Your cart is currently empty.

As Putin’s unprovoked attack on Ukraine continues, the world continues to stand up in defiance. Although many argue the US and the international community should be doing more, harsh sanctions have come in. These have, among other things, reduced the Ruble to less than a cent and sparked fear among Russians that if Putin’s invasion of Ukraine continues, Russia will become financially, culturally and politically isolated.

In response to this uncertainty, billionaire Roman Abramovich has put Chelsea football club up for sale.

Speaking of hasty moves, one Ukrainian yacht worker recently went viral trying to sink his (Russian) boss’s vessel. And it’s not just wayward workers making Russian superyacht owners think twice: a number of Russian superyachts have come under the scrutiny of authorities as sanctions kick in.

Forbes recently reported that the Dilbar, a 512-foot, $600 million yacht owned by sanctioned Russian billionaire Alisher Usmanov, had been seized in Germany, working off the information of three sources. They since issued a correction stating that the Ministry for Economy and Innovation in Hamburg says the authorities have not seized the Dilbar, but rather work on the ship has been halted.

“Three sources had told Forbes it had been seized, but a representative for Usmanov cited the statement from the ministry in Hamburg to confirm that it had not. In its statement, the ministry elaborated that the German federal customs agency is the ‘responsible enforcement authority’ and would have to issue an export waiver for the yacht to leave, and that ‘no yacht leaves port that is not allowed to do so.'”

Forbes

According to Forbes, because the yacht is registered in the Cayman Islands and owned through a holding company, it is difficult for the authorities to tie it directly to Usmanov for the purpose of sanctions.

Usmanov spoke out against the sanctions in a statement to the International Fencing Federation. He wrote: “I believe that such decision is unfair, and the reasons employed to justify the sanctions are a set of false and defamatory allegations damaging my honor, dignity, and business reputation.”

“I will use all legal means to protect my honor and reputation.”

Usmanov

Usmanov isn’t the only Russian billionaire to be impacted by sanctions. CNBC reports that French authorities seized a massive yacht they say is linked to Igor Sechin, a Russian billionaire who previously served as Russia’s deputy Prime Minister (and who is apparently known in Russian business circles as “Darth Vader”), and who is CEO of state oil company Rosneft.

The seizures come at the same time the U.S. Justice Department has announced a new ‘KleptoCapture’ task force that will help enforce sanctions.

These aren’t the only two billionaires who have to worry about their boats being battered by sanctions: Forbes and yacht valuation experts VesselsValue say there are 32 of them out there.

Reuters recently observed that ship tracking data shows “at least five other superyachts owned by Russian billionaires are anchored or cruising in the Maldives,” a nation where there is no extradition treaty with the United States.

Not so smooth sailing indeed…

Read Next

- Revealed: What It Costs To Spend A Week On A Super Yacht In The Mediterranean

- Forget Saint-Tropez: Turkey Is Now The Centre Of The Luxury Yachting Universe

The post Superyacht Seizing Spree Continues As Authorities Target Rich Russians appeared first on DMARGE Australia.

The Samsung Galaxy S22 and its variants are all now available to buy. There are three models to choose from: Galaxy S22, Galaxy S22+ and Galaxy S22 Ultra, each of which offers something slightly different, making it easy to find the best Samsung phone for you.

All three come with some of the very latest smartphone technologies, intuitive features and gorgeous design, and, while reviews are still thin on the ground, we expect them to be just as, if not more popular than the generation they replace.

But what separates the three smartphones, how much do they cost and when can you get your hands on one in Australia? Read on to find out.

Samsung Galaxy S22 Release Date Australia

Samsung unveiled its latest flagship Galaxy S22 devices on Wednesday 9 February at 7pm ET/2am AEDT.

However, as of March the 3rd 2022, all three models can now be purchased via Samsung Australia direct, or a host of other mobile phone plan providers, such as Telstra and Optus.

You can view the teaser Samsung released for its February 2022 Unpacked event in the video below

Samsung Galaxy S22 Features

Design

Samsung has always been known for its incredible smartphone design and the Galaxy S22 trio continue that trend. All three Galaxy S22 models look pretty much the same, except for the fact they all differ in physical size.

The overall design of the three devices is similar to the Galaxy S21 series they replace, but this time round the finish is a lot more refined. The most notable difference can be found in the rear camera assembly of the S22 Ultra, which now sits more flush with the device itself, as opposed to being placed in an external housing. The triple-lens camera of the S22 and S22+ are still in a framed housing.

The ‘entry’ level S22 and S22+ feature plastic rear covers while the more premium S22 Ultra opts for a glass rear panel. All three also feature a punch hole camera in the centre of their screens for selfies.

All three also offer IP68-rated water-resistance, so should be fine to take a slight dunk. But we still wouldn’t recommend it.

The main difference that separates the S22 Ultra from its siblings is the fact it now comes with Samsung’s S Pen stylus built into the body. This is a feature that was teased before the offical launch, and now that it’s reality, the S22 Ultra could well be Samsung’s best smartphone yet, since it combines the features of the long-established Galaxy S series, with the rather excellent, but perhaps more business-focused Galaxy Note series.

The Samsung Galaxy S22 and S22+ are available in white, pink, phantom green and black colours, while the S22 Ultra comes in black, green, burgundy and white. There are also three colours exclusive to Samsung.com, these being graphite, sky blue and red.

Camera

Samsung has once again opted for a triple-lens camera system for the Galaxy S22 and S22+, and a quad-lens camera system for the Galaxy S22 Ultra.

That four-lens system comprises a 108-megapixel wide lens, 12MP ultra-wide, 10MP telephoto with 3x optical zoom and a 10MP telephoto with 10x optical zoom. The front-facing selfie camera comes in at 40-megapixels. These are pretty much the same specs as the camera system found in the Galaxy S21 (even the aperture is the same), but Samsung has said it has improved the AI photo processing that goes on behind the scenes.

This should mean you will be able to take photos with far greater detail and colour balance, and Samsung has also introduced the term ‘Nightography’, promising low-light photos like you’ve never seen before.

The Galaxy S22 and S22+, meanwhile, receive a 50-megapixel main sensor, 12MP ultra-wide and 12MP telephoto lens. The front-facing camera comes in at 10-megapixels. Some of these camera sensors are new compared to the Galaxy S21; the megapixel count is up, and again, the photo processing technology has been improved, so we expect great things from these cameras.

Screen

Samsung has always been one of the best when it comes to smartphone screens, with colours being vibrant, brightness levels being exceptional and overall clarity being second-to-none.

As previously mentioned, the Galaxy S22 series differ in physical size, so there are three screen sizes to pick from. The Galaxy S22 receives a 6.1-inch display, the S22+ a 6.6-inch display and the S22 Ultra gets a 6.81-inch display.

The S22 and S22+ are both Full HD+ flat displays with 10-120Hz variable refresh rate while the S22 Ultra gets a higher resolution Quad HD+ curved display, but with a 1-120Hz variable refresh rate. All three displays support HDR10+ for improved contrast when streaming video content.

All three also offer a biometric fingerprint scanner integrated under the screen.

Samsung Galaxy S22: Price in Australia

Now the part you’ve all been waiting for. The Galaxy S22 trio of smartphones come with various storage options, so pricing differs throughout the range. The Galaxy S22 Ultra can also be had with a different amount of RAM, either 8GB or 12GB. The increased RAM can help the phone to run faster, as well as offer greater speeds when using it as a substitute for your computer when connected to an external monitor.

Samsung Galaxy S22 Ultra Price Australia

- Galaxy S22 Ultra (8GB + 128GB) – $1,849

- Galaxy S22 Ultra (8GB + 256GB) – $1,999

- Galaxy S22 Ultra (12GB + 512GB) – $2,149

- Galaxy S22 Ultra (12GB + 1TB) – $2,449

Samsung Galaxy S22 and S22+ Price Australia

- Galaxy S22 (128GB) – $1,249

- Galaxy S22 (256GB) – $1,349

- Galaxy S22+ (128GB) – $1,549

- Galaxy S22+ (256GB) – $1,649

Samsung Galaxy S22 Australia: Where to Buy In Australia

The Samsung Galaxy S22 series, including the Galaxy S22 Ultra, can be bought from the following online stores:

- Samsung Australia

- Optus

- Telstra

- JB Hi-Fi

- Vodafone

- The Good Guys

- Harvey Norman

- Woolworths

- Officeworks

Each of these stores may be offering limited-time deals at your time of purchase, such as money off by trading in your current smartphone or bundling in some freebies.

Read Next

- 9 Best Smartphones In Australia

- 17 Best Smartwatches For Men 2022

- 15 Best Fitness Watches For Men 2022

The post Samsung Galaxy S22 Australia: Features, Price, Where To Buy & More appeared first on DMARGE Australia.

I spent a night at a Melbourne airport hotel – Ibis Budget Melbourne Airport – which some Tripadvisor users reckon is “the worst hotel in Melbourne.”

Just so you don’t think I’m exaggerating, here’s a couple of their reviews. One guy, who rated it “terrible,” called it the “worst hotel room I’ve ever tried to stay at” and said that when he discovered the tv was not working he was able to negotiate a full refund and leave. His reasons? Beyond the tv not working, he said: “The room was horrible.”

“The bathroom was a pod with a shower and toilet with the sink in the main room. It was noisy, close to a communal mess hall but with little or no shielding from the noises in the adjacent rooms and hallway. If the tv worked I might’ve tried to survive it for a night. It would be forgivable if it was cheap, but at $140 for the night it was disgusting.”

Tripadvisor user @wajet71

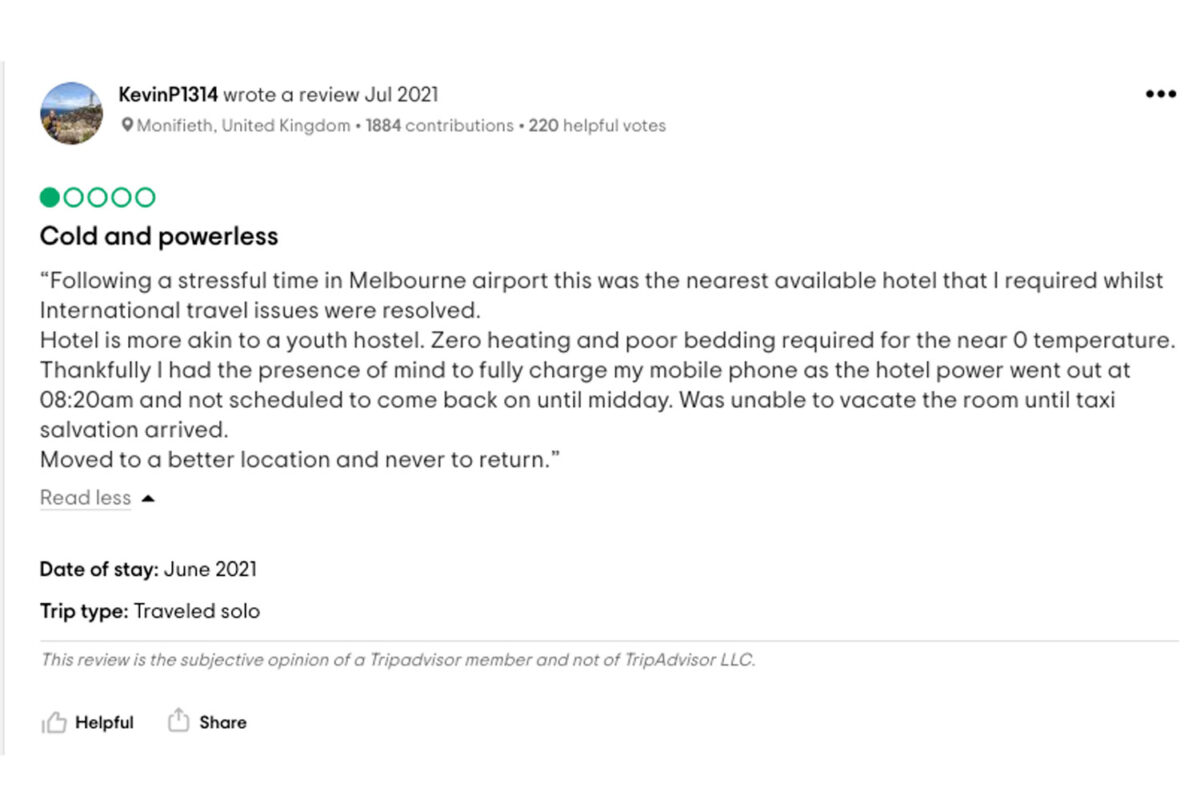

Another unimpressed Tripadvisor user said they “moved to a better location and never to return” because the hotel is “more akin to a youth hostel” than a hotel.

Another Tripadvisor user said: “We will certainly not stay there again. The room was very small with no cups ,milk or tea / coffee .The timber floor was dirty – covered in dust and hair. The TV wasn’t working until the receptionist came and gave the set a side tap , One of the main lights was not working and one had to negotiate a high step to the very confined toilet which had not been cleaned!”

Reading all this, my expectations were low. So I was pleasantly surprised to find that when I arrived in my room, everything was clean. Yes: the bathroom was tiny (it was so small you could shower yourself while sitting on the toilet), but still. I wasn’t expecting luxury.

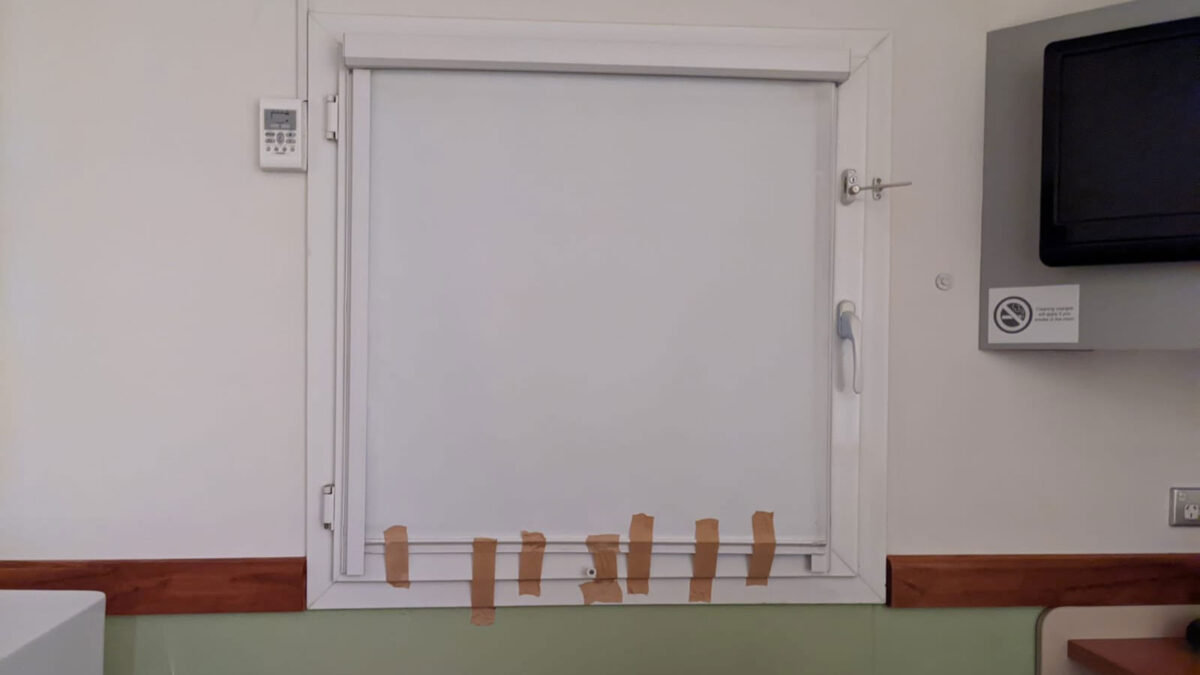

My main bugbear was that the window shade was broken, and wouldn’t stay down. This was something that I fixed with strapping tape, meaning I had multiple ‘night terror’ moments when I was rudely awakened by the sound of the tape giving way and the shade slamming up into the top of the window.

RELATED: The Most Hilarious Reviews Of London’s Worst Hotels

Other than that, the bathroom was really, really small. And the views (see below) were hardly picturesque. But I didn’t expect amazing views from a budget airport hotel.

Overall, I agree with the aggrieved Tripadvisor users in that the hotel isn’t that great. But I disagree that you should expect anything other than that. I think the hotel has got their marketing right – I didn’t rock up thinking it was going to be a flash joint. What I would say is that it’s a bit too expensive for what you get – I’d be happy to pay $70 a night, but not $120 (which is what I paid).

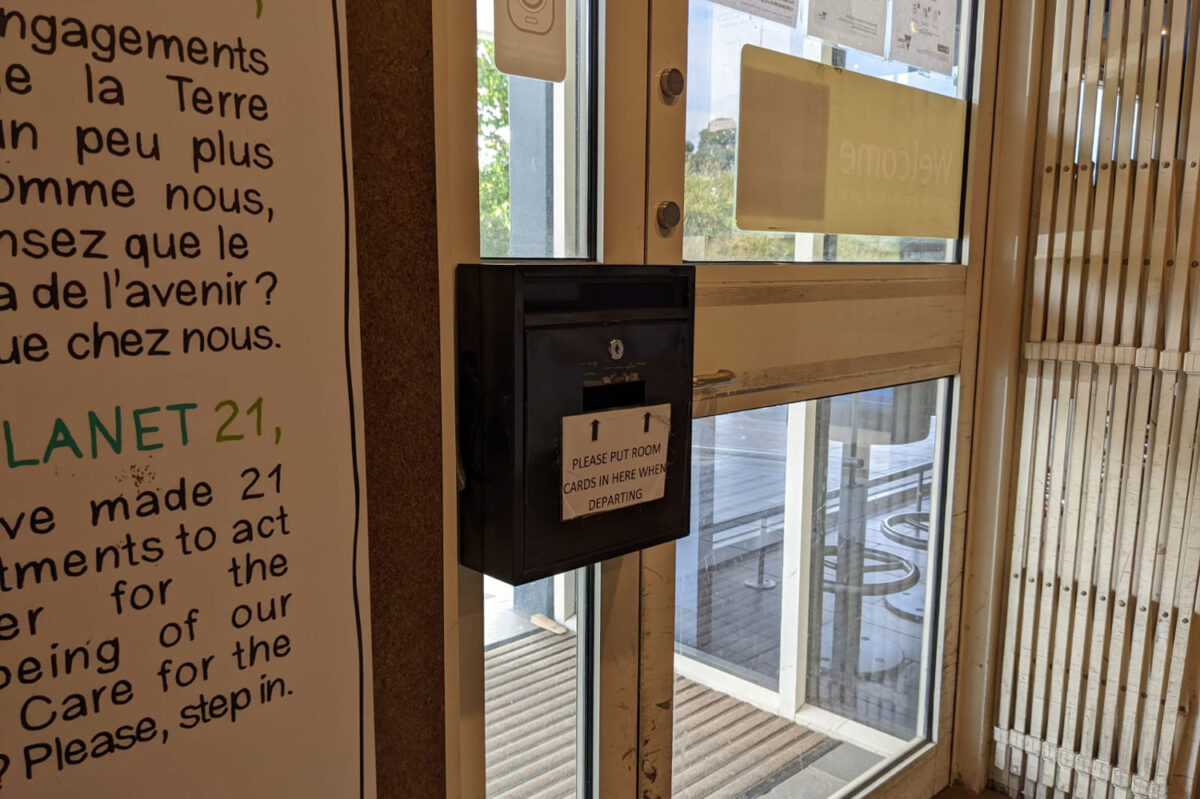

On the plus side, there was no waiting around in a line to check out (you just leave your key in a box on the door), and it was conveniently located (it was a 9-minute walk to the Qantas check-in at the domestic airport).

As they say, every hotel has a silver lining…

Read Next

The post Inside Melbourne’s ‘Worst Hotel’ – I Tried It So You Didn’t Have To appeared first on DMARGE Australia.

Roman Abramovich, the Russian billionaire who owns Chelsea football club, has decided to sell the club over the fears that his presence at the club has raised the possibility the club could be affected by economic sanctions the UK has brought in as a response to Russia’s invasion of Ukraine.

Abramovich has pumped an incredible amount of money into the club over the years. In fact, the club owes him 1.5 billion pounds (2,007,118,500 USD), which he has said he is willing to write off in quite a generous gesture.

Chelsea fans (and fans of other clubs with Russian owners like Manchester United) have gone mad on Twitter praising Abramovich for his generosity.

It’s Crazy how Roman Abramovic has been held accountable more than Vladimir putin lol

— Kemboi (@Cfc_Kemboi) March 2, 2022

Agenda against Chelsea fc smh ! pic.twitter.com/k1AddwudcN

Roman Abramovic said it’s not really about the money. Whoever is going to be the next owner of Chelsea will be critically examined because it’s very obvious he still loves the club and will want the club to get owners who also share the same passion as him.

— KALYJAY (@gyaigyimii) March 2, 2022

One fan wrote: “Take a bow, Roman Abramovic… One of us.”

— talkSPORT (@talkSPORT) March 2, 2022

“He’s been a brilliant owner. He’s been the best owner in the world.”

“He bought Chelsea to bring success & he delivered everything.”

Jason Cundy pays tribute to outgoing #CFC owner Roman Abramovichpic.twitter.com/VKXsoOVpx0

Imagine being owed £1.5bn, people don’t realised how much money that is, could last generations. Roman Abramovic told Chelsea “you can keep it”… unbelievable.

— Mod (@CFCMod_) March 2, 2022

Another said: “So @UKLabour Roman Abramovic has put Chelsea up for sale, he’s righting off the £1.5bn the club owes him & the rest of the money from the sale is going to a foundation for the Ukrainian victims! & you think he’s the enemy?  ”

”

If this is the end

— badboy.jeremy (@badboy_jeremy1) March 2, 2022Thank you Roman Abramovic

Thank you for Loving Chelsea football club

We as fan’s would never forget the good work you did at Chelseapic.twitter.com/W5LjtJx6He

Another – a fan of a rival club, Manchester United – wrote: “Roman Abramovic has put Chelsea up for sale for the ‘best interest of the club’. Hoping our Russian owners — Avram and Joel Yuri Usmanov Glazer — do the same for Man Utd.”

Despite all the fawning, however, Chief Soccer Correspondent for the New York Times, Rory Smith, has taken to Twitter to suggest we hesitate a second before feeling too sorry for Abramovic, who has a net worth of 13.1 billion USD.

“Roman Abramovich is selling Chelsea to whoever will take it off him, as fast as he can, because his presence has raised the possibility the club could be affected by actual economic sanctions. He is currently being cast as a ‘good owner,’ Smith said.

“It’s great that he’s giving all the net proceeds of the sale to a charity some people are setting up for him. Might be worth noting that his asking price currently covers all the money he’s pumped in over the years.”

As well as Hansjörg Wyss, I believe Todd Boehly, the part-owner of the LA Dodgers, is worth mentioning at this juncture. Pool of potential owners is “very small,” both @tariqpanja and I are told, and there is a belief that the price will drop *fast* the longer it runs on.

— Rory Smith (@RorySmith) March 2, 2022

“I get why Chelsea fans love(d) him,” he added. “I get that he made dreams come true. I believe he is fond of Chelsea. But surely being a good owner is in some way related to safeguarding the future of the club? It’s really hard to make the case Abramovich is doing that, even if he’s trying.”

Read Next

- Vladimir Putin Documentary Explains Why He’s Invading Ukraine

- Vladimir Putin’s $140 Million Superyacht Move Might Be Scarier Than The Russian Army

The post Why You Shouldn’t Feel Too Sorry For Russian Billionaire Roman Abramovich appeared first on DMARGE Australia.

You wouldn’t think that the FBI would be filled with sneakerheads, but you’d be surprised. Being able to identify a sneaker’s unique footprint or recognise a valuable shoe could make the difference between getting your man and letting him get away.

Case in point: FBI agents investigating a series of armed robberies across Michigan arrested an aspiring TikTok star after he was spotted dancing in what investigators described as his “stick-up shoes,” The Detroit News reports.

Chozen Terrell-Hannah, who goes by @chozenwrld on TikTok where he has just over 150,000 followers, was nabbed by the FBI after they connected the distinctive Nike sneakers he’s worn in many of his videos with a string of violent robberies across Metro Detroit.

The 22-year-old had gone on a three-month-long crime spree, where he’d stuck up convenience stores (and ironically, sneaker stores) in a black hoodie, a black ski mask and white Nike React Presto sneakers using a Glock 23 pistol chambered in .40 S&W.

A tip-off led the police to suspect someone with the Snapchat handle @Chozenn_One (someone should have turned off their Snap Map…) Investigators learned the account’s name had been changed to “ChozenWrld” – which they easily connected to the TikTok profile with the same name.

If that wasn’t enough of a paper trail, Terrell-Hannah had worn the distinctive Nike sneakers in a number of TikToks dating as far back as 2020. If you thought TikTok dances were pretty cringe, we’d say that pales in comparison with the embarrassment he’s probably feeling right now having got stung thanks to wearing his sneakers in those videos.

RELATED: Football Legend’s ‘Cringy’ TikTok Yet Another Trend Grown Men Shouldn’t Adopt

Of course, this isn’t the first time a criminal’s sneakers have been responsible for their capture. For example, Richard Ramirez, better known as ‘The Night Stalker’ or ‘The Walk-In Killer’ – a serial killer active in the 80s who, in 1989, was convicted of thirteen counts of murder, five attempted murders, eleven sexual assaults, and fourteen burglaries – was also caught thanks to his distinctive sneakers.

The distinctive footprint left by Ramirez’s Avia sneakers helped police connect the killer to many of his crimes, a process depicted in detail in the Netflix documentary series Night Stalker: The Hunt For A Serial Killer.

Read Next

- Keanu Reeves Gets Sent To Detention For His ‘Schoolboy’ Style Error

- Nike Vice President’s Son Sprung Stockpiling Enough Rare Sneakers To Fund Rogue State

The post TikTok Star Arrested By FBI: Wears Sneakers During Multiple Robberies appeared first on DMARGE Australia.

A video has emerged of Usher eating at Salt Bae’s restaurant looking mildly awkward (we reckon) when asked to cut up his own steak.

So far, Salt Bae has 15 restaurants in total: four in Turkey, two in the United Arab Emirates, five in the United States and one each in Greece, the United Kingdom, Qatar and Saudi Arabia.

We don’t know for sure which restaurant Usher was in, but judging by his latest Instagram stories, it was one of his American ones.

To us, it looked like Usher hasn’t cut up his own steak for a while. In Usher’s defence, however, even if you cook your own dinner every night, going to Salt Bae’s restaurant and being asked to chop up a Tomahawk is probably an intimidating experience (not to mention: it’s probably a bit cynical to assume celebrities never prepare their own meals).

“You’re going to teach me?” Usher asks Salt Bae at the start of the video, before going through the motions that Salt Bae usually does, waving the knives in the air and cutting up the steak and then springing it with salt.

As one Instagram user pointed out: “That’s like going to a restaurant and cook[ing] your own food.”

Food for thought indeed.

Read Next

- Usher Resurrects The 80s’ Most Underrated Style Move With Crisp Balmain Look

- Salt Bae’s Restaurant Prices Will Blow Your Mind

The post ‘Uncomfortable’ Usher Moment At Salt Bae’s Restaurant Suggests Celebrities Don’t Cook Often appeared first on DMARGE Australia.

Choosing a reliable super fund is one of the most important investment decisions you’ll ever make. Because a super fund is typically a 40+ year investment, opting for a trustworthy superannuation fund that provides strong returns with the lowest-possible fees from the outset is the goal.

In this article:

Why the Right Super Fund Really Matters

There’s a very good reason why Albert Einstein (allegedly) called compound interest the ‘8th Wonder of the World’.

Here’s why:

Let’s say that you take $5000 every year for the next 40 years and invest it into an account with a 10% annual return. When you open that account in 40 years time you’ll be looking at a very respectable $2.78 million, with $2.58 million (92%) of that total sum being earned solely from interest.

Say you did the exact same thing again, but you mistakenly decide to invest in an account with a 7% annual return. In 40-years time you’ll be opening an account containing $1.14 million, a substantially smaller sum than if you’d decided to take the 10% return.

What seems to be a relatively small difference in fees or projected returns can actually make millions of dollars of impact over the long-term. That’s why choosing a great fund from the outset or switching to a better one right now, is a must for all Aussies who want to retire in comfort.

“Time in the market beats timing the market.”

How to Choose a Super Fund

When comparing different super funds, the main factors your need to assess are:

- Performance – It goes without saying but you want to actually look at a funds’ long-term track record to see whether it has a history of delivering high returns. Just because a fund has delivered high returns in the past doesn’t guarantee that you’ll get the same performance in the future, but it’s a good sign that the managers of the fund know what they’re doing.

- Fees – Fees are one area that can really differentiate a super fund. Very simply, you want to find the super fund that charges the lowest fees yet still provides the best management.

- Risk – When you’re picking a super fund you need to have a basic understanding of how much risk you want to take on. If you’re 19-years-old and just setting up a super fund for the first time, you probably want to go for a more aggressive strategy, because you’re not going to be affected by short-term fluctuations in price. If you’re 55 years-old however and you’re planning on retiring soon, you may want to move your super into a ‘conservative’ holding.

- Investment Options – Because a super fund is possibly the most long-term investment that any person will make, many Australians have sought to place their hard-earned money into super funds that support more ‘sustainable’ assets and industries. For example, Future Super is dedicated to investing solely in industries and companies that are “fossil fuel free”. When choosing a super fund, always look to see if the fund invests in assets you’re comfortable with.

Industry Funds Vs. Retail Funds

Before we get stuck into the best performing super funds, it’s really important to understand the difference between an industry super fund (remember those ads where people made the diamond shape with their hands) and a retail super fund.

Industry super funds were originally created by trade unions to provide money to their members when they retired, and they were typically only available to people working in specific industries. Over the years, however, most large industry funds have opened their doors to the general public, meaning that anyone can join. The most important part of an industry super fund is that they are not-for-profit, which means that all profits are returned to the members

A retail fund on the other hand is usually run by a bank, investment firm or some other type of financial institution. The key difference between retail and industry funds is that a retail funds is for-profit, meaning that all profits are distributed amongst the shareholders and not necessarily the members. Membership for retail funds is generally open to everyone, although some banks do provide incentives for customers to opt into their in-house funds.

The Best Super Funds in Australia (Actually)

At DMARGE, we understand how easy it can be for the marketing teams at different super funds to manipulate information and use flashy graphs to make their products look better than the others, even when it’s not remotely true.

That’s why we’re going to cut through the noise and use a range of different measurements to give you the best Australian super funds for your own needs. We’ll be assessing them on a variety of factors, from ‘benchmark outperformance’ over the past 7 years all the way to their performance on the Australian Prudential Regulation Authority’s (APRA) ‘Super Test’.

We’ll even throw in an added section called ‘The Dud-Funds’ where the unfortunate funds that fail APRA’s Super Test end up. If you’re holding your superannuation in one of the 13 funds listed in this section, it’s well worth switching over to a better alternative immediately.

Without further delay, here are the best super funds in Australia.

Best Performing Industry Super Fund: UniSuper

UniSuper was originally for those working at Australian universities (hence the name), but recently its doors were opened to the general public. Both Finder and APRA listed UniSuper as Australia’s best-performing industry super fund, with UniSuper offering 7 different investment options, ranging from very low risk to more risky, growth-oriented portfolios. UniSuper’s funds landed 4 out of the 10 top spots for the best choice of super in Australia, according to APRA.

UniSuper’s Balanced Fund was named as the best-performing default (moderate risk) fund overall in 2021, outperforming the super fund benchmark by 1.5% and delivering an average return of 9.22% over 7 years. The balanced fund also comes with extremely low fees, only charging $326 annually on a balance of $50k.

For younger investors, UniSuper’s High Growth Fund is one of Australia’s highest-performing super funds delivering holders an impressive 11.47% annually for the past 10 years and will only set you back $406 per year in fees on balance of $50k.

Best Ethical Fund: Australian Ethical

Australian Ethical is a superannuation fund that exclusively invests in companies that have a positive impact on the planet. Australian Ethical offers 7 different options that are risk-adjusted and focused to varying degrees on sustainability, clean energy, waste management, recycling, health and responsible banking. It actively divests from industries and assets that deal with coal, oil, tobacco and gambling.

Australian Ethical has one of the best performing long-term funds in the business, with its Balanced Fund returning an average of 9.01% for the past 10 years. It is worth noting that Australian Ethical does charge higher fees than competitors — the Balanced Fund will set you back $622 yearly on a balance of $50k.

Its more aggressive Australian Shares Fund is also one of the best performing super funds of the past 10 years, delivering an average of 14.01% annually to investors for the past decade. It is fairly costly with yearly fees coming to $842 on a balance of $50k and is aimed at investors with a higher tolerance for risk.

Strong Long-Term Performance: Aware Super

Aware Super is Australia’s second-largest super fund, currently managing around $130 billion in assets. It is also a not-for-profit industry fund with over 750,000 members. Aware provide a large selection of 12 different funds to choose from and boast some of the most steady long-term returns in the market.

Aware’s Balanced Growth fund has returned a respectable 8.97% for investors over the past decade and is mid-range when it comes to fees, charging around $519 a year on a balance of $50k.

Aware Super also has a specific ethical investment product called the ‘Diversified Socially Responsible Investment’, which is an investment option that excludes companies operating in the tobacco, ammunition, gambling, alcohol, forest logging and pornography industries, as well as companies that attribute 20% or more of their revenue to coal, oil and gas.

Despite not advertising themselves as an ethical super fund, AwareSuper actively tries to avoid association with tobacco companies across the board, only holding a total 0.1% exposure to tobacco across all of their portfolios.

Best Lifestage Fund: Virgin Money

While each super fund is different, they all invest in a variety of growth assets — such as shares and property, intermingled with defensive assets like bonds and cash that are less volatile. While shares and other growth assets can be subject to wild price swings, they tend to be much better investments over the long term. As you get older, you’ll have a bigger super balance and less time to ride out ups and downs in riskier investments like shares and property. It’s a time when it’s usually better to play things safe by choosing an option with a higher allocation of defensive assets.

This is why Virgin Australia’s Lifestage Tracker fund is a great option for someone looking to leave their finances running in the background, as it automatically decreases your risk exposure as you age.

The Lifestage Tracker fund is only 3 years old but has so far provided solid returns for holders, returning an average of 10.04% over the past 3 years. It also has one of the lowest fee-rates on the market, only charging $363 annually on a balance of $50k.The investment team at Virgin Australia were also named a Responsible Investment Leader 2020 and 2021 by the Responsible Investment Association Australasia (RISA).

Best New Fund: Spaceship

Spaceship is the new kid on the fund manager block, and it’s looking to the next generation of passive investors, having products for both superannuation and retail investing. Spaceship markets itself as a fund that actually invests in the future, specifically targeting 20 to 40 year olds and allocating a large portion of its holdings to high-growth tech stocks such as Tesla, PayPal and Shopify

Spaceship’s superannuation fund is definitely for younger investors that are only just getting started as the GrowthX Fund is highly allocated towards risky ‘growth’ assets, with around 30% of the funds total portfolio in US tech stocks. If that suits your risk tolerance, the GrowthX Fund is also one of the least expensive high growth funds in the market, only costing around $536 per year on a balance of $50k.

Spaceship also comes with a mobile app. The only major downside is that there are only two fairly high-risk superannuation products available at the time of writing, which means that those of you looking for more choice or a more conservative option are best to look elsewhere.

The Best Overall – AustralianSuper

Saving the best for last, the best overall super fund for Aussie investors is AustralianSuper.

It offers the widest range of strong-performing investment options so that investors can tailor a portfolio to their individual needs more easily. Australian Super has also routinely outperformed the benchmark of other Australian funds over the past 10 years, and also receiving one of APRA’s top spots in 2021.

It’s Balanced Fund received the Finder award for the best Australian super fund in 2021 and has been one of the strongest performing super funds of all time. The balanced fund has returned a strong 9.74% annually over the past 10 years and will only set you back $476 per year on a balance of $50k.

AustralianSuper is also one of Australia’s largest, most user-oriented funds, as it comes with its own mobile app and the website is clean and easy to navigate. AustralianSuper also makes sure that all documentation is pre-filled with your information as soon as you sign up, which takes the hassle out of filling out tax and super forms for yourself.

What About the Worst Funds?

What review would be complete with a good old-fashioned name and shame?

These are the super funds products that failed to meet the standards set by APRA. If a fund ends up on this list, it usually means that it’s charging absurd fees or that its overall performance is genuinely bad. If you see your fund here, take this as a sign to swap over to one of the funds mentioned above, or speak to a financial advisor about finding a new fund that will best suit your own unique financial circumstances.

- AMG MySuper

- ASGARD Employee MySuper

- Australian Catholic Super: LifetimeOne

- AvSuperGrowth: MySuper

- BOC MySuper

- Christian Super: ‘My Ethical Super’

- FirstChoice Employee Super

- Commonwealth Bank: ‘Accumulate Plus Balanced’

- Energy Industries: Balanced (MySuper)

- Labour Union Retirement Fund: MySuper Balanced

- Maritime Super

- Retirement Wrap: BT Super MySuper

- VISSF Balanced Option

Read Next:

- Best Reverse Mortgage Lenders Australia 2022: Ranked

- Best Crypto Cards 2022: 6 Best Crypto Cards Available Right Now

The post Top Performing Super Funds Australia 2022 appeared first on DMARGE Australia.

I’ve always hated stand up paddleboarders. My thinking? They’re longboarders on steroids; a consistent danger, and a greedy nemesis in the lineup (their size means they can catch more waves, from further out, than other surfers).

But recently I swallowed my pride and thought: if you can’t beat them, why not join them? I was offered the chance to trial an inflatable stand up paddle board (an ISUP), and took it with both hands.

The ISUP I tried wasn’t the kind of SUP you typically surf on (though the model I tested claims to work in all conditions, generally speaking, inflatable SUPS are more known for cruising around lakes on), but in the end, I couldn’t help myself but take it out in the very last place you should take a SUP: a crowded, competitive, close-out ridden beachbreak.

Here’s how it went – and what I realised along the way.

Stand up paddle boarding takes serious skill

Despite intending to limit myself to the flat water around the corner off Mackenzies Bay, I couldn’t help myself but try to catch a couple of waves at neighbouring Tamarama. It was bloody hard. In fact, it was hard to paddle around flat water, let alone catch waves, without losing my balance.

It’s pretty easy to pump up – but make sure you keep the valve in the up position before pumping

My 10’6 board was much easier than I expected to pump up. However, when it came time to pull the tube out and plug the hole, I found a lot of air would escape (I later realised there was a setting on the pump which prevents this).

If you secure the valve in the up position before pumping, this can be avoided (and once you do it once, you don’t tend to forget again).

Inflating the board adequately is a game changer

If you’re ever going to use an inflatable stand up paddle board, make sure you pump it up well beyond the canoeing setting on the pump, and get it well into the stand up paddle boarding range. Otherwise, it will be harder to stand on than a waterbed in an earthquake (as I, not bothering to pump it up properly, found out).

Speaking of standing up on a waterbed in an earthquake… I ended up giving up on the paddle and just lying on my stomach and paddling around with my arms, like I would on a surfboard (this wouldn’t have happened if I had inflated it sufficiently).

People are really judgemental of stand up paddle boarders

I felt the stares as I rocked up, the only person with a stand up paddleboard on the beach, and having forgotten my boardshorts to boot (I ended up paddling out in my denim shorts).

I also saw people smiling at me, though I am not sure if they were mocking me or being friendly.

You have such a ball you don’t really care what snobbish surfers think

I’m not going to lie – I had a lot of fun. It was really enjoyable to try something different to usual, and (try to) learn a new skill.

It’s very easy to nosedive

This probably shouldn’t come as a surprise, but it was extremely easy to come a cropper when taking off down a wave. This could probably have been avoided with a smaller, more surf specific ISUP board (rather than the all-rounder I had) and – more than anything – by pumping the board up adequately.

It’s essential you use your legrope, especially when there are people around

I discovered this when I went to lend the board to a friend in the water, and then we got taken out by a set in the process. Fortunately, I recovered the board before it hit the rocks, but it was a close call. I don’t know if I became the most hated surfer in the Eastern suburbs that day, but I certainly felt like it.

It’s super convenient if you don’t have roof racks

Compared to normal SUPS, these guys are much easier to transport. If you have a decent-sized boot you can just whack it in the back.

The bag is very useful

Why carry when you can roll?

Stand up paddle boarders are the cyclists of the sea

They are probably having more fun than you, and they don’t care if you know it. Bonus points if you rock up later on to the cafe in your spring suit…

They are super fun

I can’t wait to try one of Red Paddle Co’s boards again and go on more of an adventure, getting in fewer people’s way, and putting its storage features to the test.

Read Next

The post Stand Up Paddle Boarders Are The Cyclists Of The Sea appeared first on DMARGE Australia.

Thanks to the rise of social media, more and more people are striving to become ‘influencers’. If that’s a goal that you’re working towards, then be warned – do not beg companies or businesses for free products through a poorly written email.

Case in point: food writer and critic, John Lethlean has shared to his Instagram screenshots of an email that was sent to the Australian winery, Eldridge Estate (via the winery’s website contact page). The email was sent by an influencer who did a mighty poor job writing it.

Firstly, the influencer addressed it to “David and Wendy”, despite Eldridge’s website clearly explaining that the owner/winemaker, David, sadly lost his wife, Wendy when she passed away eight years ago. Then, admittedly, the first paragraph is not that bad – aside from the horrifying spelling and grammar mistakes – as the influencer just praises Elderidge’s wine, especially the Pinot Noir. But then, buckle up, because it gets interesting.

She claims to have a TikTok account with 10,000 followers (or maybe 12,000; at first mention she’s written 10,000 but then later in the email, she’s written 12,000) and that she’s uploaded a video to the platform where she highly recommends Elderidge Estate’s wines and gives the winery “a really good plug.”

Then she’s written, “I’m not wanting anything in return” which is good because she never links to or gives her TikTok account name, so there’s no way for the winery to verify whether she’s a) got more than 10,000 followers and b) has actually posted a video of herself recommending their wines.

The influencer goes on to contradict herself and starts hinting that she would like “a couple of bottles of wine” for free as thanks for giving an “endorsement to over 10,000 people.” Then, she just flat out begs: “you can thank me by giving me a dozen bottles, I’m your advocate… Free endorsement and advertising is what any business would love, feel free to thank me with some wine.”

Instagrammers had a field day commenting on Lethlean’s post of this screenshotted email, which the food writer, himself, called “disturbing”. Some comments flat out slammed the request while others humorously shaded it.

One Instagram user commented, “I am lost for words. This one really does make me feel sick, having known both David and Wendy for many years,” while another user wrote, “Oh… it would appear you need to get back on track. Here’s some directions. Turn right on Pay Your Own Way Road, turn right again onto World Owes Me A Living Highway, take the exit onto What An Embarrassment Parade…”

We’ve added some of the other best responses to the shameless email below:

This is just the latest example of the exploitive ‘couscous for comment’ culture – a term coined in 2016 by Tim Philips-Johansson, co-owner of Sydney bar & restaurant, Bulletin Place – that the hospitality industry has had to endure since more and more people started blogging and ‘influencing’.

Hopefully, people will see Lethean’s post (as well as the responses!) and will think twice before requesting free stuff in the future.

Read Next

- Influencers Stun Bondi Diners, Sparking Restaurant Etiquette Debate

- Rock Salt Noosa Owner Destroys Rude Influencer With Brutal Comeback

The post Australian ‘Influencer’ Slammed For Shameless Request Of Winery appeared first on DMARGE Australia.

- « Previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- Next »