Your cart is currently empty.

Think ‘swinging’ is rife with double standards? Put that question on hold; there’s a juicier one to squeeze: should group sex at approved swinger clubs and adult parties currently be allowed, while wedding guests are not allowed to dance in Queensland?

That’s the question a member of the Gold Coast entertainment industry recently posed, telling the ABC that certain COVID-19 regulations should be reviewed.

“We have had so many bookings cancelled because of the dancing rules,” wedding entertainer Nik Edser told the ABC.

“The irony is if I was invited to a wedding this weekend to attend with my wife and I wanted to dance with her there, then I wouldn’t be allowed to,” he said.

“But if we decided to go to a sex club and swap partners with some people who we don’t know where they’re from or who they really are, that’s OK.”

“The State Government’s COVID Safe Industry Plan for Sex on Premises Venues and Adult Parties considers such events as ‘high risk’ and outlines mitigation strategies, such as record keeping and compliance with contact tracing,” ABC reports. They are, however, not banned.

“Meanwhile, gatherings at homes or public spaces have been restricted to 10 people in Greater Brisbane and the Gold Coast, and 30 people elsewhere.”

In other words: the swingers are not so much exploiting a legal loophole as taking advantage of arguably unfair legislation.

Mr Edser initially took the no dancing rule “on the chin.” He now believes, however, given Queensland’s low case numbers, it should “be lightened up.”

He also doesn’t advocate for swingers’ parties to be shut down.

“They’re business owners just like us and they want to continue making their money and they’re entitled to do that. I don’t want to see this turn into them getting shutdown, hurting another business.”

With JobKeeper payments due to end in March 2021 and wedding bookings usually made at least six months in advance, Mr. Edser told the ABC “now is a really critical time” for the Getting Hitched industry.

“Once the restrictions on dancing are lifted, six months after that date is when I feel we’re going to be starting to come back again.”

Mr Edser claims to have collected more than 300 signatures in an online petition to State Parliament.

Read Next

- ‘New Era Of Hedonism’: Adults Only Resorts Still Swinging Despite Pandemic

- The World’s Best Nude Resorts Have Been Revealed

The post Swinger Clubs Australia: Sex Parties Thrive During Pandemic appeared first on DMARGE Australia.

While some male celebrities seem to be withering in front of our eyes (like Mickey Rourke or Nico Rosberg), Rob Lowe just defies the passage of time. The 56-year-old actor, producer, and director simply doesn’t age.The former member of the ‘Brat Pack’ – a loose group of actors who frequently appeared together in the 80s, such as Charlie Sheen, Emilio Estevez, Demi Moore, James Spader and Robert Downey Jr., known for their hard-partying ways – Lowe these days is known more for his clean living and family image than the debauched antics he and other Brat Pack members got up to before the turn of the century.Many Brat Pack alumni have derailed their lives through drugs and alcohol – Lowe himself was also caught up in a sex tape scandal. But unlike some of his colleagues, Lowe really turned things around, recently celebrating 25 years sober – a milestone that perhaps holds the secret to Lowe’s youthful longevity.

View this post on Instagram

On top of celebrating 25 years alcohol-free, 2020 also marks 30 years drug-free for Lowe. Earlier in May he posted a heartfelt message to Instagram, celebrating his sobriety and encouraging others to follow suit:

“30 years ago today, I found a sober life of true happiness and fulfilment. I am filled with gratitude on this anniversary. From a treatment centre in Arizona to a bomb shelter in Israel, I have come to know many extraordinary people, and the fellowship of recovery has changed my life and given me gifts beyond my selfish imaginings. If you or someone you love is struggling with any kind of addiction, there is hope! Love to you all.”

While here at DMARGE we’re partial to a drink or two, it’s hard to deny how well clean living has worked out for Rob Lowe. Other similarly youthful men who’ve sworn off the sauce include Brad Pitt, Samuel L. Jackson, Bradley Cooper, Jim Carrey and Zac Efron. Maybe there’s something to this alcohol-free stuff after all.Lowe’s positive message of sobriety comes at a particularly pertinent time: Australians are drinking alcohol more frequently during the COVID-19 crisis than before, a new report from the Australian National University details. While the temptation to lay into a few Negronis during lockdown is hard to resist, we might want to consider slowing our drinking down a bit (or bringing it to a stop entirely) if we want to stay looking young like Rob Lowe. Alcohol’s a preservative, but not in that way…Lowe directs and stars in the procedural drama 9-1-1: Lone Star, which has recently made its way to Australian TV. Check out the stunts he pulls on that show if you doubt our claims of his youthfulness.

Read Next

- Arnold Schwarzenegger’s Latest ‘Low-Tech’ Workout Demonstrates Fitness Truth We Shouldn’t Forget

- Chris Hemsworth’s Birthday Bash Holds Subtle Nutrition Message

The post Rob Lowe’s Secret To Looking Young Forever appeared first on DMARGE Australia.

It’s been a tough year to be solo. While lockdown has given some couples the chance to ‘solidify’ their relationship (see: “Australian couples in honeymoon stage gaining most from self-isolation“) it has also made scoring a date as a singleton even more complicated.

From Zoom dates to outrageous sex laws to creative new isolation dating trends it’s been a whirlwind.

This makes the following advice even more important. Though it doesn’t specifically relate to lockdown, given many daters’ more limited options right now, it’s more important than ever to be on your game (and not to waste your, or others’, time).

This in mind let’s turn to Reddit for the gem of advice, which takes the form of a Mark Twain quote, posted in the r/dating_advice community.

The quote reads: “Never allow someone to be your priority while allowing yourself to be their option.”

“This quote is a good reminder. Value yourself and what you have to offer. I had let myself forget that,” the author of the thread adds.

The top voted comment beneath the original post offers more smart advice, which many often forget: “It’s important to remember that you can’t make someone do anything.”

“You can’t make them text you back. You can’t make them agree to go on a date. You can’t make them talk when they’re giving you one word responses.”

“If they wanted to do it and cared enough to do it, they would do it. Find someone who cares enough to do it. Not someone who you have to beg to do it!”

While some users cast aspersions over whether Twain really followed his own advice (“Not ironically, Twain used his secretary, Isabel Lyons, as his option when he was her priority”), the point remains: it’s a useful reminder.

It also links to the “Fuck Yes or No” concept, coined by author of “The Subtle Art Of Not Giving A Fuck” Mark Manson.

According to Manson, the Law of “Fuck Yes or No” states that when you want to get involved with someone new, in whatever capacity, they must inspire you to say “Fuck Yes” in order for you to proceed (you also need to be getting a “Fuck Yes” from them.

“This may sound a bit idealistic to some. But The Law of “Fuck Yes or No” has many tangible benefits on your dating life,” Manson writes.

Not only is this good for you (“No longer be strung along by people who aren’t that into you”) but it’s good for other daters too (“No longer pursue people you are so-so on for ego purposes”).

For more dating advice check out the DMARGE dating vertical.

Read Next

- Eugenie Bouchard Offers ‘Brutal’ Dating Lesson Every Man Needs To Hear

- ‘Anxiety, Affairs & Instagram’: Survey Shows True Impact Of Pandemic On Dating

The post Mark Twain Quotes: How They Can Relate To Dating appeared first on DMARGE Australia.

Sometimes you need to forget about everything and hit the road. But would you travel from Delhi to London by bus?

That’s the question expedition company Adventures Overland is currently posing to travellers, as it launches a new organised bus trip from India to the UK.

“Described as the ‘first-ever hop-on/hop-off bus service’ between the two destinations, Bus to London will ferry 20 passengers on a modified luxury bus, inspired in part by the Hippie Trail buses that crisscrossed the world in the 1950s and 1960s,” CNN Travel reports.

“The bus will cross 18 countries over a period of 70 days, with passengers hopping off to marvel at the pagodas of Myanmar, hike the Great Wall of China and wander historic cities including Moscow and Prague.”

Started in 2012 by Sanjay Madan & Tushar Agarwal, Adventures Overland calls itself a “unique travel company that organises driving expeditions all across the world…literally, in all the 7 continents!”

Adventures Overland is also the holder of 16 World Records in long distance driving expeditions, and has driven in 75 countries all around the world.

“Whether its pioneering the first ever drive from London to Delhi back in 2010, organising the largest expedition driving from India to London through 18 countries, taking the first ever group of vehicles on a cross border expedition from India to Bangkok, snow driving in Iceland or executing a road trip on the Dalton Highway in Alaska, we have done it all,” Adventures Overland states.

“We have driven in -40 degrees on frozen lakes in Russia and also organised drives on the worlds most challenging roads in South America and Africa!”

Since founding Adventures Overland, Agarwal and Madan have organized three India-to-London expeditions, which involved travellers bringing their own cars and travelling in a convoy.

View this post on Instagram

With their latest venture, Agarwal and Madan are keen to try something a little different:

“There are a lot of people, travelers, who want to experience these overland journeys, but they don’t want to drive,” Agarwal told CNN Travel. “So, we came up with the idea of putting together a bus in which people can sit comfortably and go on long distance journeys. And that’s how the idea of the Bus to London was born.”

Assuming Covid restrictions lift as expected, the first Bus to London journey is set to take place in mid-2021.

“The best time to do this journey is between April and June, because that’s when the weather is favorable to start the journey from India through to Myanmar, and to cross the high mountains of China and Kyrgyzstan,” Agarwal told CNN Travel.

The trip will cost around $20,000, but you can choose to just do part of the journey, which is split into four legs.

It will be marketed to travellers both young and old, and Agarwal claims 40,000 people have already registered their interest.

Though it’s not exactly high tech, could this be the ‘anti Covid’ holiday we all need right now? Only time (and bookings) will tell.

Read Next

The post Adventures Overland: Tour Operator Launches 70-Day Bus To London appeared first on DMARGE Australia.

Building a balanced diet is a challenge.

Not only do you need to consider your nutritional intake, but there’s plenty of other factors: cost, accessibility, ethics, environmental impact, variety… Many fitness experts and athletes like Tom Brady advocate a partially or wholly vegan diet, and there’s plenty of evidence to suggest that replacing animal protein with plant-based alternatives has a whole bevy of health benefits.

RELATED: ‘Vegan Investors’ Set To Bring Home The Bacon During Pandemic

However, it’s not as simple as swapping lamb for lentils when it comes to constructing a healthy diet.

Max Lugavere, nutritionist and author of New York Times best-seller The Genius Life, is still a staunch advocate for omnivorous diets, and regularly espouses the benefits of eating animal protein (particularly beef).

His latest Instagram post explores a common misconception people have about animal protein – specifically, red meat.

View this post on Instagram

“When we think of meat we just think of protein or calories. This is short-sighted… all animal sources [of protein] but especially beef… [are] filled with copious nutrients, many of which are needed to function optimally and reach our full potential,” Lugavere shares.

It’s why high-protein diets like keto can actually work: animal proteins aren’t a zero-sum game; they’re not just macronutrients. They contain a whole cocktail of essential micronutrients as well that are essential for good nutrition.

One common pitfall people fall into when starting a new diet is being too myopic and not making sure they’re getting a balanced nutrient intake. It’s why so many people turn to supplements to make up for the shortfall.

“You can not out-exercise a poor diet and you can not definitely out-supplement poor food choices.”

Supplements can be expensive and might be doing you more harm than good: they can fool you into thinking you’re living a healthy, balanced lifestyle and lead you into neglecting other aspects of your nutrition… You’ll just end up with expensive piss.

There’s also a mental health advantage to eating red meat, Lugavere relates.

“There are numerous studies suggestive of red meat being beneficial to mental health. Often overlooked nutrients such as choline which is needed for methylation, and serves as the backbone for acetylcholine which aids in executive function. Or carnitine, an important amino acid, needed for fatty acids to be transported across the mitochondria membrane to be used for beta-oxidation (fat burning) and shown to be neuroprotective.”

A more psychosomatic justification for eating red meat and other animal proteins is that they’re very good at satiating hunger, as well as simply being enjoyable to eat. Satisfaction is a huge and particularly underrated component of any diet: you might be losing weight or building muscle, but if you’re miserable, what’s the point?

“In the modern world, we are more deficient in nutrients than calories, which run the operation of cellular function and dynamics of what we do with the energy potential of a calorie. A protein shake or protein bar will never compare to unadulterated natural sources of protein. Opt for the best equality source as possible as this will affect the nutritional values but also support local farmers who properly care and treat their animals for our benefit.”

It’s certainly food for thought, as is Lugavere’s cheeky sign-off:

“Let me know your thoughts… I am off to eat a steak.”

Read Next

- Grim ‘Bulking Gone Bad’ Transformation Shows What Happens When You Blindly Follow Internet Fitness Gurus

- These Creatine-Rich Foods Could Be Your Ticket To Getting Huge… Without Supplements

The post Red Meat Benefits: Nutrition Coach Explains How Red Meat Is Good For You appeared first on DMARGE Australia.

Every man and his dog is tracking their fitness these days (dogs quite literally can) and we’ll admit that some fitness trackers and activity monitors are perhaps better known than some others. But with that notoriety also comes a high price tag, and if it’s just simple tracking of your runs and your sleep, this incredibly affordable Timex Metropolitan S Smartwatch could be your new best friend.

The Metropolitan S ticks all the boxes of a fully-fledged smartwatch and fitness tracker: built-in heart rate monitor so you know when you can (and can’t) push yourself further; GPS tracking so you can leave your phone at home if you wish and still track your progress and it’s water-resistant to 30-metres so you even take it swimming.

Ok, so it might not have the ability to store songs, so if you do need to listen to music on your run, you will need your phone to hand, but who really leaves their phone at home anyway? It’s a smartwatch too, notifying you of incoming calls, texts and other app notifications but perhaps the best feature of this Timex watch is its two-week battery life. When you compare to that some other smartwatches that need to be charged every night, it makes this Metropolitan S a whole lot more attractive.

Plus, we think it’s pretty handsome, although we won’t ignore the fact it does look similar to a certain fruit-based smartwatch doing the rounds.

For $179, it’s all the smartwatch and fitness tracker you could ever need and you’d be a fool to miss out. Head to Huckberry now to buy yours.

Buy The Timex Metropolitan S Smartwatch $179

Read Next

The post Apple Watch Alternative: This $179 Timex Smartwatch Is Too Good To Miss appeared first on DMARGE Australia.

Stock market advice tends to either be speculative and risky (“stocks only go up!”) or oozing with platitudes (“it’s time in the market, not timing the market”). Historically this has led young Australians to spend most of their money on kale smoothies, Mazdas and gap years, only to turn 35, start investing properly, and wish they’d started earlier.

RELATED: The Best Australian Shares To Buy Right Now

Generalisation? Sure. But ASX investor studies bear out that the ‘investor demographic’ has for years been overpopulated by those with dad bods and cellulite.

However, since the ASX’s March nosedive, we have seen unprecedented numbers of retail (individual) investors enter the market. Inspired by the Robinhood craze across the pond, many young Australians began jumping into the market while prices were cheap (and while sports betting and RSL poker machines were off-limits due to the pandemic).

I’m sure Warren Buffett is a great guy but when it comes to stocks he’s washed up. I’m the captain now. #DDTG pic.twitter.com/WqMR89c7kt

— Dave Portnoy (@stoolpresidente) June 9, 2020

“Dirt cheap, automated on apps and championed by newbie traders who brandish their broker balances on Twitter, the stuck-at-home trading phenomenon, born in the USA, has become a global craze,” Bloomberg reported in August.

“Retail’s tentacles are everywhere. In the U.K, tax-free savings account openings at Interactive Investor jumped 238% for investors between 25 and 34 years of age in April and May. In India, newly minted day traders are crowing after falling in love with stocks that trade below 7 U.S. cents apiece and riding most of them straight up. Small-time investors in Moscow bought almost twice as many Russian shares in June than in April. In Malaysia, individual buyers are at least partially behind giant rallies in medical glove makers – one gained more than 1,600% this year. In Japan, tiny investors boosted an obscure biotech venture with seven straight years of losses by almost 11-fold on optimism for an unproven coronavirus treatment.”

Now it might be Australia’s turn. As The Australian Financial Review reported yesterday, Australia’s free-trading app boom could just be beginning.

“The founders of buy now, pay later juggernauts Zip and Afterpay are among the backers of a new low-cost Australian share trading platform that hopes to capitalise on the rush among young investors into the stock market.”

“The share-trading site – named Superhero – is set to launch on Monday and is charging a flat fee of $5 per trade with minimum investments of $100.”

“We’re making investing accessible to the younger generation,” co-founder and CEO of Superhero Mr Winters told The Australian Financial Review.

Superhero aims to challenge share trading applications like SelfWealth, which charges $9.50 per trade, and the dominant player CommSec, which charges a minimum of $19.95.

“These players have experienced enormous growth in trading volumes. SelfWealth recently reported that monthly trade volumes had increased from around 20,000 at the end of 2019 to almost 140,000 in June,” The Australian Financial Review reports.

The Reddit forum /r/AusFinance has numerous threads dedicated to the topic (including many Australians in their 20s asking the financial community for advice) reflecting young Australians’ growing interest in free trading applications and investing more generally.

From a financial literacy point of view, this is excellent: Australians taking an interest in their savings and seeking to maximise them is great. However, the craze also opens up a lot of vulnerable individuals to some painful failures.

The confounding factor is what it takes, intelligence or otherwise, to know when to get out. Anyone can sit on a roller coaster while the cable beneath chug-chug-chugs it up the hill.

— Mike Pienciak (@MikePienciak) May 26, 2020

Tweets like the following, highlighting individual stocks that have performed incredibly over the last few months, form just part of a huge rose-tinted picture many rookie investors may be exposed to on Twitter, perhaps lulling them into a false sense of security or encouraging them to take risks more experienced investors and financial advisors would steer clear of.

Top YTD % Returns

This is why individual stocks can help your portfolio…

Zoom: +262%

Tesla: +259%

Docusign: +165%

Teladoc: +160%

Shopify: +133%

Etsy: +132%

Wix: +120%

Peloton: +106%

Square: +93%

Spotify: +76%

Nvidia: +73%

PayPal: +61%

Amazon: +60%

Netflix: +52%— KingMaker$Enterprises (@KingMakerIQ) July 20, 2020

Twitter is also full of statements from rookie investors boasting their winnings from having a flutter on individual stocks.

I bought Tesla stocks at $400 and now they’re $1600

— jo

(@triple7isheaven) July 12, 2020

While this isn’t necessarily wrong (individual stocks can help your portfolio), and while many seasoned investors may have a few well-picked individual stocks on their books, when you’re starting out investing it’s much smarter to focus on building an intelligent overall plan (read: a diverse portfolio), covering your bases and minimising your exposure (which is much easier to achieve via index funds and ETFs), rather than making bets on specific stocks (something you may get the luxury of being able to afford to do further down the line).

It looks enticing when you

pick high performers, but keep in mind, it’s riskier holding individual stocks. That’s why roughly 1% of individual Investors beat the index in a long-term period.

— Chris (@SenseofDollars) July 20, 2020

Even then, it’s crucial to remember the risks behind investing in individual stocks (as we like to call it, “fluttering”) – something apps like Superhero are making a much easier proposition for many young Australian professionals.

That’s not to say free trading applications are the enemy, but when you use them you should do so with your eyes open.

“When trying to get as much return as you can for the least amount of risk, your number one concern should be diversification,” according to Investopedia.

“While having low fees and managing your own tax situation is good, it is better to have adequate diversification in your portfolio. If you don’t have the funds to make this happen, an ETF or mutual fund is probably better for you – at least until you build up a solid base of stocks.”

Further information on the pros and cons of investing in single stocks can be found here.

Another good point of contact – in our view – for rookie investors, is a recent episode of The BIP Show podcast. During said episode, James Whelan, Investment Manager at VFS Group in Sydney, divulged a common error rookie investors commit: being tempted into making lots of little punts.

“You duck down to Ryan’s Bar, catch up with your mates, they say, ‘I’ve got a red hot tip for you Jimmy, you’ve got to get onto this one… they’re in Sierra Leone and they’re digging ants out of copper mines.”

“It’s just the biggest load of baloney… [but] you do a cursory look and purchase.”

“It’s the worst possible idea – you don’t know anything about it, you’re not that close to the company, it’s probably going to be a terrible idea anyway and there’s every likelihood that… on the other side of it someone is just selling into your buying.”

“If you’re not close to it, don’t even worry about it – at the small end of the scale.”

“It’s easy to keep up with what the HP’s are doing or CBA, Apple or Amazon because it’s in the news and it’s well disclosed. But the worst mistake you can make is to have a whole shoebox full of these [speculative] pieces.”

Wow. This passage from an 1887 book on Speculation is relevant.

Particularly after Robinhood traders piled into Tesla yesterday.

“When a great movement has been projected, and the bubble has become inflated near its utmost tension, then it is that stocks look cheap.” pic.twitter.com/TEFTD7z8J2

— Jamie Catherwood (@InvestorAmnesia) July 14, 2020

Another common faux pas is not cutting your losses, Chris Weston, head of research at Pepperstone, stated during the same podcast episode. According to Mr. Weston, understanding position sizing can help you do this.

“Everyone comes on board, they start trading FX markets or indices and all they’re focussed on is entry points.”

“[You see] signal services and all that nonsense advertised every day of the week on Youtube and it becomes completely infuriating.”

“Every time you go onto Facebook there’s a signal service trying to be pumped out – that’s not trading.”

“Getting into the market is about 10% of trading,” Mr. Weston said. More importantly: “You’ve got to get correct position sizing for the right size of your account. You’ve got to understand where your stock loss is, how much risk you’re taking, and understand what sort of reward you need to be taking from that.”

In other words: it’s not about obsessing over your win-loss ratio, but getting enough winnings from your wins (and not losing too much from your losses). In fact, some of the most successful traders have a 60% loss rate, but the amount they win vastly offsets them.

“A 40% success rate can still make you money [if you cut your losses correctly].”

Mr. Weston told The BIP Show this is a mistake he sees “time and time again” at a retail level.

According to Mr. Weston, it comes down to pure ego: [many people] have made money in property, done well in life, run a successful business, etc. [Then they] start trading…”

“Human beings have been bred to be right [so they] will start making a loss on a position and continue holding that position.”

“There’s a saying: ‘professional traders go broke taking small profits, retail traders go broke taking massive losses.’”

“That is the number one reason I see people blowing up their accounts.”

“You don’t always have to be right – the notion you can accept a [small] loss and move onto something else is what trading’s all about.”

“You need a process.”

Another smart piece of financial wisdom can be found in the r/financialindependence Reddit thread on “timing the market.” It illustrates why, though it may be boring and cliche, time in the market tends to beat timing the market.

The author of the thread claims to have downloaded the historic S&P 500 data going back 40 years, and uses it to model three different portfolios, named after three fictional friends Tiffany, Brittany and Sarah.

“All three saved $200 of their income per month for 40 years for a total of $96,000 each. But after 40 years they all ended up with different amounts based on their investment strategies.”

The findings may be fictional, but they demonstrate a valuable point.

Tiffany’s Terrible Timing

“Tiffany is the world’s worst market timing. She saves $200/month in a savings account getting 3% interest until the worst possible times. She started by saving for 8 years only to put her money in at the absolute market peak in 1987, right before Black Monday and the resulting 33% crash. But she never sold, and instead started saving her cash again, only to do the same at the next three market peaks. Each time she invested the full amount of her saved cash only to watch the market crash immediately after. Most recently she put all her money in the day before the 2007 financial crisis. She’s been saving cash ever since waiting for the next market peak.”

“With this perfectly bad market timing, Tiffany still didn’t do too bad. Her $96,000 she saved and invested over the last 40 years is now worth $663,594. Even though she invested only at each market peak, her big nest egg is thanks to the power of buying and holding. Since she never sold, her investment always recovered and flourished as the market inevitably recovered far surpassing her original entry points.”

Brittany Buys at the Bottom

“Brittany, in stark contrast to Tiffany, was omniscient. She also saved her money in a savings account earning 3% interest, but she correctly predicted the exact bottom of each of the four crashes and invested all of her saved cash on those days. Once invested, she also held her index fund while saving up for the next market crash. It can’t be overstated, how hard it is to predict the bottom of a market. In 1990 with war breaking out in the Middle East, Brittany decided to dump all her cash in when the market was only down 19%. But in 2007, the market dropped 19% and she didn’t jump in until it fell all the way down to a 56% drop, again perfectly predicting the exact moment it had no further to fall and dumped in all of her cash just in time for the recovery.”

“For this impossibly perfect market timing, Brittany Bottom was rewarded. Her $96,000 of savings has grown to $956,838 today. It’s certainly an improvement, but interesting to note that when comparing the absolute worst market timing versus the absolute best, the difference is only a 44% gain. Both Brittany and Tiffany have the vast majority of their growth thanks to buying and holding a low cost index fund.”

Slow and Steady Sarah

“Sarah was different from her friends. She didn’t try to time market peaks or valleys. She didn’t watch stock prices or listen to doomsday predictions. In fact, she only did one thing. On the day she opened her account in 1979, she set up a $200 per month auto investment in an S&P 500 index fund. Then she never looked at her account again.”

“Each month her account would automatically invest $200 more in her index fund at whatever the current price happened to be. She invested at every market peak and every market bottom. She invested the first month and the last month and every month in between. But her money never sat in a savings account earning 3% interest.”

“When Sarah Steady was ready to retire, she signed up for online access to her account (since the internet had been invented since she last looked at it). She was pleasantly surprised by what she found. Her slow and steady approach had grown her nest egg to $1,386,429. Even though she didn’t have Brittany’s impossibly perfect ability to know the bottom of the market, Sarah’s investment crushed Brittany’s by more than $400,000.”

Recap

Amount Saved/Invested: $96,000 each

Investment: Buy and hold an S&P 500 index fund

Tiffany (worst timing in the world): $663,594

Brittany (best timing in the world): $956,838

Sarah (auto invests monthly): $1,386,429

Read Next

- The Sneaky Investing App Catch Most Rookie Traders Have No Idea About

- Investment Guru Debunks The Naive Investing Psychology Australians Need To Grow Out Of

The post Single Stock Investing: Market Trend Young Australian Investors Need To Be Wary Of appeared first on DMARGE Australia.

While Australians are definitely more fashion-focused than we were even a decade ago, some things remain the same. Double denim will always be a gamble, R.M. Williams boots will always be in demand, and Tarocash will always be there if you need a suit that’s more artificial than the cheese at McDonalds.That’s the stereotype, anyway.Tarocash, for the uninitiated, is a menswear brand that sits somewhere between Lowes and Zara. They principally make affordable – usually aggressively polyester – suits, shirts and other men’s clothing items. For late Gen X kids, Millennials and younger Australians, your first suit was probably from Tarocash, and it’s probably still gathering dust somewhere in your wardrobe.Tarocash is a genuine suburban phenomenon in the Antipodes, boasting over 115 standalone stores across Australia and New Zealand as well as countless online stockists. They fill a niche in the market: they make cheap, cheerful formal wear for every occasion, whether that’s your Year 11 formal, the Melbourne Cup or a court appearance.Naturally, fashion snobs look down on Tarocash. The Betoota Advocate, Australia’s leading source of satire and social commentary, often makes light of the infamous ‘Cash for its supposed trashy reputation. But the brains behind the Advocate, Clancy Overell and Errol Parker (real names Archer Hamilton and Charles Single) have harsh words for anyone who genuinely hates Tarocash, they told DMARGE exclusively.

“They haven’t gone out of business, like countless other clothing brands recently, which shows they’re doing something right. Nobody loathes Tarocash and if you do, wake up to yourself. They’re a pillar of suburban life.”

View this post on Instagram

It reveals a truth about the business: it might not be your cup of tea, but it’s hard to deny Tarocash’s success.The last eighteen months have been incredibly tough for most industries, but the fashion industry – and retail more broadly – has been hit harder than most. At a time when many ready-to-wear brands are going under thanks to the pandemic and fast fashion continues to dominate the space, that Tarocash continues to thrive is evidence that they’ve got a winning formula.It’s easy to be snobby or classist about Tarocash, but isn’t it a good thing that formalwear brands continue to thrive in Australia? Dressing with a sense of decorum is fashionable, no matter who you are (or what your bank balance looks like).RELATED: Menswear Experts Explain What Will Happen To Australia’s Suit Culture If We Don’t Go Back To WorkFounded in 1987 in Melbourne by South African brothers Stephen and Michael Leibowitz, Tarocash grew so successful that the brothers founded Retail Apparel Group (RAG), which also has Aussie brands Connor, Rockwear, Johnny Bigg and yd. in its stable. Somewhat ironically, RAG is now in South African hands under The Foschini Group.Few brands make the same sort of affordable formal menswear that Tarocash do – you wouldn’t go to H&M for a suit, for example. Tarocash has also always kept its finger on the pulse of Australian fashion, constantly offering clever designs, patterns and cuts that suit average Australian men. They’ve also had a long tradition of using unconventional models for their clothes, using men of diverse backgrounds and body shapes. Most blokes on fashion runways for luxury brands look like they subsist on nothing but cigarettes and nose beers.Tarocash is to business attire what Casio is to the watch world. Some men covet Patek Philippes and Ermenegildo Zegna suits, and others don’t. We shouldn’t look down on other men who don’t care about the same sorts of things we do. More to the point, let’s not pretend we’re ‘too good’ for Tarocash. Every man needs a good, cheap suit.In short: don’t be a wanker; embrace the ‘Cash.

Read Next

- Is Fashion F*cked? Experts Reveal Who Will Come Out On Top Post Pandemic

- Online Retailer’s Study Finds Alarming Change In Australians’ Fashion Sense Since Lockdown

The post Tarocash May Have The Last Laugh appeared first on DMARGE Australia.

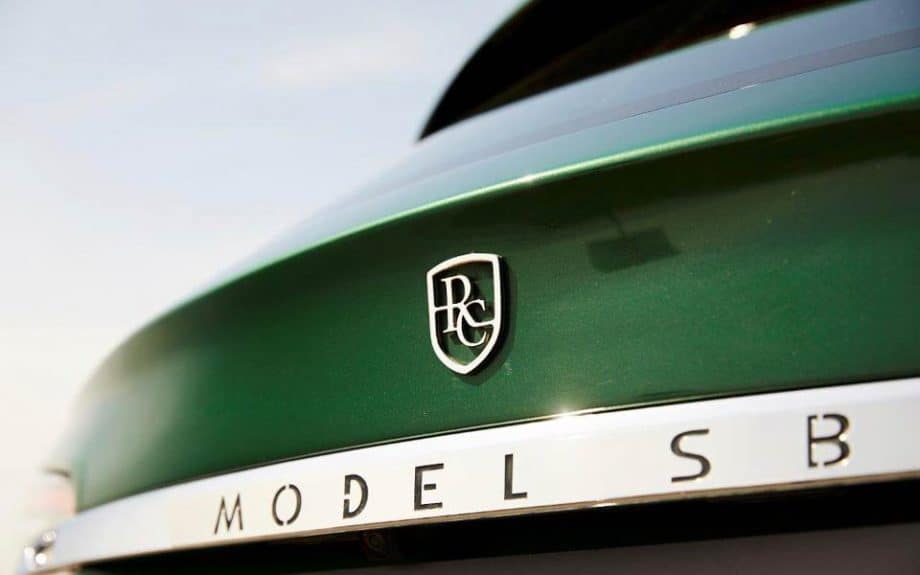

Before you think, “wasn’t there a one of a kind Tesla Shooting Brake launched a few years ago?”. Yes, there was. This one. But while stories from previous years spoke about the incredibly unique electrified wagon’s inception, this piece is here to inform you it is now possible to own it yourself – for the small fee of €224,521 (or less if you live outside the EU), of course.

So, as a refresher, what is it? Well, this Tesla Model SB – unlike any you’ve ever seen or likely will ever see – is a custom-built version of the ubiquitous electric vehicle, forged by Dutch coachbuilder RemetzCar and further proof that the Dutch are the ones to call upon whenever you want to elongate a vehicle, given they’re also responsible for creating this Porsche 911 Shooting Brake.

The Tesla project was commissioned by Floris de Raadt, an avid admirer of all things shooting brake (and a man who dreams of owning an elongated Aston Martin DB5) as well as electrified cars. It was only a matter of time, then, that Floris would want to own a shooting brake version of a Tesla (arguably the best EV around) and having seen RemetzCar produce a hearse edition of the Model S, he not only knew it would be possible, but he knew who he would need to employ to build it.

But in order to custom-build a Tesla Shooting Brake, you need to get yourself a Tesla to work on. Floris managed to source a Model S 85 Performance, which, while not quite as quick or fear-inducing as Model S 100, still manages to kick out 422hp/314kw and 600Nm torque. Hardly a slouch, then.

Floris was also bowled over by the rare green colour he’d managed to find too, considering it to be perfect. He wanted to commemorate British motoring with the project (the birthplace of the shooting brake bodystyle) and you can’t really get more British than ‘racing’ green.

Next up, the monumentally tough task of creating the rear assembly. For this section, RemetzCar took the rear end of a Jaguar XF Sportbrake and essentially bolted it onto the Tesla. This did produce some trouble, as the aluminium body of the Tesla didn’t exactly play nice with the steel Jaguar. After much perseverance and tinkering, the two sections were connected. To help hide the longer body style and to give the car that extra wow factor, car designer Niels van Roij came up with a piece of chromed steel that runs from the A-pillar at the front of the car through to the C-pillar at the rear.

The result is a Tesla that looks as though it could have genuinely rolled out of Elon Musk’s production plant, such is the attention to detail and craftsmanship involved. Inside, it looks just as you’d expect any other Tesla to look, complete with custom green piping on the cream-coloured seats to complement the external colour.

With the project going surprisingly well, it was a shock to Floris to learn that the cost of putting the car together was skyrocketing. His plan was to be able to produce some clones of his Tesla to sell to keen buyers, but given the fact the selling price would have had to have been a high one to cover costs, the plans were scrapped.

And that is what makes this Tesla Model SB truly one of a kind. And now it can be yours, as it’s now selling at Netherlands-based car dealer JB Classic Cars.

The cost for such a unique car? €185,555/AU$300,000 for buyers from outside the European Union, or for anyone within the EU and therefore liable to pay VAT, €224,521/AU$365,000.

Read Next

- Australia’s Coolest New Cars To Buy Right Now

- Where To Find Vintage, Unique & Classic Cars For Sale In Australia

The post Tesla Shooting Brake: Custom Tesla Can Now Be Yours For An Eye Watering Price appeared first on DMARGE Australia.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »