.78 AUD) in the next few days, as well as a possible drop to $1.15 ($1.55 AUD) over the next week.

Polygon 1-Year Price Prediction (2023):

As always, long-term price predictions in the crypto space are difficult to make, owing to the inherent volatility of digital assets. When it comes to Polygon, experts remain mostly bullish.

Advocates of Ethereum are likely to see Polygon in a more bullish light. For example, billionaire Mark Cuban publicly declared his support for, and shared that he is invested in Polygon:

“Polygon is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development.“

In regards to price, almost automated and algorithmic analysis remains fairly bullish on MATIC for the remainder of this year.

Analysis from GovCapital predicts that MATIC could rise to $4.25 ($6 AUD) by the beginning of next year, a whopping 138% increase from today’s price.

The outlook from Wallet Investor is quite similar, expecting that MATIC could reach a price target $4.50 ($8.47 AUD) by the start of 2023, an overall gain of 152%.

DigitalCoin is far more reserved in its analysis of MATIC, forecasting mostly “sideways” price action, predicting an end of year price target of $2.30 ($3.25 AUD), an increase of 29% from here.

Polygon 4-Year Price Prediction (2027)

Once again, Gov Capital and Wallet Investor are both extremely bullish on Polygon long-term, predicting that Polygon will be worth $11.60 ($16.38 AUD), and $12.75 ($18.01 AUD) respectively.

Automated analysis from Digital Coin is far more bearish, long-term and only expects Polygon to reach a maximum price of $4.27 ($6.03) by the beginning of 2027.

Polygon Price Prediction Conclusions:

- If investors are bullish on Ethereum (ETH), then they would be making a complimentary bet by holding some portion of their crypto portfolio in Polygon.

- Depending on what investors believe the crypto market will look like in the future, Polygon being joined at the hip to Ethereum could be seen as a major upside, or a major downside: as the value of the Ethereum network rises and falls, so too does Polygon’s.

- Ultimately, the Polygon is led by a team of experienced developers, who have worked hard to structure an organisation that is clear and transparent in its goals. If security remains a top priority and Ethereum remains a market-leading force in the crypto market, it makes sense that this project will continue to grow in value moving forward.

RISK STATEMENT

This article is of a general nature only, and is intended for solely informational purposes. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next

- Best Crypto: The Three Best Cryptocurrencies To Buy Right Now

- I Bought $1,000 Worth Of Cryptocurrency. It Taught Me A Painful Lesson

The post Polygon Price Prediction AUD: What Price Can MATIC Reach In 2022? appeared first on DMARGE Australia.

- Binance Coin (BNB) is the native token of the Binance ecosystem and the 4th largest cryptocurrency by market cap.

- BNB significantly outperformed both Bitcoin (BTC) and Ethereum (ETH), growing over 1,300% in 2021 — researchers expect this trend to continue.

- BNB is currently down 39% from its all-time high (ATH) on May 10 2021 and is down 21% year-to-date (YTD).

- Most experts are bullish on BNB and expect Binance’s healthy war-chest and its focus on new blockchain developments to provide strong long-term price action.

2022 started off poorly for crypto investors, with the overall crypto market witnessing some pretty substantial losses throughout the first 2 months of the year. Over the past 3 weeks, however, the market has begun to recover BNB coin has recouped some of its gains, and is currently valued at US$416 ($561 AUD) down 21% YTD. As of today, BNB is ranked as the 4th largest cryptocurrency by market cap and is one of the most well-established & widely used digital assets in the cryptocurrency sector.

What is Binance Coin (BNB)?

Binance Coin (BNB) is the native token of the Binance ecosystem. Quite simply, BNB is used to pay and validate transactions on the Binance Smart Chain (BSC). The 29 million users of the Binance exchange are incentivised to use BNB wherever possible and are rewarded with 10-25% discounts when using BNB for transactions fees and payments.

BNB Tokenomics

BNB is a deflationary token, meaning that the total number of BNB tokens decreases over time. This generally tends to have a positive impact on price long-term, as the total number of tokens become more scarce.

Binance reduces the supply of BNB every quarter based on the amount of trading volume. In crypto parlance, reducing the number of tokens in circulation is called a “burn”. Binance states that they will continue the quarterly burns until 100 million BNB are destroyed, which is equivalent to 50% of the total supply.

A total of 31.9 million have already been burned from a total circulating supply of 168.1 million thus far.

A Brief History of Binance

Binance was launched in July 2017 by founder and CEO Changpeng Zhao, affectionately known in crypto circles and on Twitter as “CZ”. CZ said that he decided upon the name “Binance” after combining the words “Binary Finance”. CZ stressed that the name was a signal to investors that a new paradigm of ‘binary’ assets (cryptocurrency) was being ushered into the world of global finance.

Binance is quite well-known, owing to its status as the world’s largest cryptocurrency exchange based on both users and daily trading volume. However, the Binance ecosystem goes far beyond just the exchange and includes a diverse lineup of blockchain-related projects, such as: Binance Chain, Binance Smart Chain (BSC), Binance Academy, Binance Research, Binance Labs, Binance Launchpad and even Trust Wallet.

BNB News & Information 2022

The most important thing that investors need to keep an eye on when it comes to BNB is regulation. Binance was banned from the UK in June last year, after regulators concluded that the exchange’s activity could not be “sufficiently supervised”, and now regulatory agencies around the world are beginning to take action against suspicious activity on Binance and other major crypto exchanges.

CZ has stressed on multiple blog posts and tweets that Binance is staunchly “pro-regulation” and is willing to work alongside all domestic regulators to make cryptocurrency as accessible as possible. While this eagerness for transparency and bipartisanship is definitely nice to see from Binance, it means practically nothing to regulatory agencies like the SEC who are looking to shut down anything they consider to be “unregulated” in the crypto market.

Regulation fears aside, Binance had an extremely successful 2021 – introducing the Binance Smart Chain (BSC) and the host of DeFi, NFT and smart-contract applications that came with it. As Ethereum “gas” prices climbed in 2021, the BSC offered a faster, less expensive alternative for those looking to build DeFi projects, mint NFTs or create new DApps. Because BNB is the native token for all transactions and payments on the BSC the price soared in response, growing over 1,300% in 2021 alone.

BNB Short-Term Price Prediction (1 month):

Analysts at FXStreet are quite bullish on BNB in the short term, with the FX Street team predicting an 18% surge over the coming weeks. This will occur if Binance Coin can hold steady at its new support level of US$410 ($552 AUD) — however it’s still possible that the market could take a dip, with bears will continue to push BNB to new lows. The analysts are bullish an expect short-term gains, however if BNB continues to drop, then investors can expect an approximate 15-20% drop from today’s (11 April 2022) price: US$416 ($561 AUD).

BNB 1-Year Price Prediction (2022):

Short-term technical analysis from both TradingView and CoinCodex remains bearish, with most indicators leaning towards a negative price sentiment for the coming months. The overall analysis of BNB remains bullish for the long-term with automated analysis from WalletInvestor predicting that BNB could feasibly reach a price of US$789 ($1122 AUD) by the end of 2022.

Analysis from DigitalCoinPrice is slightly less bullish and predicts that BNB will be worth US$584 ($830 AUD) by the end of this year. Additionally, CoinQuora suggests that an end of year price target of US$700 ($995 AUD) is still on the cards. Finally, analysis from Gov.Capital predicts that BNB will finish the year at a price of $597 ($849 AUD).

BNB 5-year Price Prediction (2026):

Automated analysis from Wallet Investor states BNB could be valued at US$2,450 ($3,485 AUD) in the next 5 years, provided that current macro-trends continue.

Gov.Capital’s algorithmic predictions are slightly less bullish than Wallet Investor but still put BNB at a value of US$2,183 ($3,105 AUD) come 2026.

How to Buy BNB:

So, if you decide to go ahead and purchase BNB you can do so on every major crypto exchange. Unless you are already extremely comfortable with a certain exchange or platform, the best place to purchase BNB is on the native Binance exchange itself, as Binance will charge users lower fees and offer incentives for everything involving BNB.

BNB Price Prediction Conclusion:

- BNB token has an extremely solid & sustainable foundation for growth and strong performance in the wider crypto market. Because BNB is a high utility token with a host of real use cases, it is arguably one of the safest crypto assets to invest in. It is also the native token in the Binance Smart Chain, which is posing serious competition to the Ethereum platform.

- Owing to its current status as the 4th largest cryptocurrency, flexing a substantial market cap of US$62 billion ($87.6 billion AUD), it is unlikely that you’ll ever 100X your money with BNB.

- It can be useful to imagine BNB as a large-cap tech stock (like Facebook), except in the crypto market. Binance maintains a strong market-leader status in all of the most fundamental sectors of the crypto market. They have the largest number of users and the highest consistent daily trading volume of any exchange.

- While BNB may not ever “moon” from here, it has all the necessary fundamentals to grow sustainably into the future. Investors should keep a watchful eye on all updates regarding regulation as the price of BNB is particularly vulnerable to events that disrupt the performance of Binance and its financial activity.

RISK STATEMENT

This article is of a general nature only, and is intended for solely informational purposes.Crypto markets are substantially more volatile than that of regular finance, unexpected and dramatic price movements are bound to occur. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

The post Binance Coin Price Prediction AUD: What Price Can BNB Reach In 2022? appeared first on DMARGE Australia.

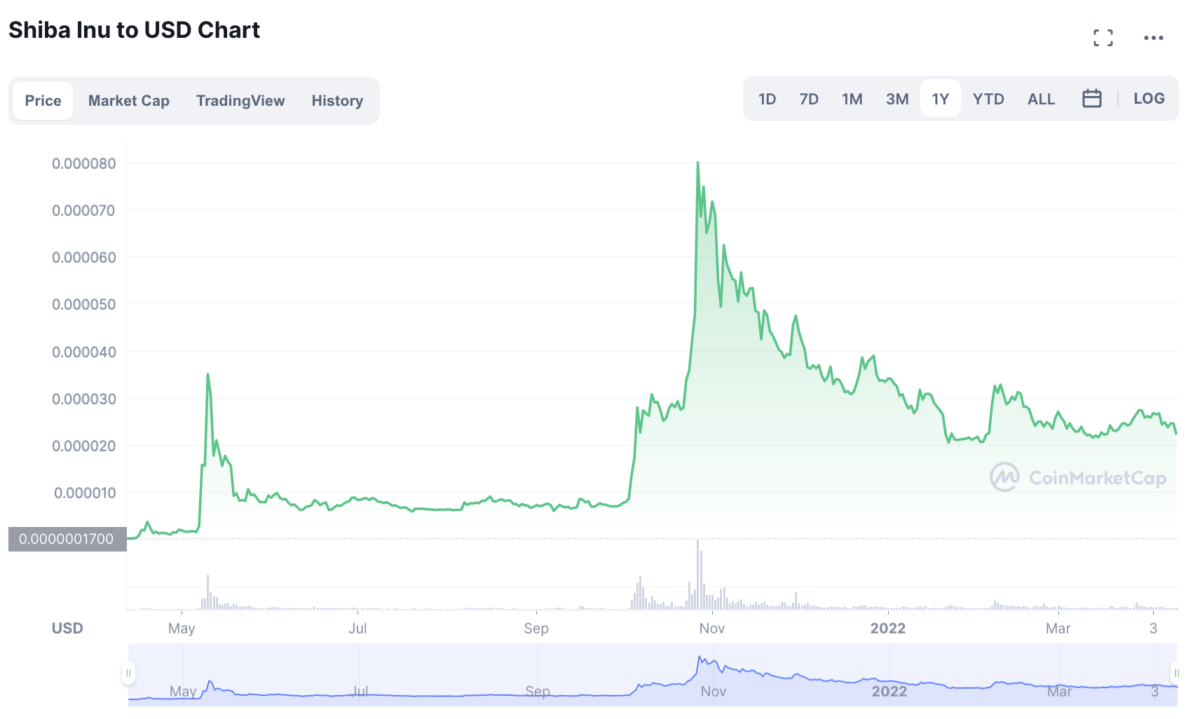

- Meme coin Shiba Inu (SHIB) has plummeted over 73% from its all-time high in October 2021.

- SHIB belongs to a controversial class of crypto assets called “memecoins” (also called sh*tcoins) that swing massively in price in response to related news, hype and the tweets of Elon Musk.

- Due to the purely speculation-based movements of SHIB’s value, analysts and experts are bearish on SHIB’s long-term price prediction.

As of Tuesday March 8th, SHIB is trading for $0.00002226 USD ($0.00002999 AUD). SHIB is down 73.2% from its all-time high of $0.00008616 USD ($0.00011478 AUD) on October 28 of 2021. With a market cap of $12.1 billion USD ($16.3 billion AUD) SHIB is ranked as the 15th largest cryptocurrency at the time of writing.

SHIB and similar meme coins like DOGE & FLOKI have proven to be major head-scratchers for traditional investors. It’s easy to poke fun at meme coins for being more like gambling than investing, but after SHIB’s meteoric rise, thousands of meme coin investors were laughing their way to the bank.

In what’s being called “the greatest trade of all time”, one SHIB investor managed to turn $8000 USD ($11171 AUD) into $5.7 billion ($7.9 billion AUD) after purchasing 70 trillion tokens (13% of the total supply) when SHIB launched on August 1, 2020.

So, what is SHIB? And how did a cryptocurrency valued purely on speculation come to be worth nearly $13 billion?

In this story…

What is Shiba Inu (SHIB)?

SHIB was launched by an anonymous founder, who goes by the pseudonym Ryoshi in August 2020. SHIB initially gained in popularity after the first crypto meme: Dogecoin (DOGE) went viral in January of this year. DOGE was created as a joke back 2013, but after members of the crypto subreddit r/SatoshiStreetBets began “pumping” the coin and witnessing epic returns from it, the market for meme coins exploded.

SHIB positioned itself as the next big thing and quickly became the cryptocurrency of choice for those who felt that they had missed out on DOGE’s exponential growth. Needing a daring plan to differentiate themselves from the new wave of meme tokens, the developers of SHIB came to the attention of the crypto world after deciding to “gift” 50% of the SHIB’s total supply to Ethereum founder Vitalik Buterin at the beginning of May. For a brief period in time, rumours that Vitalik chose to own SHIB of his own accord spread like wildfire on social media and the price surged in response.

Dashing the hopes of speculators, Buterin donated 50 trillion SHIB (worth $6.7 billion USD (($9.4 billion AUD) at the time) to a COVID relief fund in India and “burned” the remainder of his SHIB holdings, sending the price tumbling. However, these events plastered SHIB across international headlines, and because the total circulating supply of SHIB had been reduced by nearly 50%, the meme coin was primed for growth in the future.

It wasn’t until October 4, when Elon Musk tweeted the following picture of his new Shiba Inu puppy that the token once again began to skyrocket.

Holders of SHIB went crazy, and rumours that Elon Musk owned the coin spread rapidly across Twitter. The price exploded from $0.00000856 USD ($0.00001177 AUD) to $0.00008616 USD ($0.00011478 AUD) on October the 28th, an astonishing gain of 9,965% in just over 3 weeks.

Since then SHIB has tumbled over 70%, dashing the hopes and crypto wallets of many FOMO-fulled investors that “YOLO’d” into the meme coin too late. SHIB’s performance over the past 2 months has sparked fears about SHIB’s ability to return to prices near its all-time high.

So, can investors expect to see SHIB grow in value again? And what do experts and analysts have to say about the coin’s future?

Does Shiba Inu (SHIB) Have Any Real Value?

Ultimately SHIB has no real underlying value. It is a cryptocurrency that only grows in value because of wild speculation, hype, FOMO and the erratic tweets of Elon Musk. While some lucky investors have seen legendary returns from SHIB and other meme coins, the chances of making any serious gains on SHIB moving forward are extremely low.

If investors are willing to gamble on the chance that Elon will post another photo of his puppy, or that a positive rumour about SHIB goes viral, then there may well be some ROI in it for them. But that’s not exactly a sound investment strategy.

Watch Elon Musk and Mark Cuban discuss the potential applications of meme coins in the video below.

Despite the real-world applications of meme coins being discussed by the likes of Mark Cuban and Elon Musk (and Elon Musk recently announcing that Tesla will now accept DOGE as payment for merch), most experts remain sceptical about SHIB’s future growth.

Could Shiba Inu Creators End Up In Jail?

On December 1st 2021, the infamous “Wolf of Wall St,” Jordan Belfort publicly slammed meme coins like SHIB and DOGE, referring to them more colloquially as “shitcoins” and declaring that their creators should be jailed.

He told The Sun Online: “I’m a fan of blockchain but there’s a lot of nonsense out there, a lot of shitcoins which serve no purpose and are only there to separate people from their money… you hear crazy stories of people making millions and billions but for every person like that there are 10,000 or a 100,000 people getting their ass handed to them in Shiba Inu… it’s not a proper investment.”

If Jordan Belfort, the man that spent 22 months in jail for defrauding investors to the tune of $200 million, is saying that meme coins are dangerous for retail investors, investors would probably do well to heed that advice.

With that being said, here’s what technical analysis can tell us about the future of SHIB.

Shiba Inu’s (SHIB) Price Prediction 2022

If we use technical analysis to predict SHIB’s performance for the beginning of this year, the general outlook is mostly uncertain. SHIB’s trading volume remains low, and while the RSI continues to fall (which means that SHIB is becoming more undervalued) it seems unlikely that buyers will re-enter the market until sentiment changes.

Analysts at FXStreet are extremely unsure of SHIB’s current moves. According to the analysts, the short term outlook for SHIB is mixed, however it seems most likely that more bad news is yet to come. Unless SHIB sees a major change in price action it will continue to slide. However if SHIB can show signs of improvement it may yet be primed for a short-term rally of 27% from its current price to $0.00003736 USD ($0.00005128 AUD).

Shiba Inu (SHIB) Price Prediction 2023

Owing to a lack of any underlying value, it’s almost impossible to make any accurate long-term predictions about SHIB or any speculation-based meme coin.

The automated technical analysis from Wallet Investor is undeniably bullish and forecasts that SHIB can reach $0.0000714 USD ($0.0000992 AUD) by the end of this year, a gain of 148% by mid-next year.

Automated analysis from DigitalCoin also shares the growth sentiment predicting that the price could hit $0.0000502 USD ($0.0000698 AUD) next year, gaining 75% from its current price.

It’s worth noting when using automated technical analysis services such as Wallet Investor or DigitalCoin, the algorithms used to make predictions are basing all predictions off past performance data. When looking at meme-coins in particular, past performance does not guarantee future results.

Shiba Inu (SHIB) Price Prediction Conclusions

- SHIB is an incredibly risky digital asset that has no underlying value. It’s value is based almost entirely on speculation.

- While the price of SHIB may rise in the future with new developments in crypto, it is one of the riskier options on the crypto market.

- Unless you are a technical trader, who understands technical analysis, how to read charts and you can accurately interpret short-term price signals, all investing in SHIB and other meme coins should be treated like gambling.

RISK STATEMENT

This article is of a general nature only, and is intended for solely informational purposes. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next

The post Shiba Inu Price Prediction AUD 2022 appeared first on DMARGE Australia.

It’s no secret that Melbourne’s housing market had a great year in 2021, with the overall market witnessing a 18.6% gain throughout last year alone. Soaring valuations and a sea of eager buyers saw Melbourne’s median house price rise to a cool $1.1 million, despite the city weathering 6 different lockdowns.

While the Melbourne market didn’t reach the levels set by record housing prices in Sydney, Melbourne still has plenty to offer investors that are looking for high growth in 2022. Experts and analysts say that with the return of both domestic and international immigration, Melbourne is set to experience even higher growth than Sydney this year, especially now that lockdowns are finally a thing of the past.

According to Metropole Properties’ Property Development Specialist, Bryce Yardney – the more affluent suburbs of Melbourne, where the median income is higher, will be where property prices grow the most in the long term.

So, which Melbourne suburbs are the best choice for investors or new home buyers? This comprehensive list will go through all of Melbourne’s best suburbs that have been tipped to experience the highest growth in price throughout the rest of this year (in no particular order).

1. Ashwood

According to Terry Ryder, the Managing Director of Hotspotting, the suburb of Ashwood which is located just 15 kilometers from Melbourne’s CBD is a brilliant growth opportunity. While the median house price is relatively high at $1.365 million, Ashwood is experiencing rising buyer demand and the rate of price growth has accelerated rapidly over the past year. Ashwood is also situated right near a diverse range of medical and university facilities that make the suburb a compelling investment opportunity — including the $1 billion Victorian Heart Hospital which is set to be opened later this year.

2. Templestowe

Ryder continues to say that Templestowe, which is less than 20km from Melbourne’s CBD is another fantastic opportunity. Despite the suburb having a fairly high median house price of $1.5 million, the first few months of this year have already witnessed elevated buyer demand, alongside lower than average vacancies, causing substantial growth in rental prices. Adding to its livability factor, Templestowe is surrounded by parks, wetlands and golf courses.

3. Heidelberg Heights

The suburb of Heidelberg Heights is a standout opportunity for new investors, says Ryder. With a more affordable median price of $865,000 houses in Heidelberg Heights have solid rental demand and are witnessing a growth in overall sales, alongside a solid uptick in the rate of price growth. The suburb is situated right next to the La Trobe University campus and is located just 16km from the CBD.

4. Bentleigh

Property expert, Bryce Yardney thinks that Bentleigh is one of Melbourne’s most underrated investment opportunities. The nearby suburb of Bentleigh East is already a very high-demand market with great public transport, local schools, and plenty of amenities on offer, which is making Bentleigh a hub for the construction of new townhouses.

5. Caulfield

Yardney believes that the increasingly gentrified suburb of Caulfield is a no-brainer for property investors interested in the Melbourne market. Situated just 10 kilometers from the CBD and having one of the most well-serviced public transport systems in Melbourne, the suburb is primed for growth in 2022 as its aging population continues to hold onto properties, driving up surrounding prices.

6. Ormond

The almost-coastal suburb of Ormond has a high density of owner-occupier properties, flexing an overall rate of 59%. Because the suburb’s owner-occupation demographic is divided evenly among families and single people, Ormond is set for consistent growth over the coming years, Yardney says. He continues to add that Ormond is in the midst of solid gentrification with a wealth of cafes, shops, supermarkets all situated close by as well as offering great public transport and superb schooling for families.

What type of property should you invest in?

Buying a house in Melbourne is definitely the preferred choice of investment, as apartments in the current market just aren’t delivering the same long-term return. Owing to the length and consistency of lockdowns during the pandemic, a lot of people left Melbourne, leaving a pretty high vacancy rate for apartments in their wake.

This has granted Melbourne the official title of: “cheapest Australian capital city to rent in,” which is great news for tenants but not so much for new investors…

How much will Melbourne house prices grow in 2022?

An article on the best Melbourne suburbs to invest in wouldn’t be complete without an overall market prediction thrown in.

QBE expects that house prices in Melbourne will increase by over 11% in 2022 as immigration and the reopening of borders work to raise GDP and median income.

Westpac bank is slightly more conservative in its forecast, projecting a growth of roughly 8% across all suburbs in Melbourne throughout the remainder of this year.

DISCLAIMER: Not all properties in the aforementioned suburbs will make great investment properties as certain locations and neighbourhoods are subject to random conditions that can cause significant differences in long-term performance.

Read Next

- The Best Sydney Suburbs To Invest In Right Now

- Best Australian Real Estate ETFs… For When You Can’t Afford A House

The post The Best Melbourne Suburbs To Invest In Right Now appeared first on DMARGE Australia.

Summer presents the perfect opportunity to get outdoors and enjoy pursuits that winter and the colder months simply don’t allow. It’s also an opportunity to show off and enjoy a different style of clothing, and that’s where men’s summer clothing comes in.

You want to feel comfortable in lightweight and breathable fabrics but still look polished and stylish… However, finding clothing that ticks all those boxes can be a bit of a task if you are unsure of where to look or which brands to invest in.

Therefore, we’ve rounded up the brands producing the absolute best summer clothing. These brands will provide you with high-quality clothing perfect for summer, and we’ve included such a wide variety, you’re guaranteed to find summer clothing suitable for any dress code, or any budget.

You May Also Like:

Take a look at the following list and be ready to have the best wardrobe you’ve ever had with these men’s summer clothing brands.

The post 20 Best Summer Clothing For Men 2022 appeared first on DMARGE Australia.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »