Your cart is currently empty.

Right now, the best interest rate you can get with a traditional bank tops out somewhere around the 1% p.a. mark – in what the big banks still laughably call a “high interest” savings account.

This widespread shortage of interest-bearing savings products has left a pretty substantial gap in the market – a gap that a new wave of crypto-savvy fintech companies like Block Earner, are rushing to fill.

Block Earner is an Australian fintech startup that harnesses the power of Decentralized Finance (DeFi) to offer Aussies a minimum 7% interest rate on their savings. For most people that don’t have a vested interest in cryptocurrency, navigating the technical world of DeFi isn’t exactly the easiest thing to do.

That’s why the team at Block Earner wanted to streamline that process and create a product that allowed everyday users to deposit regular Australian Dollars onto their platform and take care of the complex lending process in the background.

In an interview with DMARGE, Jordan Momtazi, the co-founder of Block Earner, said that Australia’s current economic climate makes products that offer even the smallest of yields on savings attractive, especially when it’s literally impossible to get the same returns in the world of traditional finance.

Comparing the difference between interest rates in traditional finance and DeFi, Momtazi said: “The best returns Australians can get from a traditional savings account ranges from 0.1-0.3% – compare that to a stable 7% product like Block Earner, it’s easy to see where people are going to end up.”

Momtazi added that Block Earner was designed to take the “heavy lifting” out of accessing the benefits of cryptocurrency so that anyone can grow their savings over time.

While Momtazi promises that investors will receive a guaranteed 7% return until July of this year, he added that Block Earner’s variable interest rate product could see new users receive up to 18% p.a. returns on their savings.

While Block Earner is one of the first fintech companies in the world to offer mainstream, direct access to the world of DeFi, other crypto-based companies are also expanding their horizons when it comes to offering Australians higher interest rates.

Swyftx Earn

Swyftx is Australia’s first crypto exchange to officially offer Aussie investors interest-bearing yields on cryptocurrency through its recently-launched product, Swyftx Earn.

Earn offers Australian and New Zealand residents the ability to earn interest on 21 different digital assets, including large-cap cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) as well as stablecoins like Tether (USDT) and USD Coin (USDC).

Swyftx CEO Ryan Parsons said that the exchange’s Earn feature was one of the most competitive in the crypto industry, offering investors flexible, zero-fee yields of up to 6.7% on stablecoin deposits.

“Very few global exchanges are offering crypto users the level of interest rates that we are without also having lock-in periods.”

“You’ll start to see many more Aussies using crypto wealth services as they become more familiar with digital assets,” Parsons added.

Swyftx states that the amount of interest that can be offered to investors depends on the volatility of the underlying asset. Large-cap crypto assets like BTC and ETH will offer interest rates of up to 5.1%, while riskier assets like Polkadot (DOT) can offer returns of up to 12.7%

It goes without saying, that lending crypto to earn yields does carry some risk, but Swyftx is fully insured against any potential losses, meaning that investors’ funds are always safe.

If you currently own cryptocurrency that’s just sitting there, putting them into a yield-bearing account can be a great way to get your digital assets making gains while you sleep.

Read Next

- If You Bought $10 Of Bitcoin In 2010, This Is How Much Money You’d Have Now

- Best Cryptocurrencies To Buy Right Now [May 2022]

The post How Crypto Can Land You 7% Interest Rates On Your Savings appeared first on DMARGE Australia.

Right now, the best interest rate you can get with a traditional bank tops out somewhere around the 1% p.a. mark – in what the big banks still laughably call a “high interest” savings account.

This widespread shortage of interest-bearing savings products has left a pretty substantial gap in the market – a gap that a new wave of crypto-savvy fintech companies like Block Earner, are rushing to fill.

Block Earner is an Australian fintech startup that harnesses the power of Decentralized Finance (DeFi) to offer Aussies a minimum 7% interest rate on their savings. For most people that don’t have a vested interest in cryptocurrency, navigating the technical world of DeFi isn’t exactly the easiest thing to do.

That’s why the team at Block Earner wanted to streamline that process and create a product that allowed everyday users to deposit regular Australian Dollars onto their platform and take care of the complex lending process in the background.

In an interview with DMARGE, Jordan Momtazi, the co-founder of Block Earner, said that Australia’s current economic climate makes products that offer even the smallest of yields on savings attractive, especially when it’s literally impossible to get the same returns in the world of traditional finance.

Comparing the difference between interest rates in traditional finance and DeFi, Momtazi said: “The best returns Australians can get from a traditional savings account ranges from 0.1-0.3% – compare that to a stable 7% product like Block Earner, it’s easy to see where people are going to end up.”

Momtazi added that Block Earner was designed to take the “heavy lifting” out of accessing the benefits of cryptocurrency, so that anyone can grow their savings over time.

While Momtazi promises that investors will receive a guaranteed 7% return until July of this year, he added that Block Earner’s variable interest rate product could see new users receive up to 18% p.a. returns on their savings.

While Block Earner is one of the first fintech companies in the world to offer mainstream, direct access to the world of DeFi, other crypto-based companies are also expanding their horizons when it comes to offering Australians higher interest rates.

Swyftx Earn

Swyftx, is Australia’s first crypto exchange to officially offer Aussie investors interest bearing yields on cryptocurrency through its recently-launched product, Swyftx Earn.

Earn offers Australian and New Zealand residents the ability to earn interest on 21 different digital assets, including large-cap cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) as well as stablecoins like Tether (USDT) and USD Coin (USDC).

Swyftx CEO Ryan Parsons said that the exchange’s Earn feature was one of the most competitive in the crypto industry, offering investors flexible, zero-fee yields of up to 6.7% on stablecoin deposits.

“Very few global exchanges are offering crypto users the level of interest rates that we are without also having lock-in periods.”

“You’ll start to see many more Aussies using crypto wealth services as they become more familiar with digital assets,” Parsons added.

Swyftx states that the amount of interest that can be offered to investors depends on the volatility of the underlying asset. Large-cap crypto assets like BTC and ETH will offer interest rates of up to 5.1%, while riskier assets like Polkadot (DOT) can offer returns of up to 12.7%

It goes without saying, but lending crypto to earn yields does carry some risk, but Swyftx is fully insured against any potential losses, meaning that investors’ funds are always safe.

If you currently own cryptocurrency that’s just sitting there, putting them into a yield-bearing account can be a great way to get your digital assets making gains while you sleep.

Read Next

- If You Bought $10 Of Bitcoin In 2010, This Is How Much Money You’d Have Now

- Best Cryptocurrencies To Buy Right Now [May 2022]

The post How Crypto Can Land You 7% Interest Rates On Your Savings appeared first on DMARGE.

Jason Bateman is set to return to comedy after proving he could be a serious actor in Netflix’s original series, Ozark. However, it’s also been confirmed that the actor will direct a few upcoming projects, suggesting that Bateman could soon step away from acting and focus solely on directing.

If you’re a fan of Ozark, you’re probably a fan of the show’s star, Jason Bateman too. The actor has had an impressive career over the last forty years but now that Ozark is done and dusted, it’ll be interesting to see what Bateman’s next career steps will be.

Bateman, who prior to Ozark’s release was best known for comedic roles in films and television, deliberately took the role of Marty Byrde to prove that he could do more than the dry and uptight (but funny) character he was constantly typecast as – think Bateman’s roles in Arrested Development, The Break-Up, Couples Retreat, Horrible Bosses, Office Christmas Party etc.

It’s been confirmed that Bateman’s next acting role will be in an upcoming remake of Clue – a 1985 comedic film based on the board game of the same name that follows a group of strangers who have to figure out who among them is a murderer. The only details about this Clue remake is that, it too, will be a comedy and it will star Bateman and Ryan Reynolds.

Considering the film is set to be comedic and that Bateman played his typecast role the last time he and Reynolds starred in a film together – 2011’s The Change Up – it looks like that the actor isn’t set on never again playing the stereotypical role he’s infamous for, nor is he set on staying in the drama genre post-Ozark.

Aside from Clue, no other projects with Bateman attached to star have been announced. However, he is set to direct two upcoming films – Here Comes The Flood and Project Artemis. For those who didn’t know, Bateman doesn’t just act; in fact, his true passions lie in directing. In 2014, Bateman told Screen Rant:

“Directing a movie is the greatest job in the world. I could not be more envious of the guys who get to do it all the time”.

Jason Bateman

Directing isn’t just a mere hobby for Bateman though; he’s actually a rather accomplished director. In 1989, Bateman was allowed to direct two episodes of Valerie – the sitcom Bateman had his first leading acting role in – and became the Directors Guild of America’s youngest-ever director. Since then, Bateman has dabbled in directing multiple times for both television shows and films.

Of course, Bateman directed multiple episodes of Ozark; thanks to Ozark, he won the 2019 Emmy Award for Outstanding Directing for a Drama Series. In my opinion, it’s extremely likely that Bateman will soon step away from acting and instead focus on directing.

Especially considering that one of the upcoming films he’s set to direct, Project Artemis, sounds incredible. According to Deadline, the movie’s plot will involve the space race and will star Marvel Cinematic Universe actors Chris Evans and Scarlett Johansson.

There’s no word on when Clue, Here Comes The Flood or Project Artemis will start filming or even be released but here’s hoping it’s soon as, we know after finishing the final episodes of Ozark, we’re desperate for more Jason Bateman – even if he’s just behind the camera and not on-screen.

Read Next

- What Breaking Bad Stars Bryan Cranston & Aaron Paul’s Relationship Is Like In Real Life

- Leonardo DiCaprio Joins Lewis Hamilton In ‘Game Changing’ Business Venture

The post Where Jason Bateman’s Career Will Likely Go Next appeared first on DMARGE Australia.

Jason Bateman is set to return to comedy after proving he could be a serious actor in Netflix’s original series, Ozark. However, it’s also been confirmed that the actor will direct a few upcoming projects, suggesting that Bateman could soon step away from acting and focus solely on directing.

If you’re a fan of Ozark, you’re probably a fan of the show’s star, Jason Bateman too. The actor has had an impressive career over the last forty years but now that Ozark is done and dusted, it’ll be interesting to see what Bateman’s next career steps will be.

Bateman, who prior to Ozark’s release was best known for comedic roles in films and television, deliberately took the role of Marty Byrde to prove that he could do more than the dry and uptight (but funny) character he was constantly typecast as – think Bateman’s roles in Arrested Development, The Break-Up, Couples Retreat, Horrible Bosses, Office Christmas Party etc.

It’s been confirmed that Bateman’s next acting role will be in an upcoming remake of Clue – a 1985 comedic film based on the board game of the same name that follows a group of strangers who have to figure out who among them is a murderer. The only details about this Clue remake is that, it too, will be a comedy and it will star Bateman and Ryan Reynolds.

Considering the film is set to be comedic and that Bateman played his typecast role the last time he and Reynolds starred in a film together – 2011’s The Change Up – it looks like that the actor isn’t set on never again playing the stereotypical role he’s infamous for, nor is he set on staying in the drama genre post-Ozark.

Aside from Clue, no other projects with Bateman attached to star have been announced. However, he is set to direct two upcoming films – Here Comes The Flood and Project Artemis. For those who didn’t know, Bateman doesn’t just act; in fact, his true passions lie in directing. In 2014, Bateman told Screen Rant:

“Directing a movie is the greatest job in the world. I could not be more envious of the guys who get to do it all the time”.

Jason Bateman

Directing isn’t just a mere hobby for Bateman though; he’s actually a rather accomplished director. In 1989, Bateman was allowed to direct two episodes of Valerie – the sitcom Bateman had his first leading acting role in – and became the Directors Guild of America’s youngest-ever director. Since then, Bateman has dabbled in directing multiple times for both television shows and films.

Of course, Bateman directed multiple episodes of Ozark; thanks to Ozark, he won the 2019 Emmy Award for Outstanding Directing for a Drama Series. In my opinion, it’s extremely likely that Bateman will soon step away from acting and instead focus on directing.

Especially considering that one of the upcoming films he’s set to direct, Project Artemis, sounds incredible. According to Deadline, the movie’s plot will involve the space race and will star Marvel Cinematic Universe actors Chris Evans and Scarlett Johansson.

There’s no word on when Clue, Here Comes The Flood or Project Artemis will start filming or even be released but here’s hoping it’s soon as, we know after finishing the final episodes of Ozark, we’re desperate for more Jason Bateman – even if he’s just behind the camera and not on-screen.

Read Next

- What Breaking Bad Stars Bryan Cranston & Aaron Paul’s Relationship Is Like In Real Life

- Leonardo DiCaprio Joins Lewis Hamilton In ‘Game Changing’ Business Venture

The post Where Jason Bateman’s Career Will Likely Go Next appeared first on DMARGE.

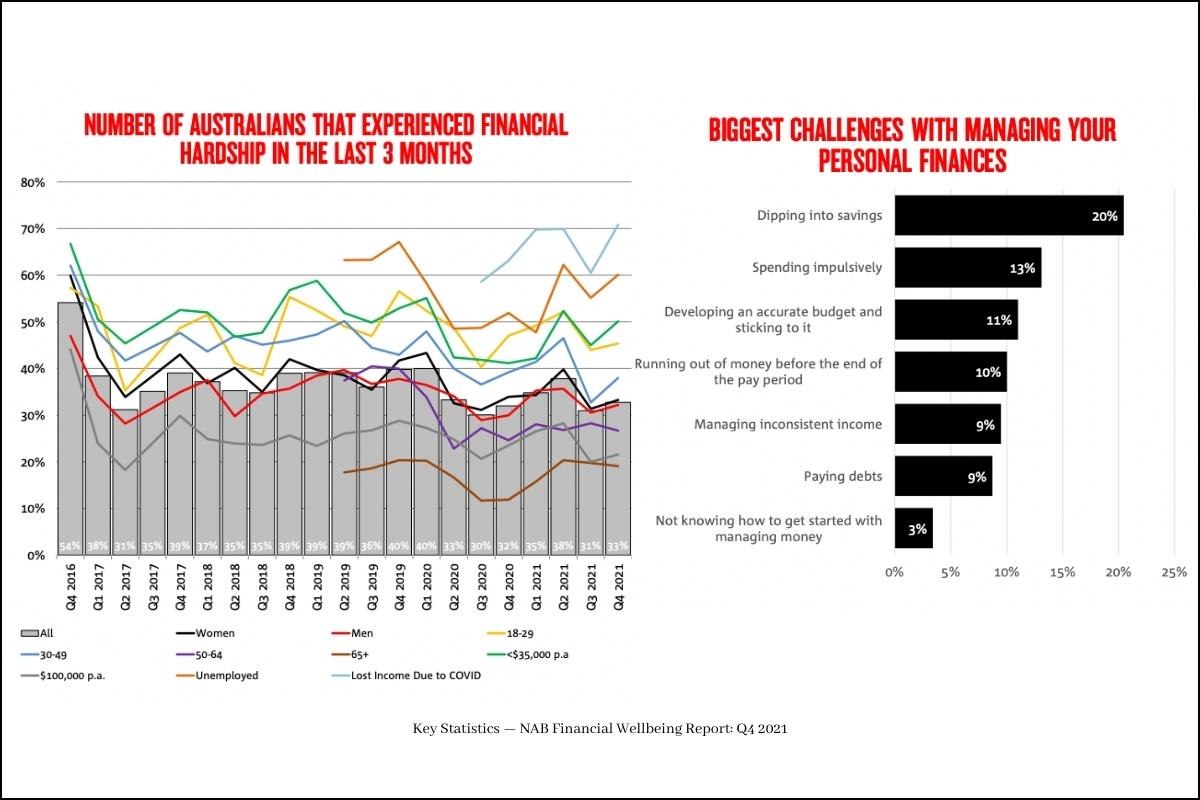

Financial anxiety is (unfortunately) a growing issue in Australia today – particularly when it comes to men.

According to a recent survey published on April 29, the Cost of Living has soared to the top of Australia’s “worry list,” with 50% of all Aussies reporting that increased financial pressure is now their number one concern.

Obviously, money-related hardship can affect anyone regardless of their gender, but here at DMARGE we hone in on the things that disproportionately impact men.

And what a scary number of people don’t seem to know, is that as many as 1 in 5 – roughly 20% – of all male suicides are directly linked to financial stress, according to recent data from the Australian Men’s Health Forum.

Not only that, but male suicide is also 5 times more likely to be linked to financial concerns than female suicide and it’s an unfortunately well-documented fact that rates of male depression and suicide increase significantly during economic downturns.

As we stare down the barrel of an increasingly likely recession in the next year, it’s super important that we try to get a handle on men’s financial wellbeing before it’s simply too late.

Why Does Financial Anxiety Disproportionately Affect Men?

While money concerns affect everyone negatively – a recent study showed that anyone who has recently experienced severe financial strain is 20 times likely to attempt self harm – there’s a major psychological factor that makes financial stress particularly troublesome for men.

Speaking to Health, Dr. Sabrina Romanoff a Professor of Clinical Psychology at Yeshiva University, pointed out that with the role of men traditionally being the breadwinners of the family, it’s quite logical that financial stress would be felt more intensely by guys.

“Financial stress is a significant risk factor for suicide, particularly among people who are tasked with the role of ‘provider’ or those who are responsible for preserving the livelihoods of those who depend upon them.”

Dr. Romanoff

It’s my own personal experience that here in Australia we do very little in the way of any meaningful financial education. Unless you come from a family that talks about money openly or goes out of their way to demonstrate good spending habits, it’s just assumed that you’ll figure it out as you go along.

The “she’ll be right” mentality strikes again.

So, if roughly 20% of all Australian blokes that take their own lives are doing so because of links to financial stress, why aren’t any of our major banks doing something about it?

What Are Men’s Biggest Money Problems?

According to NAB’s Australian Financial Wellbeing survey, the most challenging issues that Australian men struggled with were: unexpectedly dipping into savings, followed closely by impulse spending. Notably, outstanding Buy Now Pay Later debts was also a significant male-skewed problem, represented particularly by guys under 35.

While it’s all fun and games to laugh off the occasional blowout on a bunch of beers (and a few extra things) on a big night out, uncontrolled impulse spending can be a serious concern — especially for younger blokes.

Speaking from my own experience as a 25-year-old guy, we always like to put on a brave face and make it seem like we’ve got everything under control, even when things are going terribly just beneath the surface. Admitting that your spending habits aren’t what they should be can be really difficult, because it feels like you’re not living up to your own, or other people’s expectations.

So, I think that it’s time for the link between money and men’s mental health to get some serious air time. Our banks need to step up and start promoting awareness and providing some better education around finances.

We need to change the culture so that men no longer feel “inadequate” for not being the best at managing their money, and start providing some real tools to help them to get better at it.

Men Need Better Education and More Support

Now, I’m not trying to say that the Big Four banks aren’t doing anything at all – I’m simply making the case that a lot more needs to be done if we’re going to take this issue seriously.

While the Big Four Banks do have some resources dedicated to financial wellbeing (Commbank, NAB, ANZ, Westpac) it’s obviously not doing enough.

I’m not taking away from their efforts, but it seems pretty clear to me that our biggest banks and major financial institutions seriously aren’t taking into account the degree to which some basic financial literacy could change the lives of everyday Aussie blokes.

Educating men on how to better manage their finances isn’t just a feel-good marketing pitch, it’s a public health priority.

When nearly 1 in 5 men take their own lives because of financial stress, increased awareness and education can legitimately save lives, especially as we look primed to head into another recession.

Ultimately, any bank or institution that steps up to help tackle these issues would be taking an enormous step forward for the entire industry of finance.

If you are experiencing financial stress, try to remember that literally anyone can get into financial difficulty and that there are so many ways to get help. MensLine have a great list of resources for dealing with acute financial stress.

Quick & Easy Finance Resources

While we wait for the major financial institutions to read this article and start introducing proper financial education tools — I’d recommend taking a quick glance at the following resources:

- The Barefoot Investor: Focused on Australians — super simple and easy to read.

- I Will Teach You To Be Rich: US-focused but packed with heaps of good, simple tips.

- How to Save a Lot of Money Fast: 4 simple methods I’ve personally used to take control of my finances.

Read Next

- Unpopular Opinion: Australians Need To Get Used To Living In Apartments

- The Best Sydney Suburbs To Invest In Right Now

The post Nearly 20% Of Male Suicide Is Linked To Financial Stress. So Why Don’t Banks Do More For Men? appeared first on DMARGE Australia.

Australians bloody love SUVs. SUVs have long supplanted the hatchback or sedan as the most popular vehicle segment for Aussies, a trend we’ve seen right around the world. It’s not hard to see why, either: their practicality, comfort and greater ride height make them particularly well-suited to a wide range of driving conditions.

But the stereotypical sport utility vehicle is no longer a huge, hulking fuel guzzler. Thanks to the rise of crossover and small SUVs, the typical SUV these days much more closely resembles a jacked-up hatchback – and indeed, many of the most popular SUVs on the market are based on hatchbacks.

Indeed, Australia’s love for the small SUV has reached new heights in 2022. Not only have light/small SUVs become one of Australia’s best-selling vehicle segments according to VFACTS, but Carsales’ internal data shows an almost 41% increase in views for small SUVs in March 2022 compared to March 2021.

Seems the only thing more contagious than The Spicy Cough is The Small SUV. But it’s got us thinking: what does the continued popularity of small SUVs mean for small/compact performance cars?

To try and explain what we’re getting at, let’s take a look at Ford. The Blue Oval brand just announced that they’re ending production of their legendary small hatchback, the Fiesta, after an impressive 7 generations and over 16 million sold.

Australia already didn’t receive the standard version of the 7th gen Fiesta. Ford chose to only bring the top-spec, performance-oriented Fiesta ST Down Under. Instead, the Ford Puma – a small SUV based on the Fiesta’s platform – filled the role of an entry-level small car for Ford, despite being bigger and more expensive than the Fiesta. It’s confusing but bear with us.

RELATED: The Biggest Loser In Australia’s Second Hand Car Market Chaos

Here’s the issue. Ford doesn’t sell the Puma ST here. It exists, but it’s not quite as sporty as the Fiesta ST. Even if Ford brings the Puma ST to Australia, is it really a proper replacement for the Fiesta ST?

Even the best and sportiest SUVs inherently drive differently compared to sedans or hatchbacks. The higher ride height and increased kerb weight of an SUV make them less suited to performance applications compared to light, low-riding small cars. Case in point: the Puma ST is a great car, but it’s not quite as dynamic as the Fiesta ST.

So, the question is, does the Fiesta’s demise and Puma’s ascent spell the end of Ford’s long tradition of small sporty cars – think the Escort and Sierra? More to the point, will we continue to see similar situations with other brands? Will Volkswagen ditch the Golf and Polo GTI, for example?

DMARGE spoke exclusively with Carsales‘ Editor-in-Chief Mike Sinclair, who’s not quite as pessimistic about the whole situation.

“The small SUV segment has its own momentum… Every carmaker has identified SUVs as becoming the default,” Sinclair explains.

“They hit that sweet spot between space, size and affordability, and there’s a total proliferation of brands offering small SUVs.”

But he’s not convinced that the rise of small SUVs will necessarily mean that hatchbacks and sedans will disappear entirely – especially when it comes to performance or enthusiast vehicles.

“There’s increasingly a blurring of lines between hatchbacks and SUVs. Think about cars like the Polestar 2. But sedans are a different kettle of fish… Sedans offer a sort of luxury experience that’s very different and distinct to an SUV.”

RELATED: The Polestar 2 Threatens Tesla’s Dominance Down Under

“It’s all a matter of degrees… But this something we’ll continue to see with the move towards electrification.”

The rise of electric vehicles, which is occurring parallel to the rise of small SUVs, definitely informs this whole discussion. EVs inherently drive differently compared to normal cars thanks to their low centre of gravity and have all sorts of performance benefits – namely their inherently higher torque and acceleration.

From a performance perspective, small petrol-powered hatchbacks being supplanted by small electric SUVs with similar if not better equivalent performance characteristics isn’t a bad thing, right?

“At the end of the day, a lighter, lower hatch will always outperform a higher-riding SUV. But there’s also a great opportunity for manufacturers to explore different suspension setups with higher cars,” Sinclair says.

“Too many manufacturers try and make the performance versions of their SUVs ride low like hatches or sedans, to give them that more hatch-like driving experience. But if they stop trying to make SUVs drive like hatches, there will be different, more exciting vehicles.”

Indeed, if we consider the Ford example we mentioned earlier: Sinclair points out that Ford’s latest World Rally Championship contending car is based on the Puma, and while that car doesn’t share too much in common with its road-going siblings, it demonstrates how an SUV’s higher ride height certainly does offer its own benefits…

Much to ponder.

Read Next

- The Best Small SUVs In Australia

- Porsche Unveils Bold Plan To Save The Petrol-Powered Car

- Finally: Proof You Don’t Need An SUV To Drive Around Australia

The post Australia’s Small SUV Obsession Might Spell The End Of Affordable Performance Cars appeared first on DMARGE Australia.

Some people think Australia deserves an all business class airline. But until our population grows significantly, it’s probably not a viable ambition.

As the travel industry rebounds, Australians are finally getting back into the swing of travel again (despite some people being a bit rusty).

As part of that, all sorts of things are heating up. Project Sunrise is back on. People are remembering how annoying long haul flights are. Business class fanatics are even remembering how how the pointy end isn’t always everything it’s cracked up to be…

RELATED: Why Flying First Class Is More Stressful Than Flying Business Class

Speaking of business class, though it has its flaws, we still would take that over economy any day. And – environmental concerns aside – we can’t help but look at Europe with a severe case of jealousy right now.

Why? The following video, recently thrust in front of our faces on TikTok, gave us a serious case of FOMO. In fact it had us (briefly) thinking: Australia really ought to have an all business class airline of its own.

The video, posted by traveller @robineblickman, gives viewers a look at what it’s like to fly business class on La Compagnie – an all business class airline – from Paris to New York.

Robine shows off how her journey “started with some champagne and before we knew it we were up in the air.”

“Then the first course was some sushi which was super good and I had some curry with fish afterwards,” she gushed.

She then watched a movie, went to sleep, had some “amazing dessert” and then was “bored.”

So far so normal.

“Before we knew it we arrived at New York.”

You get the gist.

RELATED: First Time In Business Class: How My First Trip Ruined Me For Life

Unfortunately, despite our strongest wishes, it’s unlikely we’ll see an all business class airline in Australia any time soon.

One upstart airline – OzJet – tried to create an all business class airline, between Melbourne and Sydney, back in 2005, but only survived 14 weeks before the owner, millionaire Paul Stoddary, gave up and said: “There just isn’t a market [for it].”

He also said that Australia hadn’t been able to support three strong domestic carriers for a while, calling the situation: “A reality that goes back to the old Ansett.”

Until Australia reaches the population size of Europe (or something closer to it), it seems the best we can wish for is more business class seats you can upgrade to with points.

Read Next

- Australian Aviation Law Sparks ‘Furry’ Over Animals Flying With Their Owners

- ‘Airport Goggles’: Why You Find Strangers More Attractive On Flights

The post All Those In Favour Of Australia Getting An All Business Class Airline, Say ‘Aye’ appeared first on DMARGE Australia.

If you’ve ever logged onto Instagram, TikTok or Facebook, there is a good chance you would have seen videos posted by Supercar Blondie. Her videos are exactly what you’d expect: a ‘blondie’ talking about supercars. But, of course, Supercar Blondie isn’t the only social media star to talk about the latest and greatest supercars, so what makes her so special?

We’re about to answer that question and more, including Supercar Blondie’s net worth, her age and what she did before she hit the big time on social media.

Supercar Blondie Quick Facts

Name: Alexandra Mary ‘Alex’ Hirschi

Age: 36

DoB: 21st September 1985

Nationality: Australian. Born in Brisbane, Queensland

Net Worth: $17 million (estimated)

Instagram: @supercarblondie – 10.1m followers

TikTok: @supercarblondie333 – 1.6m followers

YouTube: SupercarBlondie – 7.97m subscribers

Facebook: Supercar Blondie – 46m followers

Who Is Supercar Blondie?

Supercar Blondie is the social media name for Alexandra Mary Hirschi. Alex was born in Brisbane, Queensland in 1985. She has claimed she has had a passion for cars since an early age but went on to study Journalism & Business at the Queensland University of Technology. After graduating, Alex became a presenter for Southern Cross Austereo – the largest radio broadcaster in Australia – in Brisbane.

She moved to Dubai, UAE in 2008 and took up a job presenting radio for Dubai Eye 103.8. It was during this time she was able to interview high-profile celebrities including John Travolta, Jake Gyllenhaal and Liam Neeson.

It wasn’t until 2018 she decided to leave her job in radio to focus on a social media career revolving around all things automotive.

The move certainly paid off, as Supercar Blondie is now one of the biggest social media stars and accounts to bring the latest automotive news to millions of people. She does so via a range of video content, which is filmed by her husband, Nik Hirschi.

Chief to her success in the world of automotive is the fact she’s a woman. Traditionally, cars have very much been a male-dominated category, but Supercar Blondie has effectively said “up yours” to this tradition, and proves anyone can become increasingly involved – and obsessed – with cars.

Admittedly, she doesn’t delve into the intricate details of the cars she features and reviews, but she isn’t trying to appeal to the car-obsessed geeks out there. Instead, Supercar Blondie gives a general overview of the latest supercars and hypercars, and points out some of their coolest features, making her videos far more appealing to a much wider audience.

What Cars Has Supercar Blondie Reviewed?

Because of her astronomical success and reach on virtually all social media platforms, Supercar Blondie is able to gain access to some of the latest, most exclusive and rare supercars on the planet. While most of these cars already tend to be in Dubai – the world’s playground for billionaires – she also travels to other countries and continents to be one of the first to get hands-on with a range of cars.

She was the first in the world to drive the Devel Sixteen, for example. This is a prototype hypercar developed in the United Arab Emirates that delivers 5,000bhp. She was also the first to get the keys to Bugatti Veyron L’Or Blanc – a collaboration model of the Bugatti Veyron 16.4 Grand Sport with the Royal Porcelain Factory in Berlin – which was shipped to Dubai from Berlin, especially for her.

Some of her most recent videos include the all-new electric Hummer, a futuristic BMW concept car with gullwing doors, the world’s first Hermes Pagani Huayra, valued at $7 million and the Matador MH2, the world’s first hydrogen-powered supercar.

Supercar Blondie has also been fortunate enough to be able to drive the actual Batmobile from the 1989 movie starring Michael Keaton as the famous caped crusader.

Supercar Blondie Net Worth

Due to her huge online presence, Supercar Blondie has been able to charge more and more for her social media posts. It’s now claimed she charges up to $1.4 million per sponsored post. This has enabled her to amass an estimated fortune of US$17 million.

How Many Cars Does Supercar Blondie Own?

Of course, the combination of a million-dollar fortune and a keen interest in cars means that Supercar Blondie has an impressive car collection of her own. Supercar Blondie used to own a Lamborghini Huracan LP610-4 finished in a custom blue paint job, which she named ‘Lucy’. She has, however, since sold this car.

She has since bought a Rolls Royce Wraith Black Badge, a McLaren 720S and a custom Brabus G (based on the Mercedes-AMG G Wagen) with Tiffany blue interior. Her other cars include an Ares S1 hypercar, which is made in Modena, Italy and sells for $500,000. She’s also said she has ordered a Tesla Cybertruck, which is set to finally launch in 2023.

Say what you want about Supercar Blondie. Yes, she may not give a tremendous insight into the inner workings of some of the most exclusive vehicles on the planet, but there’s no denying she has serious mass appeal. It’s definitely worth checking out her social media channels, not least to be able to stay up to date on the latest technological developments in the world of automotive.

Read Next

The post Who Is Supercar Blondie? The Australian, Car-Mad Social Media Star appeared first on DMARGE Australia.

If you don’t look after yourself – both physically and mentally – you will prematurely age. If you don’t want to look older than your age, you need to be in optimal health and it’s surprisingly easy to achieve that. DMARGE spoke to multiple experts who recommend simple tips that’ll help you stay healthy and will ultimately keep you looking young.

When it comes to looking and feeling your best, there are a few common mistakes many men make that prematurely age them. Have you noticed that you’re feeling more sore than usual or perhaps a few wrinkles have popped up on your face?

If that sounds familiar, you could be making these mistakes. Now, before you furrow your brow and wonder what you’re doing wrong, never fear, as we’ve spoken to multiple experts who have simple fixes for these faux pas‘ – mistakes you may not even realise you’re making…

If you’re wanting to get in the best shape of your life – and look a tad younger too – these are some straightforward and easy things you can incorporate into your hair, skincare, mental health, diet and exercise routines. You’re welcome.

Hair

If you want to look your best, you’ll need a haircut that truly suits you. As Jacob Martin – barber & founder of Tate & Lyle Sydney – recommends, you need to consult your barber and ask what haircut or hairstyle they believe, in their professional opinion, will be the most flattering.

“…always remember to find a cut that suits your style, profession and face shape. The key is an age-appropriate [style]. A cut seen on a teen might not suit a 50-year-old dad of three. [Ultimately,] rely on the professional advice of your barber or stylist.”

Jacob Martin

Aside from the cut, your hair will inevitably either go grey or go bald – unless you’re the luckiest SOB on the planet. Both greys and/or hair loss can severely age you, however, there are steps you can take to combat these problems.

Jacob says you should be open to letting your barber colour your hair – don’t do it yourself!!! – and you should also invest in quality hair care products.

“Colouring your hair can be a great way to take some years off your look but the key is to make it look subtle. Too many gents don’t take into account other factors such as skin complexion or other facial hair, such as eyebrows, and dye their hair an unnatural colour or [use a] cheap box dye which screams ‘I’m dyed and trying to be young’.”

“In our shop, we use Goldwell which blends naturally and leaves a very natural finish; people would never know [you’ve coloured your hair]! Speak to your barber/stylist about options.”

Jacob Martin

“Thinning or loss of hair… can be helped with great products and styling. Sea salt sprays [and] hair powders, which help with volume, can be a great tool to use to help combat this. Also, semi-permanent pigmentation can also help with giving the illusion of fuller hair if you don’t fancy a more extreme [option like a] hair transplant or medication like finasteride. Always seek professional help though.”

Skincare

Your skin is the largest organ of your body and yet, most men don’t have a skincare routine. If you’ve neglected your skin and it’s starting to show, you can ensure no further damage is done; you just have to start being sun safe daily and, if you’re a smoker, cut out the cigs.

As Dermatologist, Dr Leona Yip advises, “The commonest causes of premature skin ageing by far is sun exposure and cigarette smoking; [which] degenerate skin collagen and elastin. In the longer term, this leads to the appearance of dry skin, uneven skin complexion, yellow leathery skin and deep wrinkles.”

“Stop smoking and be sun aware as much as possible – sunscreen is only one component of sun protection, and should be used in combination with a broadbrim hat, protective clothing, sunglasses and staying in shade.”

Dr Leona Yip

Dr Yip also recommends to those wanting to vastly improve the way their skin looks, use skincare products daily and for, ultimate results, look out for the following specific ingredients:

“… [If your] all-important skin moisture barrier weakens, lipid production, hydration and elasticity all drop, which can contribute to your skin looking drier and older.

To avoid this, establish a consistent cleansing and moisturising daily routine with products that contain ingredients like Hyaluronic Acid, Vitamin E and Panthenol to really protect your skin’s moisture barrier.”

Dr Leona Yip

Mental Health

In recent years, the stigmas associated with discussing mental health have started being broken down – which is fantastic. But there’s still a shocking amount of men who don’t prioritise their mental health.

Health & Community Psychologist, Dr Marny Lishman says that looking after yourself psychologically can take just a small amount of time but it needs to be done daily; just like exercise.

“Looking after your physical health comprises little actions on a daily basis, and so too does looking after your mental health.”

Dr Marny Lishman

Dr Lishman also advises that men should learn to open up more if they’re wanting optimal mental health and should most definitely seek help – whether it be from a professional or a friend or family member – if they’re particularly struggling with the stress of everyday life.

“It is important for our psychological well-being to learn to express our emotions and be vulnerable about how we are feeling and why. Life can be stressful and many men have a lot on their mind – learning to identify and control their unhelpful cognitions when they are worried about things going on for them is extremely important, and in many cases that means reaching out to get additional help.”

Men who are wishing to improve their mental health should also prioritise living in the moment and should stop constantly focusing on work.

“We live in a very busy society where we often focus too much on working and trying to be successful! Learning how to not get bogged down in working all the time – particularly the ‘all work and no play’ mentality – and [instead] focusing on ‘being’ is extremely beneficial to our mental wellbeing.”

Dr Marny Lishman

Nutrition

Here’s the part you were dreading. Diet – the worst four-letter word in the English dictionary. Sure, while cookies and burgers are ridiculously delicious, that doesn’t mean we can just indulge in eating that sort of ‘junk’ food all the time.

However, while Alex Thomas, the founder of the Sports Nutrition Association, declares nutrition is key to your health, he admits you can, and should, satisfy your junk food – or as Alex calls it, ‘energy-dense food’ – cravings once in a while. He also advises that sleep and hydration are also important.

“Nutrition is an extremely important part to overall health, as is sleep and hydration…”

Alex Thomas

“Putting it together… eat veggies three times a day, eat fruit one to two times a day, eat protein three times a day; also include some of the energy-dense foods that you like. [Plus, you should] sleep six to eight hours per night, limit excessive alcohol [and] limit excessive caffeine.”

Exercise

Most of us think of ‘exercise’ when we hear the word ‘health’ and while we’ve proven above there are many factors that contribute to your wellbeing and health, exercise is still important. Director of Flow Athletic, Ben Lucas says men wanting optimal health should be incorporating mostly strength training and just a little cardio into their fitness routine.

“The general goal should be around 30 minutes of moderate exercise per day for your health, according to the MAYO Clinic. For men, I would recommend around three days a week of strength training and some cardio such as running, cycling or a brisk walk on other days.”

Ben Lucas

Ben highly recommends strength training as it can combat common issues people face in their old age, such as “aches and pains” and “brittle bones”.

“Strength training is important for every individual because as we age, our muscle tone starts to reduce and that can lead to musculoskeletal issues that crop up as we age, such as brittle bones, struggling to hold our posture which can lead to a bunch of aches and pains.

Strength training can also raise your metabolism. In fact, some research suggests that you can burn fat even at rest for up to 38 hours post-workout. And let’s not forget that you will also feel stronger, fitter and healthier which can improve self-esteem.”Ben Lucas

Read Next

- Signs You Have High Functioning Anxiety – & How To Cope With It

- 3 Simple Hacks To Get In The Best Shape Of Your Life

The post 5 Ways Men Prematurely Age Themselves – & How To Fix Them appeared first on DMARGE Australia.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »